Iraqi Market Review: 'Winter Flash Floods'

By Ahmed Tabaqchali, Chief Strategist of AFC Iraq Fund .

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Following a strong performance over the last ten months, the market, as measured by the Rabee Securities RSISX USD Index, was down 12.2% for the month as an unexpected flash flood in the middle of the month sunk the market. However, despite the sizeable drop, the year-to-date performance, so far, is still the best in the last few years at up 10.4%

The flash flood was caused by some concentrated foreign selling, the heaviest of which, in absolute dollar terms, as well as relative to the average daily turnover for particular stocks, was in AsiaCell Telecommunications (TASC) which was up 32.2% for the year by October but down 26.8% for the month, the Commercial Bank of Iraq (BCOI) which was up 54.2% for the year by October but down 17.2% for the month, and in the National Bank of Iraq (BNOI) which was up 114.3% for the year by October but down 41.7% for the month - all of which are among the top five positions in the RSISX USD Index. Stock prices are adjusted for dividends equivalent to yields of 7.4%, 5.8% and 9.2% announced in the year by TASC, BCOI and BNOI respectively.

Such intensive foreign selling would normally spook local retail investors. However, the smart local money tends to appreciate the true value of local assets in a way that eludes most foreign investors, irrespective of their sophistication or experience in frontier markets. This was the case this month as the smart local money feasted on the opportunity provided by such a fire-sale in blue-chip stocks. One local investor explained: '... I keep on buying this stock knowing that the next day brings lower prices, but how else can I acquire such meaningful positions?' or another investor who explained: '... I have no idea how large this foreign selling is, or for how long will it continue at such intensity, yet I will keep on adding to my positions in this stock, as otherwise how often does such an opportunity presents itself ?' What is not explicitly stated, is the expectation that these stocks will rebound significantly and resume their price momentum once the selling concludes.

The case for owning these stocks is based on their business prospects and likely earnings growth. For mobile telecom operator AsiaCell (TASC), growth is rebounding so far in 2021 following a difficult 2020 in which the company was negatively affected by the lockdown as many of its customers switched to fixed-line broadband from mobile broadband for their internet access. This led 2020 revenues to decline 9.4% year-over-year while pre-tax profit was down 0.6%. However, growth resumed in 2021 with revenues in the third quarter of 2021 (Q3/21) up 25.1% over Q3/20 and up by 11.7% for the first nine-months of 2021 compared to the same period in 2020.

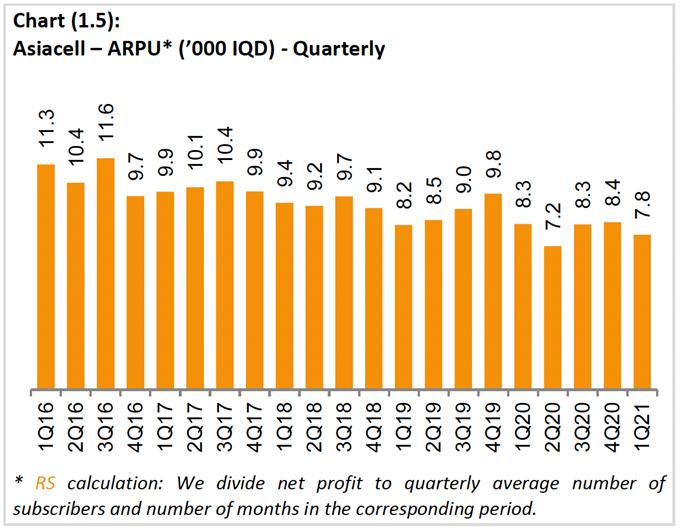

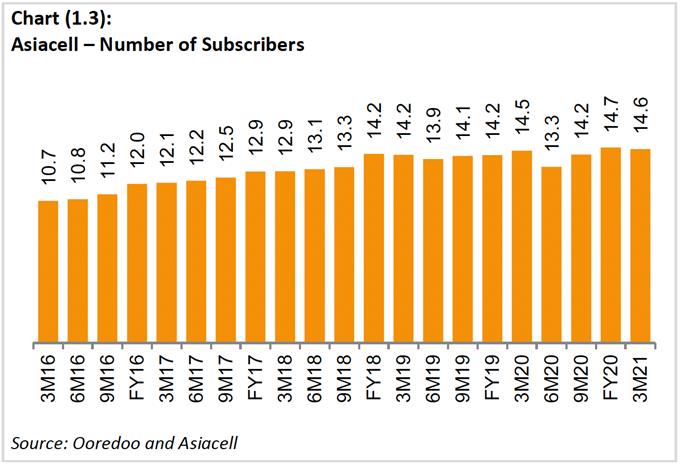

Pre-tax profit increased by 31.1% in Q3/21 over Q3/20, and by 22.0% in the first nine-months of 2021 over the same period in 2020. The continued rebound of economic activity, and crucially the rollout of 4G-LTE introduced in early 2021, should support future growth and lead to the stabilization, and eventually a recovery in both the numbers of total subscribers and in the average revenues per subscriber (ARPU) as seen from the two charts below. By month end TASC was trading at a price earnings ratio of 6.6x, price to book of 1.3x, and with an effective dividend yield of 10.9%

(Source: Rabee Securities' research report on TASC, dated November 11th)

The rationale for owning the top banks in the country is based on the revival of fortunes for the sector as discussed last year here in 'Banks Lead Market Recovery ' and in 'Private Sector Deposit & Loan Growth Continues '. The dividend announcements cited above, and the earnings of the top banks for 2020 and for the first nine-months of 2021 underpin this argument. In the case of the Commercial Bank of Iraq (BCOI), its loan book was up 87.6% the first nine-months of 2021 and up 64.6% for the year in 2020. Customer deposits declined 17.7% in the first nine-months of 2021 but grew by 86.0% for the year in 2020, while pre-tax earnings were up by 113.9% for the first nine-months of 2021 versus the same period in 2020, and up 515.9% for the year in 2020.

While the National Bank of Iraq (BNOI)'s loan book was up 113.4% for the first nine-months of 2021 and up 88.0% for the year in 2020; its customer deposits increased by 99.5% for the first nine-months of 2021 and by 67.3% for the year in 2020, and its pre-tax earnings were up by 46.6% for the first nine-months of 2021 versus the same period in 2020, and up 116.0% for the year in 2020. By the end of November, the indicators suggest that BNOI's momentum should continue unabated, sustained by an acceleration in both retail and corporate market growth, so that full year 2021 results would surpass those seen so far in 2021. BNOI's growth story was featured in last month's update 'Continued Momentum '.

This concentrated selling in TASC, BCOI and BNOI was somewhat mitigated by significant foreign buying in the Bank of Baghdad (BBOB), up 14.3% for the month and 134.1% for the year. BBOB's price momentum for the year was driven by the bank's strong earnings recovery as well as prospects for further improvements as the company's turnaround continues. This price momentum was amplified, somewhat, by expectations that its majority owner, Burgan Bank of Kuwait, would sell its 51.8% stake.

However, it's difficult to see which of the current top-quality local banks, or regional banks, is in a position to make such an acquisition that could gain the approval of the Central Bank of Iraq (CBI) - all of which explains the selling this month by local investors and some foreign investors as the stock kept on rising. BBOB's loan book was down 7.1% for the first nine-months of 2021 and down 5.3% for the year in 2020. Its customer deposits increased by 4.3% for the first nine-months of 2021 and 33.8% for the year in 2020, while its pre-tax earnings were up by 67.9% for the nine-months of 2021 versus the same period in 2020, and up 137.8% for the year in 2020.

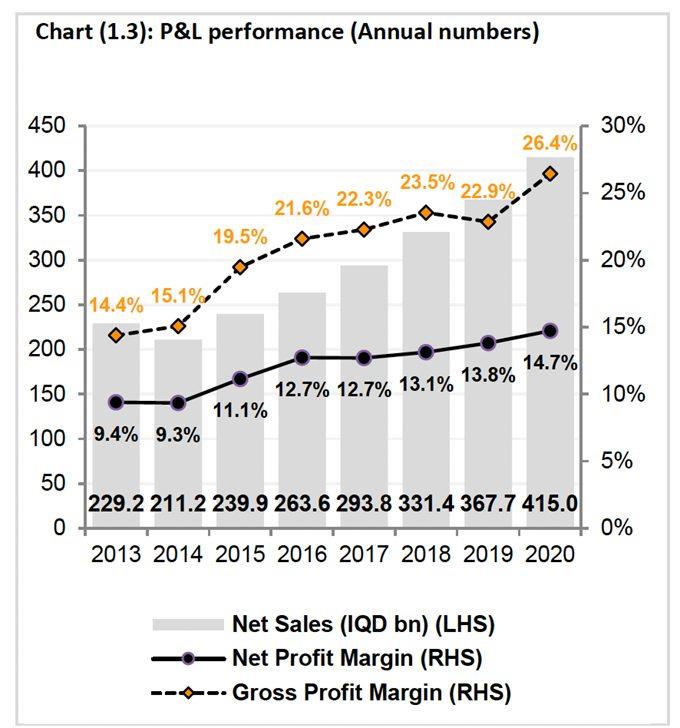

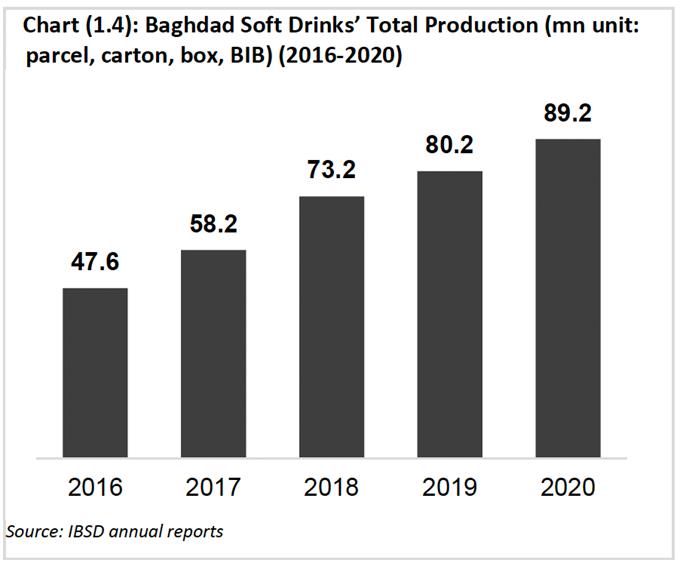

Unusually absent from the intense trading activity, until the last few days of the month when local selling hit the stock, was Baghdad Soft Drinks (IBSD). IBSD had its own share of unwanted excitement in the summer as a consequence of the Iraq Stock Exchange's (ISX) delayed decision to implement the law limiting foreign ownership to 49% as discussed in 'Summer Fireworks '. The company's stellar growth, of both the top and bottom lines (chart below), over the last few years made it a foreign investor's favourite and probably the top holding by a wide margin among their investments on the ISX - as such foreign ownership exceeded the limits allowed by law.

The implementation of the law on foreign ownership limits meant that the stock missed out on the demand coming from new foreign investments, and thus from the increased price momentum that it usually benefited from. All of which explains local selling that sent the stock down 16.1% in the month, or down 3.8% for the year by end of November - the price is adjusted for a dividend corresponding to a 4.3% dividend yield announced in April.

(Source: Rabee Securities' research report on IBSD, dated September 9th)

Baghdad Soft Drinks' consistently strong growth of both its top and bottom lines was not affected by the lockdown and the economic havoc brough in its wake in 2020. However, 2021 was a different story. The 22.7% devaluation of the IQD versus the USD in late December 2020 hurt the company's cost structure as the prices for most of its raw materials and packing goods are in USD.

The increases in costs were further exacerbated by the significant worldwide price rise of commodities - in particular imported aluminium used for cans, and domestically sourced sugar. As such, the cost of goods sold increased by 40.7% for the first nine-months of 2021 versus the same period in 2020, overwhelming impressive revenue growth of 26.4%, with the result that pre-tax profits were down 17.5%. In 2020, year-over-year revenues increased by 12.6%, cost of goods sold by 10.9%, and pre-tax profit by 20.9%.

The changed fortunes for IBSD in 2021, however, are temporary and one-off in nature as the high year-over-year cost increases will moderate significantly and most likely decline next year and beyond; while sales momentum will continue to accelerate supported by both its organic strong product line-up as well as the line-ups from is recent acquisitions (chart below).

(Source: Rabee Securities' research report on IBSD, dated September 9th)

One of IBSD's acquired line-ups is PepsiCo's water brand Aquafina, which came from its first acquisition of the Aquafina licence holder 'Ynabee' Al Zawraa Company'. According to Rabee Securities, Aquafina's unit production increased by 14% year-over-year in 2020 to account for 21% of total production. The product, like all company products, is manufactured in the company's world-class production plants in Al-Za'franiya on the outskirts of Baghdad as can be seen from the photos below from a recent visit to the company.

Aquafina's production lines with the new 70,000 bottles per hour line added in 2019

(Source: AFC Research)

Close up of a section of the 70,000 bottles per hour production line

(Source: AFC Research)

Aquafina bottles ready for distribution

(Source: AFC Research)

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali (@AMTabaqchali ) is the Chief Strategist of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a non-resident Fellow at the Institute of Regional and International Studies (IRIS) at the American University of Iraq-Sulaimani (AUIS), and an Adjunct Assistant Professor at AUIS. He is a board member of the Credit Bank of Iraq.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment