Hedge Funds See First Net Inflows Since 2021 Amid Best Performance Of The Decade

At a high level, the key findings are:

-

First annual net inflows since 2021, reversing three years of outflows, with net inflows of $62.2bn across the year

Best performance of the decade so far, with a weighted average return of 21.9% and almost 90% of funds posting positive returns

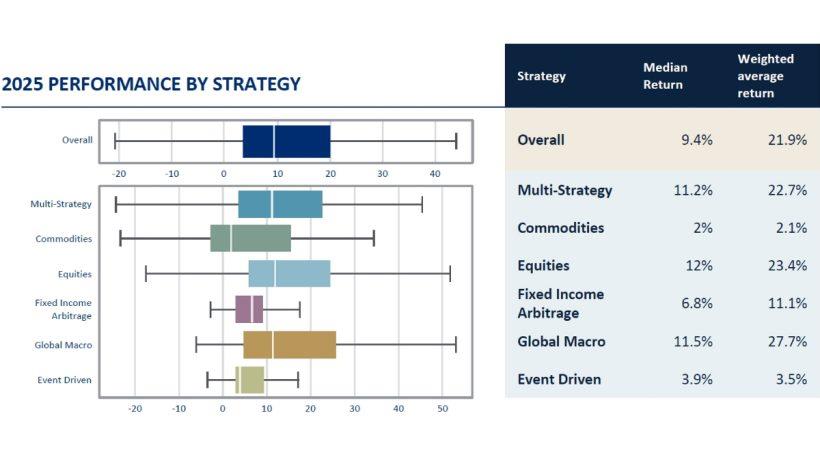

Global Macro the top-performing strategy in 2025 (27.7%), with Equity and Multi-Strategy funds also delivering returns above 20%

Multi-Strategy funds the clear flow winner, accounting for more than $50bn of net inflows

Record operational activity, including the busiest quarter on record for trade volumes and more than 700,000 treasury payments processed over the year

Continued outsourcing of middle-office functions as managers scale and respond to higher volumes, volatility and regulatory demands

Hedge funds saw their first annual net inflows since 2021 and delivered their best performance of the decade so far in 2025, with the average fund returning more than 20% to investors and almost 90% of funds in the green for the year.

Funds administered by the Citco group of companies (Citco) achieved a weighted average return of 21.9%, surpassing last year's tally of 15.7% and the previous peak of 18.3% in 2020.

Global Macro funds were the top performing strategy in 2025, with a weighted average return of 27.7%. Equity and Multi-Strategy funds also saw performance above the 20% mark, at 23.4% and 22.7% respectively.

Once again, the largest funds with more than $3bn of AUA had the highest weighted average return, at 26.5% for the year, a large move up from last year's total of 16.8%.

Following three straight years of outflows since 2022, net inflows came in at $62.2bn for 2025, surpassing 2021's tally of $37.3bn of inflows, and 2020's total of $17.8bn. In 2025, each quarter of the year saw positive flows, with Q3 the standout with $29.3bn of net inflows. Multi-Strategy funds were far and away the most popular strategy, accounting for over $50bn of net inflows.

It was also a landmark year for trade volumes which reached new highs, setting multiple records across the calendar year. Activity levels achieved numerous milestones as managers navigated major market events, including the introduction of trade tariffs in Q1, rising equity markets, and a late surge for precious metals.

As with previous years, treasury payment volumes also reached new peaks, with more than 700,000 payments processed across the calendar year.

Declan Quilligan, Head of Hedge Fund Services, Citco Fund Services (Ireland) Limited, said: "2025 was the third consecutive year that hedge funds have not only delivered positive returns on an annual basis, but double-digit returns.

"Crucially, Citco's clients turned the taps on in terms of flows in 2025, with the highest net inflows of the decade, reversing the outflows seen in the previous three years. Our clients also continued to outsource a wider range of functions to Citco, in particular middle office services, and in turn we will continue to invest in our proposition to support their needs and power their growth for decades to come."

About The Citco Group Of Companies (Citco)

The Citco group of companies (Citco) is a network of independent companies worldwide. These companies are leading providers of asset-servicing solutions to the global alternative investment industry. With $2 trillion in assets under administration and operations spanning across 36 countries, Citco's unique culture of innovation and client-driven solutions have provided Citco's clients with a trusted partner for more than four decades. Having grown organically into one of the largest asset servicers in the industry, Citco's Fund Services companies offer a full suite of middle office and back office services including treasury and loan handling, daily NAV calculations and investor services, corporate and legal services, regulatory and risk reporting as well as tax and financial reporting services. Investing heavily in innovation and technology whilst further developing its current suite of client-friendly solutions, Citco will continue into the future as a flagbearer for the asset-servicing industry.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment