Tabaqchali: Assessing The Risks Of A Wider Middle East Conflict

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Assessing the Risks of a Wider Middle East Conflict

The market, as measured by the Rabee Securities US Dollar Equity Index (RSISX USD Index), was down 3.4% in October, and up 73.3% for the year. After a scorching four-month run in which the RSISX USD Index was up 43.7%, the market was ready for a pull-back. However, when it came, the pull-back was both short and shallow.

Average daily volume for the month was down by 22.2% versus that of the prior four months, while the market was in a range of up 2.0% to down 4.3%, with the declines driven by buyers holding back on chasing stocks as in the prior months.

These muted activities were reversed on the last day of October, with the banking sector resuming its momentum, which continued into the first few days of following month. By the end of the fifth trading day of November, the market had erased its October losses and is now higher than September's close (chart below).

While a few days do not make a month, the return of the banking sector's momentum and market leadership supports the investment thesis for the banking sector and the recent fundamental developments that gave it a boost, as discussed in "Banks to Fuel the Market's Next Phase " - especially in the current context in which global markets are assessing the risks of a wider Middle East conflict.

Rabee Securities US Dollar Equity Index

(Source: Rabee Securities, AFC Research, data as of November 7th)

A wider Middle East conflict that would destabilise the region with repercussions for the world economy have been the subject of intense media coverage and extensive analysis over the last few weeks (*). Consequently, the current flurry of the U.S.' diplomatic initiatives aims to avoid such a conflict, and reinforces the ongoing behind-the-scene activities of the countries in the region, working with the main world powers in seeking to contain the conflict. It's difficult to forecast how the ongoing Gaza invasion and conflict containment initiatives will unfold over the coming weeks, however, the contours of an-emerging post-conflict world order, irrespective of its conclusion, are becoming increasingly clear.

The sharply contrasting responses of the West versus those of the Global South, to the unprecedented humanitarian crisis that is unfolding in Gaza, have crystalised the divide between them that materialised post the invasion of Ukraine. This divide is solidifying an emerging unbalanced multi-polar world in which power is diffused unequally between multiple powers, as was evident from the Global South's responses to the West's sanctions on Russia following the invasion of Ukraine. Most notably, in the diversion of Russian oil and gas from Europe to Asia and the subsequent changed supply-demand dynamics of energy markets, with their ongoing implications for the global economy that extend far beyond these markets.

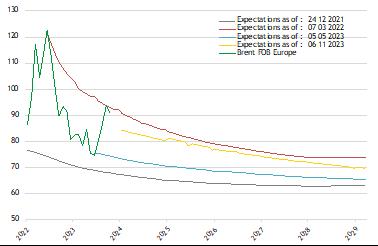

In the meantime, oil markets, as measured by Brent crude futures contracts, are discounting elevated oil prices (yellow line-chart below) that are very close to those that they were discounting immediately following the invasion of Ukraine (red line-chart below). The key difference between the two is that the latest expectations are at the end of two weeks of back-to-back oil price declines in which oil markets have begun to discount a contained conflict, and which were reinforced by events that lowered the fears of a wider Middle East conflict. As such, there are not a great deal of supply-hit fears built into these expectations, and so they are a realistic indication of the near-term price expectations of this emerging unbalanced multi-polar world.

Market Expectations for Future Oil Prices

As measured by Brent Futures Contacts (USD per barrel)

(Source: Wall Street Journal, AFC Research, data as of November 6th)

The current environment has implications for the risk-reward profile for investments in Iraq's equity market. On the risk part of the equation, the potential escalation of the ongoing invasion of Gaza into a wider Middle East conflict could threaten the relative stability that has marked Iraq over the last few years, irrespective of its distance from the conflict or of the non-existent possibility that it would be drawn into it as a combatant. While on the reward part of the equation, the changed geopolitical landscape of a multi-polar world is very positive for Iraq's economic outlook, given its extreme leverage to oil prices. Current expectations of Brent crude prices of USD 83 per barrel (/bbl) in 2024, and USD 79/bbl in 2025, would provide the government with the wherewithal to follow through with its expansionary three-year budget for 2023-25. The budget's sizeable liquidity injections into the non-oil economy should drive economic growth that would feed into meaningful growth in corporate profits, which in turn would sustain the market's current rally, as discussed here last month .

Notes:

(*) Foreign Policy Podcast featuring Kim Ghattas and Steven A. Cook on the chances of a broader conflict, 3rd November 2023.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

The post Tabaqchali: Assessing the Risks of a Wider Middle East Conflict first appeared on Iraq Business News .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment