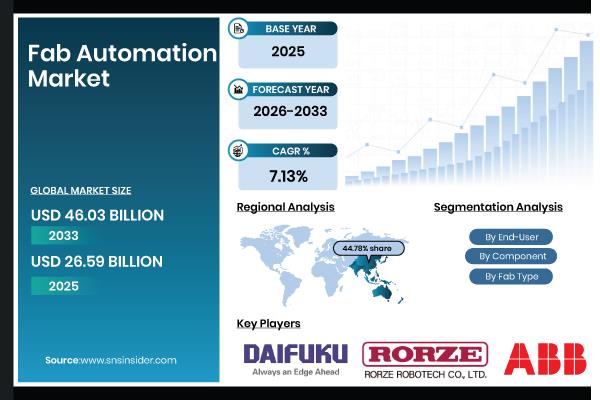

Fab Automation Market Size To Hit USD 46.03 Billion By 2033, At 7.13% CAGR Research By SNS Insider

| Report Attributes | Details |

| Market Size in 2025E | USD 26.59 Billion |

| Market Size by 2033 | USD 46.03 Billion |

| CAGR | CAGR of 7.13 % From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | . By Automation Type (Automated Material Handling Systems (AMHS), Material Handling Systems, Robotics, Process Control Systems, Inspection & Metrology Systems) . By Component (Hardware, Software, Services) . By Fab Type (Wafer Fabrication (Front-End), Assembly & Packaging (Back-End), Testing) . By Wafer Size (200 mm, 300 mm, Others) . By Technology Node (≤10 nm, 11–28 nm, 29–65 nm, >65 nm) . By End-User (Foundries, Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSATs)) |

Purchase Single User PDF of Fab Automation Market Report (20% Discount) @

High Capital Investment Requirements and Complex Integration Challenges May Impede Market Expansion Globally

The Fab Automation Market is severely constrained by high capital investment requirements and intricate system integration. Robotics, AMHS, and process control systems are examples of advanced automation solutions that are difficult for smaller factories to employ due to their high upfront costs. Production may be hampered by the technological complexity and downtime required for integration with current manufacturing processes.

Key Industry Segmentation Analysis

By Automation Type

Automated Material Handling Systems (AMHS) held the largest market share of 32.45% in 2025 due to their essential role in material transportation, wafer handling and efficient integration with fab operations. Robotics is expected to grow at the fastest CAGR of 9.21% during 2026–2033 driven by increasing adoption of precision handling, wafer transfer automation and process flexibility.

By Component

Hardware accounted for the highest market share of 54.32% in 2025 as it forms the backbone of fab automation, including conveyors, robotic arms, sensors and controllers. Software is projected to expand at the fastest CAGR of 8.57% during the forecast period driven by demand for advanced process control, predictive maintenance and real-time monitoring solutions.

By Fab Type

Wafer Fabrication (Front-End) dominated with a 48.96% share in 2025 due to the high automation requirements in lithography, etching, deposition and inspection processes. Assembly & Packaging (Back-End) is expected to grow at the fastest CAGR of 8.34% through 2026–2033 fueled by expansion in OSAT facilities and advanced packaging technologies.

By Wafer Size

300 mm held the largest share of 62.11% in 2025 as larger wafers enable higher production volumes, improved yield and reduced per-chip costs. 200 mm is forecasted to register the fastest CAGR of 7.88% during 2026–2033 driven by demand for specialized analog, MEMS and power devices.

By Technology Node

29–65 nm accounted for the largest share of 36.85% in 2025 due to their widespread use in automotive, consumer electronics and industrial applications. ≤10 nm is expected to grow at the fastest CAGR of 9.12% through the forecast period driven by advanced logic, memory and AI chip demand.

By End-User

Foundries held the largest share of 42.98% in 2025 as they serve multiple chip designers and require large-scale, automated production to meet semiconductor demand. OSATs are projected to expand at the fastest CAGR of 8.89% during 2026–2033 driven by the expansion of packaging, testing and assembly operations.

Regional Insights:

In 2025, the Asia Pacific region held a 44.78% market share, dominating the fab automation market. Major semiconductor manufacturers, top foundries, and high-volume factories in China, Taiwan, South Korea, and Japan are the main drivers of growth.

The North America Fab Automation Market is the fastest-growing region, projected to expand at a CAGR of 8.26% during the forecast period. Growth is driven by advanced semiconductor R&D, new fab construction and adoption of robotics, AMHS and process control systems across the U.S. and Canada.

Do you have any specific queries or need any customized research on Fab Automation Market? Schedule a Call with Our Analyst Team @

Recent Developments:

- In April 2025, Daifuku launched a new manufacturing plant in Hyderabad, India, expanding production of automated storage systems, conveyors and pallet sorters. This strengthens fab automation solutions and enhances operational efficiency across regional semiconductor supply chains. In November 2025, Murata Machinery showcased advanced robotics and smart logistics solutions, including ALPHABOT and MoCS AMRs, at iREX 2025, highlighting its leadership in intelligent material handling, factory automation and semiconductor manufacturing.

Exclusive Sections of the Fab Automation Market Report (The USPs):

- MARKET PERFORMANCE & REVENUE METRICS – helps you evaluate market scale and monetization by analyzing the global installed base of fab automation systems, average selling price trends, revenue split across hardware, software, and services, and market share of leading solution providers. ADOPTION & UTILIZATION BENCHMARKS – helps you assess the depth of automation penetration across wafer fabrication and assembly operations through adoption rates, system utilization levels, throughput improvements, and reductions in manual intervention. OPERATIONAL RELIABILITY & COST METRICS – helps you understand production efficiency by tracking system downtime, maintenance frequency, service costs per unit, and overall operational reliability across manufacturing lines. SUPPLY CHAIN & LOGISTICS RISK INDICATORS – helps you identify vulnerabilities by analyzing average lead times, supplier concentration for critical components, logistics cost contribution, and exposure to component shortages or supply disruptions. TECHNOLOGY & INNOVATION ADOPTION INDEX – helps you uncover innovation-driven growth opportunities by examining adoption of next-generation automation technologies, R&D intensity, patent activity, yield improvements, and system integration with MES, ERP, and fab management platforms. QUALITY, COMPLIANCE & RISK METRICS – helps you measure regulatory readiness and system robustness through compliance with manufacturing and safety standards, error rates, calibration accuracy, warranty claims, and end-of-life recycling compliance.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us: Rohan Jadhav - Principal Consultant Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment