Central banks can't stop deflation but Trump can

(MENAFN- Asia Times) US President Donald Trump visited Japan last month. Fed Chairman Jerome Powell has moved there, at least conceptually. The Fed now faces so-called Japanese conditions, that is, a bias towards deflation that no amount of central bank ease can deflect.

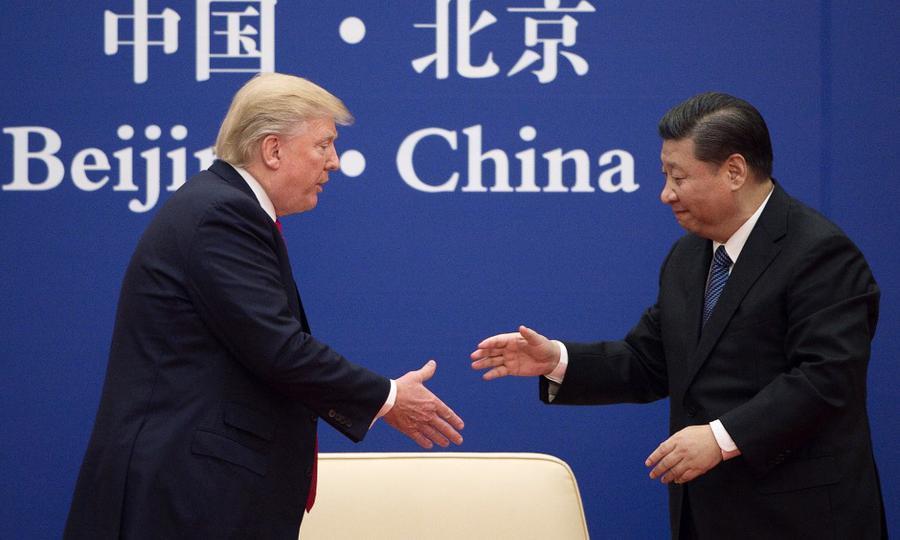

That's why I think that the Federal Reserve will cut its overnight rate at its meeting on Wednesday, June 19. The goods sector of the world economy already is in recession, with JP Morgan's global purchasing managers' index in negative territory and world trade shrinking year-over-year. It would also be a very good reason for Presidents Trump and Xi to offer an early end to the Sino-American trade war at the Osaka meeting of the Group of 20 later this week, but I hesitate to offer a prediction.

Deflation is mostly a form of collateral damage from a trade war. Uncertainty about the placement of global supply chains puts investment plans on hold, and industrial orders sag. Deflation is bad for debtors (because they have to pay back money they borrowed in currency that is worth more in terms of goods). The US is the world's biggest net debtor, with a net foreign asset position of negative $10 trillion. China's net foreign assets are $3.7 trillion. More to the point, the victor in a price war in semiconductors – which appears to be in full swing – will be the country with the greatest staying power and most government support. If you answered, 'What is the United States,' don't quit your day job for Jeopardy.

The world is at risk of deflation. I began to warn about deflation risk inNovember 2018 . Nothing is worse for equity markets: Falling prices reduce the top line and destroy earnings. The Fed tilted the wrong way when it raised interest rates in December, provoking a stock market crash. Fed Chair Powell backpedaled, at least in terms of rhetoric, and caused the market to believe that he would cut rates twice or even three times this year. The market recovered, sort of. As the expected federal funds rate 12 months' hence fell in response to Fed jawboning, equity prices rose, up to a point.

That leaves the Fed painted into a corner. If Powell frustrates market expectations of a rate cut, he probably will provoke another big drop in equity prices, and the Fed doesn't like it when that happens. Central banks try to signal their intentions to the market in order to maintain predictability, but at a cost: They have few good choices, except to become predictable. The Fed has to cut rates to maintain the status quo.

In fact, the Fed can't quite maintain the status quo. The shrinkage in world trade and manufacturing has crushed the prices of demand-sensitive goods, from energy to semiconductors, and their distress is reflected in sector equity prices.

It isn't just the actual deflation of certain prices – for example, oil or memory chips – but the expectation of falling prices in the future, that bedevils the central banks. Since March, the expected US inflation over the next 10 years (as reflected in the yield difference between ordinary and inflation-indexed Treasury bonds) has fallen from around 2% to 1.65%. It's fallen much faster than the price of oil or other commodities, which is to say that the deflationary impulse involves an important shift in expectations.

Read: Trump tweets on Xi meeting, risk markets soar

Europe is in worse shape than the United States. The expected inflation rate in Germany has fallen by almost half, from around 1.3% to less than 0.7%, between November 2018 and the present.

It's not surprising that inflation expectations in Germany have reacted further and faster than in the US. Germany is far more trade-dependent than the US and its economy is more exposed to the downturn in world capital spending.

Note that the oil price is largely unchanged since last November, but German inflation expectations for the next 10 years have fallen by roughly half. In fact, breakeven inflation in the German bond market has fallen all the way back to where it was in 2015, when the oil market crashed.

I've argued that investors should stay away from sectors in the first line of trade-war fire, for example, semiconductors, and stick to bond-like equities with stable cash flows, such as consumer staples, utilities and real estate investment trusts. These have outperformed during recent weeks, and I'm looking for the point to take profits.

Sign up for the Daily Report

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment