Aadhaarpan Linking Deadline Nears: ₹1,000 Penalty And Key Details You Shouldn't Miss Before December 31

Taxpayers who are looking to link their PAN and Aadhaar should note that the linking involves connecting an individual's PAN with their Aadhaar number. This move seeks to confirm the identity of these individuals and prevent duplicate PAN issuance in the country.

Also Read | How much gold without an invoice can't be seized during an income tax raid? Aadhaar-PAN linking deadlineThe Central Board of Direct Taxes (CBDT ) initially fixed 30 June 2023 as the deadline for people to link their PAN with their Aadhaar number. This date was later extended to 31 May 2024 with a late fine of ₹1,000 per individual.

According to the latest CBDT notification, on 3 April 2025, the authority fixed 31 December 2025 as the final deadline for the linking process. If taxpayers fail to comply with the government mandate, then this will result in their PAN being inoperational, effective from 1 January 2026.

Experts indicate that people will not be subject to any late fee if they complete the linking process within the December deadline, as per Protean data, a Government of India company.

However, for PAN holders who missed their earlier deadline, they are likely to still face a late fee of ₹1,000 under Section 234H of the Income-tax Act, 1961.

Also Read | Aadhaar-PAN linking deadline soon: Step-by-step guide to link them before 31 Dec What if you fail to link Aadhaar and PAN?If an individual fails to link their Aadhaar and PAN, then they will face the following consequences -

- PAN will become inoperational effective from 1 January 2026. Higher TDS/TCS deductions under Section 206AA and 206 CC of the I-T Act. Taxpayers will also face disruption while filing their Form 15G/15H, which is necessary for non-deduction of TDS. Banks, mutual funds, and stockbrokers are likely to suspend their services for the investors due to invalid Know Your Customer (KYC). If the Aadhaar and PAN are not linked by the December deadline, then reactivating their PAN will attract a payment of ₹1,000 and additional verification steps. Refunds of the taxpayers will not be processed due to an inactive PAN, hence they will not be paid back for their filed returns.

- Valid Permanent Account Number (PAN) Individual's Aadhaar card number Working mobile phone number

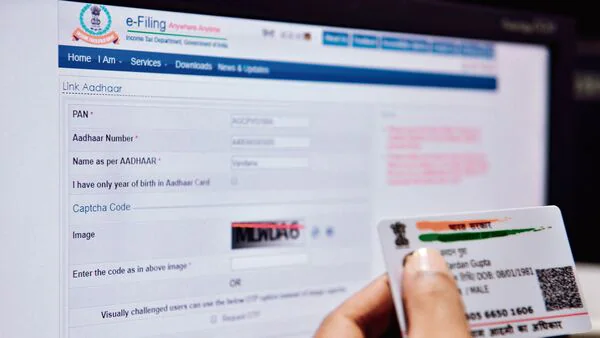

To link your Aadhaar number with your PAN number, please follow the steps mentioned below -

Step 1: Visit the official Income Tax portal.

Direct Link here -

Step 2: Select the“Link Aadhaar” option under the“Quick Links” section.

Step 3: You will now need to enter your PAN, Aadhaar number, and name (as per Aadhaar card)

Step 4: Click on the“Validate” option

Step 5: Enter the One-time password (OTP) sent to your Aadhaar-registered mobile number on the website.

Step 6: Submit the form after entering all the details.

Your screen will display a confirmation message, and the status updates will start reflecting on the portal in the next 3-5 working days.

People should also note that if you are linking your Aadhaar and PAN after missing the deadline, then you will also be mandated to pay a ₹1,000 fine. Hence, you will have to select the“ ₹500 Fee for delay in linking PAN with Aadhaar” before submitting.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment