Tabaqchali: Private Sector Loan Growth To Fuel Iraq's Economic Recovery

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Private Sector Loan Growth to Fuel Economic Recovery

The market, as measured by the Rabee Securities RSISX USD Index, was up 8.4% in September, and up 79.4% for the year.

As argued here over the last few months, and most recently in "Market Rallies as it Begins to Discount the Budget's Passage ", that the three-year 2023-5 budget following its passage in June would lead to sizeable liquidity injections into the economy. This in combination with the positive global macro-economic developments, will drive economic growth that would eventually feed into meaningful growth in corporate profits, which in turn would sustain the market's current rally.

The banking sector, in particular the top-quality banks, are likely to be key beneficiaries of this emerging economic growth that would come with increased adoption of banking, and a move away from the dominance of cash as both a store of value and a means of economic exchange. AFC Iraq Fund's investment thesis for the banking sector, as discussed in "Banks & the Iraq Investment Thesis " in February 2022, argues that the increased adoption of banking would come with growth in bank lending resulting in an expansion in the money circulating in the economy and consequently to increases in non-oil GDP's growth rate and size. Over time, banks' earnings should grow substantially, leading to meaningful increases in their valuations, and ultimately feed into much higher market multiples and higher share prices (*).

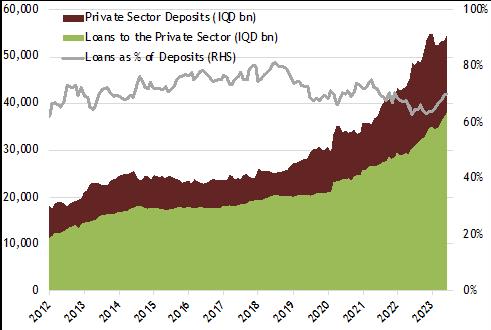

Evidence of this thesis in action can be seen from the latest Central Bank of Iraq (CBI) data on bank lending to the private sector, which shows a continuation of the multi-year up-trend brought about by the relative stability that the country has enjoyed over the last few years following decades of conflict (**). Lending to the private sector increased by 11% for the year by July, following increases of 18%, 14%, and 23% in 2022, 2021, and 2020 respectively - following the 4% recovery in lending in 2019 after the lending stagnation as a consequence of economic crisis brought about by the ISIS conflict and the fall in oil prices in 2014-17.

Private sector deposits on the other hand increased by 3% for the year by July, following increases of 27%, 20%, 17%, and 12% in 2022, 2021, 2020, and 2019 respectively. Interestingly, deposit growth year to date lagged loan growth, having outpaced it in 2021-2, indicating greater confidence by the banks. As such, the loan-deposit ratio, began to tick up during the year indicating that current deposits can sustain further growth in loans (chart below).

Private Sector: Deposits & Loans

(Source: Central Bank of Iraq, AFC Research, data as of July 31st)

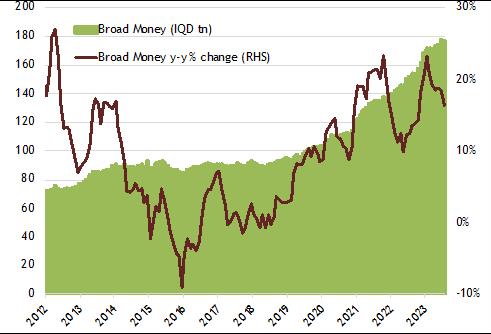

The increased lending to the private sector in combination with increased government oil revenues, has led to increases of 5% for the year to July in the amount of money circulating in the economy, or broad money. This comes on the heels of increases of 20%, 17%, 16%, and 8% in 2022, 2021, 2020, and 2019 respectively (chart below). The trend in broad money's monthly year-over-year growth over the last few years mirrors those for private sector loans and deposits.

Money Circulating in the Economy

(Source: Central Bank of Iraq, AFC Research, data as of July 31st)

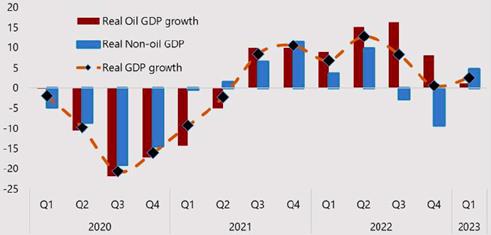

The significant liquidity injections into the non-oil economy by the expansionary 2023-5 budget, should lead to a re-acceleration in the year-over-year growth in bank lending to the private sector, private sector deposit growth, and the amount of money circulating in the economy. The effects of such stimuli should lead to further recovery in non-oil GDP, following the resumption growth in the first quarter of 2023 (chart below), which should feed into meaningful growth in corporate profits further supporting the stock markets' positive momentum.

Oil and non-Oil GDP Real Growth

(Source: Iraq Central Statical Office, IMF Iraq Economic Monitor September)

Finally, the market, as measured by the RSISX USD Index, even after its 79.4% increase year-to-date, is still 32.9% below its January 2014 peak.

Notes:

(*) Prior market reviewed AFC's banking investment thesis, banking developments, and earning profiles of two of the country's major banks:

- A combination of recent fundamental and technical developments, that promises to accelerate the adoption of banking, and bring about a transformation of the sector and its role in the economy, in "Banks to Fuel the Market's Next Phase ". AFC Iraq Fund's investment thesis for the banking sector, in "Banks & the Iraq Investment Thesis " Earnings profiles and business strategies of the National Bank of Iraq (BNOI) in "The Opportunity in Retail Banking " in April 2022, and of the Bank of Baghdad (BOB) in "Banks and the Predictability of Earnings " in November 2022.

(**) One of the most promising recent developments in the economy is the meaningful capital investment by businesses and individuals, brought about by the relative stability of the last five years following the end of the ISIS conflict. While, these years were punctured by several shocks, such as the countrywide demonstrations in late 2019, the assassination of Iran's top general in Baghdad followed by the emergence of COVID-19 and the crash in oil prices in 2020, the undecisive elections in 2021, followed by a year of a political impasse topped by political conflict and violence in the summer of 2022. Nevertheless, these shocks were short-lived, and did not lead to self-reinforcing cycles of violence and conflict along the lines of the past. As such, this relative stability provided a more stable and predictable macroeconomic framework for businesses and individuals to operate in, and to plan for capital investments on a scale not seen in the last prior decades of conflict; that in turn, should be sustained by the population's pent-up demand for goods and services to catch up with the rest of the world. These developments were reviewed in prior market reports:

- "Construction Activity and Stability ", in July 2023. "Supermarkets and Stability ", in December 2022.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a Visiting Fellow at the LSE Middle East Centre, Senior Fellow at the Institute of Regional and International Studies (IRIS), and a Senior Non-resident Fellow at the Atlantic Council. He is also a board member of Capital Investments, the investment banking arm of Capital Bank in Jordan.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

The post Tabaqchali: Private Sector Loan Growth to Fuel Iraq's Economic Recovery first appeared on Iraq Business News .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment