(MENAFN- Asia Times) Thebanking crisis triggered worries about the global banking system earlier in the year. Three mid-sizedbanks, Silicon Valley Bank, Silvergate and Signature, fell in quick succession, driving down bank share prices across the world.

America's central bank, the Federal Reserve, made significant amounts of cash available to the failed banks and created a lending facility for other struggling institutions. This calmed investors and prevented immediate contagion, with only one moreregional bank, First Republic , collapsing a few weeks later.

Yet it's far from clear whether the crisis is really over. As traders return from their summer holidays to a period commonly associated with upheaval in the markets, how are things likely to play out?

Tight margins and dwindling deposits

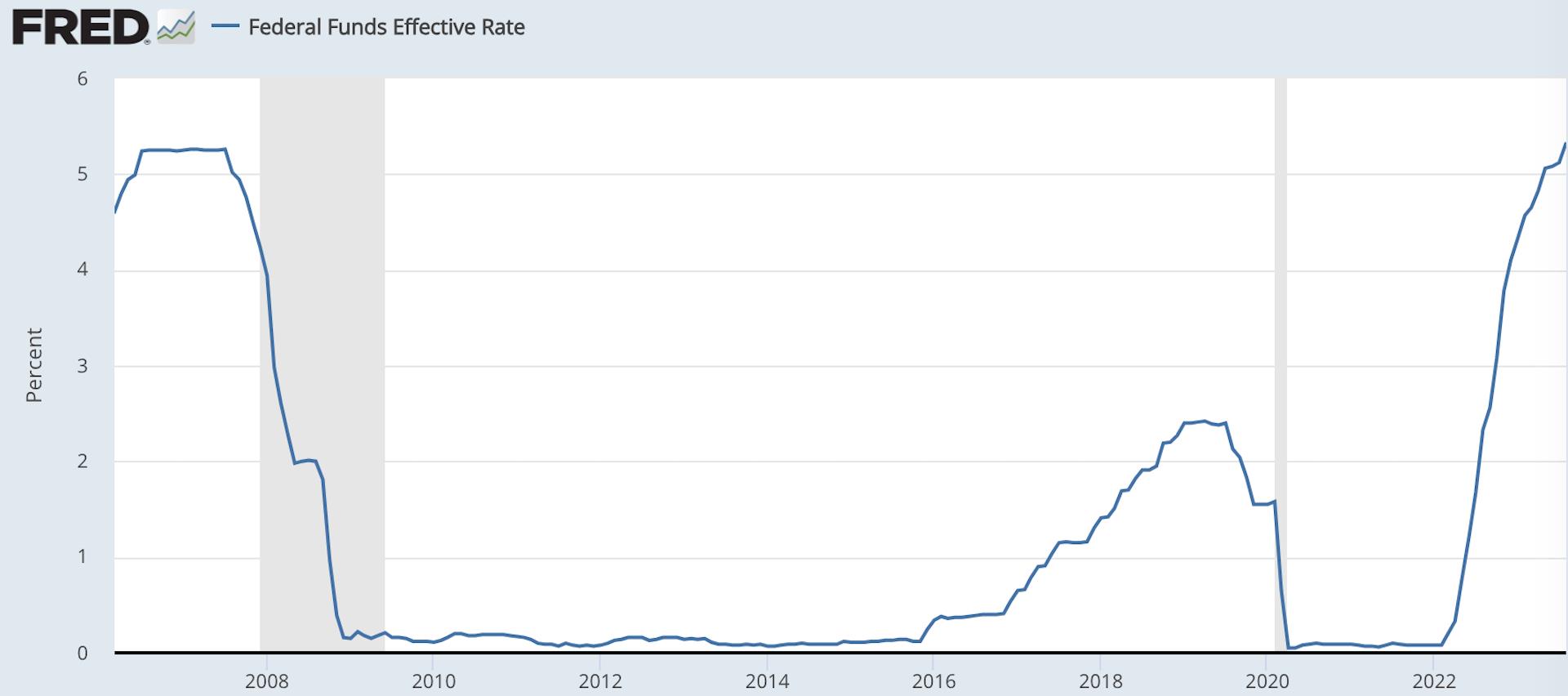

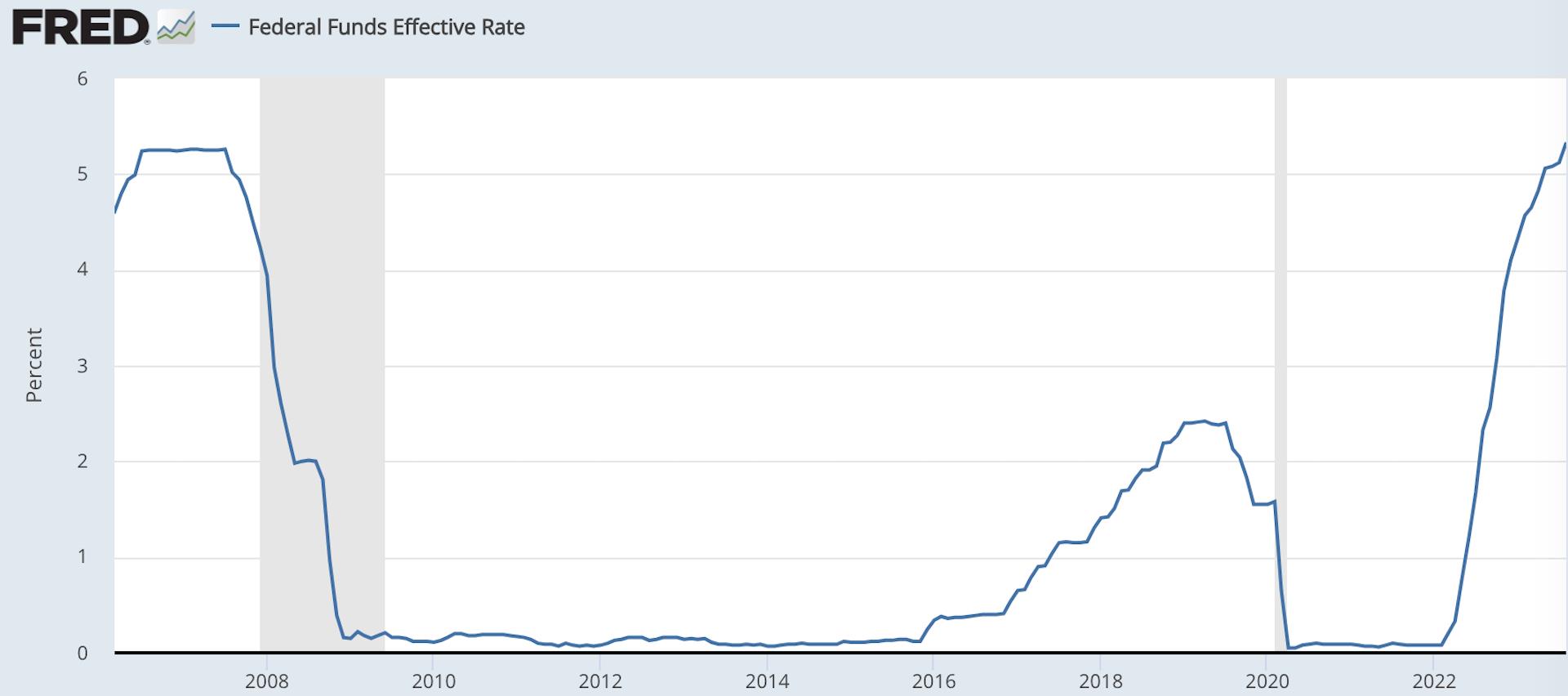

Central banks have continued to increase interest rates to counter sustained inflation in recent months. In July, the Fed raised its key interest rate to as much as 5.5% , the highest in 20 years. The rate was near zero as recently as February 2022.

Though the increases have slowed this year, such a sudden change can be very harmful for banks – particularly as part of the sort of U-shaped movement in rates that we have seen since the global financial crisis of 2007-09.

benchmark interest rate, 2007-23

St Louis Federal Reserve via The Conversation

Raising rates reduces the value of banks' assets, increases what they have to pay to borrow, limits their profitability and generally increases their vulnerability to adverse events. Especially in the first half of 2023, banks have had to cope with low loan growth and high deposit costs, meaning the amount they have to pay out in relation to customers' deposits.

MENAFN05092023000159011032ID1107007785

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment