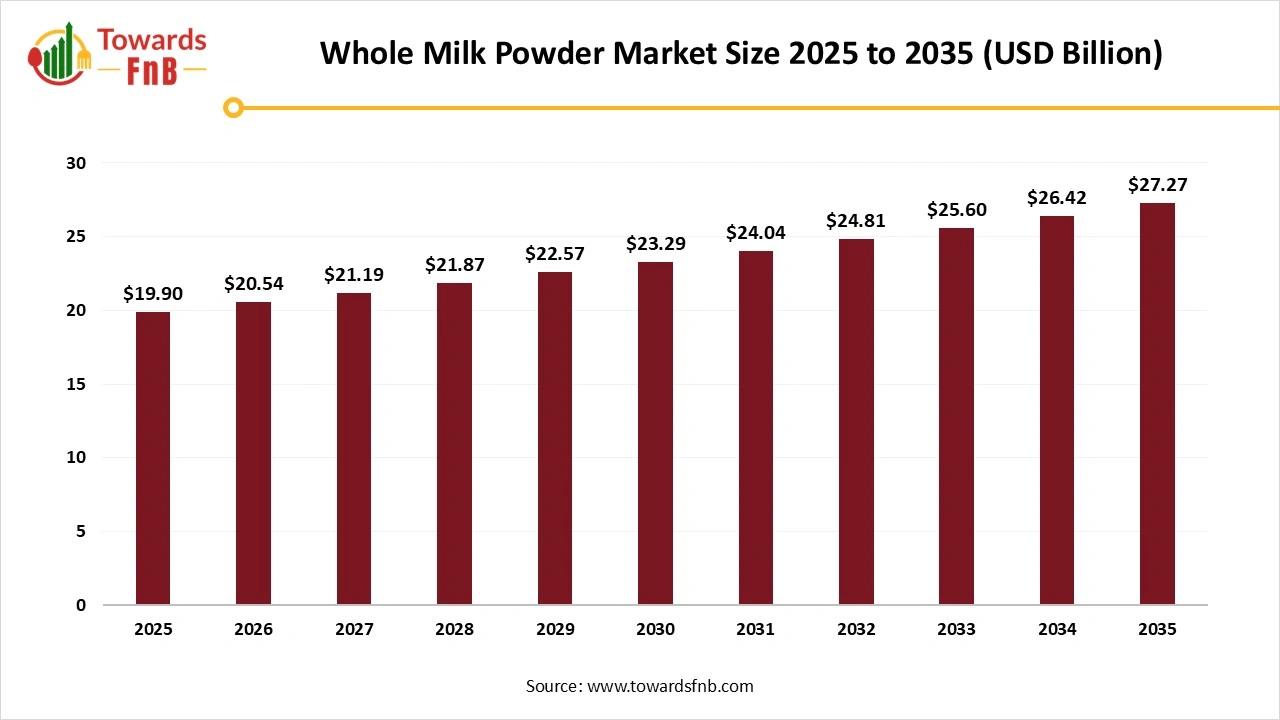

Whole Milk Powder Market Size To Worth USD 27.27 Billion By 2035 Towards Fnb

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Brands |

| Regular Whole Milk Powder | Standard spray-dried whole milk powder containing natural milk fat for broad food processing use. | Regular heat WMP, high heat WMP | Bakery, confectionery, dairy beverages, chocolate | Fonterra WMP Regular, Arla Foods Ingredients, Nestlé Ingredients |

| Instant Whole Milk Powder | Agglomerated or instantized WMP designed for fast dispersion in water. | Instant WMP, extra soluble WMP | Retail milk powders, foodservice beverages, home use | Anchor Instant WMP, Nestlé Nido, Dutch Lady Instant Milk Powder |

| Fortified Whole Milk Powder | WMP enriched with vitamins and minerals to improve nutritional value. | Vitamin A and D fortified, iron fortified, multivitamin fortified | Infant foods, school nutrition, fortified beverages | Nido Fortificada, Promasidor fortified powders |

| Organic Whole Milk Powder | Produced from certified organic dairy farms using organic processing standards. | Organic WMP, non-GMO certified | Premium foods, infant nutrition, organic bakery products | Organic Valley, Arla Organic, AusOrganic Milk Powder |

| Full Cream Milk Powder for Industrial Use | High-fat WMP is used as a functional ingredient for creaminess and color. | 26 percent fat WMP, 28 percent fat WMP | Ice cream, recombined milk, confectionery, baked goods | Fonterra FCMP, Lactalis Ingredients |

| Whole Milk Powder for Infant Formula Production | High-quality WMP meets strict nutritional specifications for formula-based powder. | Low heat WMP, tailored WMP for infant blends | Infant formula manufacturers | FrieslandCampina Ingredients, Fonterra, Dana Dairy |

| Instant Flavored Milk Powders | WMP blended with flavors and sweeteners for consumer-ready beverages. | Chocolate milk powder, strawberry milk powder, malted milk powder | Kids' beverages, retail flavored drinks | Nestlé Milo, Ovaltine, Cadbury Drinking Chocolate base |

| Halal and Kosher Whole Milk Powder | WMP is certified for religious dietary compliance. | Halal WMP, kosher certified WMP | Middle Eastern and Jewish markets | New Zealand WMP exporters, European certified suppliers |

| Lactose-Adjusted Whole Milk Powder | WMP formulated with reduced or modified lactose for digestive comfort. | Low lactose WMP, enzymatically treated WMP | Digestion-friendly milk powders | Specialist dairy ingredient producers |

| Recombined Dairy Beverage Base Powders | Whole milk powders are designed for reconstitution into liquid milk in regions with limited access to fresh milk. | Recombination bases, full cream dairy bases | Africa, Middle East, and developing markets | Fonterra recombination systems, Polfa Group |

| Specialty Whole Milk Powder for Coffee and Tea | Tailored WMPs for vending machines, tea whiteners, and coffee mixes. | Tea creamer WMP, vending milk powder | Foodservice, vending, tea, and coffee markets | Nestlé Professional, Kerry tea whitener powders |

| Whole Milk Powder for Chocolates and Confectionery | Specific particle size and heat stability for chocolate processing. | Low spore WMP, highheat-stablee WMP | Chocolate manufacturing, confectionery | Barry Callebaut WMP supply, Cargill Ingredients |

| Spray Dried Whole Milk Powder with Functional Lipids | Enhanced lipid profile for infant nutrition or functional foods. | DHA-enriched, omega enriched WMP | Infant nutrition, medical foods | Ingredient suppliers with DHA capabilities |

| Bulk Commodity Whole Milk Powder for Export | Commodity grade WMP is used in large-scale food processing and international trade. | Standard WMP export grade | Importers in Asia, Africa, Middle East | Fonterra, Lactalis, Amul |

For Detailed Pricing and Tailored Market Report Options, Click Here:

Whole Milk Powder Market Dynamics

What Are the Growth Drivers of the Whole Milk Powder Market?

Higher demand for convenient options with longer shelf lives and high nutritional value is a major factor driving market growth. The product has strong demand in the growing food and beverage and bakery industries. Hence, it further fuels market growth. Other major factors for the market's growth include rising disposable income and increasing health consciousness. Technological advancements that help maintain the product's nutritional quotient, along with sustainable packaging, also propel the market's growth.

Challenge

Supply Chain Issues Hampering Market's Growth

The dairy supply chain needs smooth coordination, as the shelf life of raw milk is short, which also necessitates higher quality control. Poor transportation infrastructure, a lack of cooling facilities, and general logistical bottlenecks are among the major issues hampering the growth of the whole milk powder market. Hence, such issues may collectively restrain the market's growth.

Opportunity

Product Innovation Is Helpful for the Growth of the Market

Product innovation driven by technological advancements that enhance the nutritional value of whole milk powder is a major factor in the market's growth. The food and beverage and bakery industries widely use it. Hence, it helps develop sweet and savory bakery options, further fueling the market's growth. The nutritional product is also used for the manufacturing of healthy infant formula, further strengthening the consumer base.

Whole Milk Powder Market Regional Analysis

North America Led the Whole Milk Powder Market in 2024

North America led the whole milk powder market in 2024 due to higher demand for convenient, dairy-based, and protein-rich options, driving market growth. Higher demand for ready-to-cook and ready-to-eat options among consumers with hectic lifestyles is another major factor driving market growth. Higher demand for nutritional and affordable options helps drive market growth. The US has a major contribution to the region's market ingrowth due to high demand for convenient, protein-rich options among consumers with busy lifestyles.

Asia Pacific Is Expected to Grow in the Forecast Period

Asia Pacific is expected to grow rapidly over the foreseeable period due to higher demand for nutritious, longer-shelf-life options in the region. The market is also seeing growth due to the expansion of the food and beverage and bakery sectors in the region. Such factors help fuel the market's growth over the forecast period. Increasing disposable income, higher demand for convenient options, and rapid urbanization also help fuel the market's growth. India has made a major contribution to the region's market growth due to rising disposable income, shifting consumer preferences, and changing lifestyles, leading to higher demand for nutritious options.

Europe is Observed to Have a Notable Growth in the Foreseeable Period

The market is observed to grow in the region at a notable pace, mainly due to factors such as rising disposable income, a supportive government regulatory framework, and technological advancements that help maintain product quality. The region's rising food and beverage industry and bakery sector are another major factor driving the market's growth. Germany, the UK, and France have made major contributions to market growth due to the flourishing bakery and food and beverage industries in these regions.

Trade Analysis for the Whole Milk Powder Market

What is Actually Traded (product forms and HS proxies)

- Bulk industrial WMP for food manufacturers and reprocessors, normally shipped in 25 kg bags or large bulk containers. (HS 040221 / 040229). Consumer-packed WMP in retail tins and sachets for direct sale. (Often recorded within the same HS lines but differentiated by trade statistics metadata where available). Specialty/fortified WMP for infant nutrition or clinical use. These flows are smaller and have additional compositional and certification requirements. (See Codex and national standards).

Top Exporters (supply hubs)

- New Zealand. Pasture-based milk production and large-scale cooperatives give New Zealand structural export strength in WMP. New Zealand remains the primary source for many Asian markets. European Union. Several EU countries export processed milk powders, supported by integrated dairy industries and logistics to Mediterranean and African markets. United States and selected South American suppliers. The United States, Argentina and Uruguay supply niche volumes and specialised product forms to global markets. National statistics and USDA reporting provide supplier-level detail.

Top Importers (demand centres)

- China. Historically the largest volume importer of WMP and a structural demand centre for Oceania and EU exporters. Recent years saw variances as domestic production and inventory cycles changed import needs. Southeast Asia and North Africa. Indonesia, the Philippines, Vietnam, Algeria and nearby markets import WMP for food processing and consumer markets. Population growth and preferences for processed dairy inputs drive demand. Middle East and some Latin American markets. Import demand here is for both consumer-packed powder and industry-grade powder for confectionery and dairy blends. National procurement programs and government food security purchases can be material.

Typical Trade Flows and Logistics Patterns

- Major flow: Oceania (New Zealand, Australia) → East and Southeast Asia (China, Indonesia, Philippines, Vietnam). New Zealand exporters use deepwater ports and container and bulk-bag shipments routed via feeder hubs. EU exports move to North Africa, the Middle East and intra-Europe via short-sea and container routes. Export logistics often require a cold chain for derivative products, though WMP itself is a shelf-stable dry commodity. Re-export and co-packing hubs exist where wholesalers rebag, fortify or re-label WMP for regional markets. Processing shifts in origin countries can change where milk solids are converted into powder versus other dairy ingredients.

Trade Drivers and Structural Factors

- Milk supply cycles at the origin. Weather, herd numbers, and farm economics determine the availability of milk solids for powder versus other uses. Demand-side compositional change. Growth in processed foods and infant nutrition influences demand for specific powder grades. Price sensitivity and inventory cycles in large importers such as China. Large domestic inventories or increased local production can sharply reduce import volumes. Trade policy and market access. Tariffs, sanitary lists, and recognition of export establishments shape supplier competitiveness.

Regulatory, Quality, and Market-access Considerations

- Codex standards: WMP composition, labeling, and testing guidance are set out in Codex Stan 207 for milk powders. Exporters should comply with Codex where importing markets reference it. Importing country rules: The EU, China, and other countries require approved exporting establishments, veterinary controls, and documentary evidence via systems such as TRACES for the EU. Certification and establishment listing are mandatory for many markets. Food safety testing: Heavy metals, mycotoxins, antibiotic residues, and microbiological criteria are commonly checked. Buyers frequently require certificates of analysis and traceability back to the batch level.

Government Initiatives and Public-Policy Influences

- Export facilitation in producer countries. Governments and trade agencies in New Zealand and EU member states support exporters through export certificates, market access negotiations, and SPS capacity building. Importer policies. China and some large importers adjust tariff and procurement policies and may prioritise domestic suppliers under food security initiatives. These moves materially affect WMP trade volumes.

Whole Milk Powder Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 3.2% |

| Market Size in 2026 | USD 20.54 Billion |

| Market Size in 2027 | USD 27.19 Billion |

| Market Size by 2035 | USD 27.27 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let's Talk-Schedule a Meeting with Our Insights Team:

Whole Milk Powder Market Segmental Analysis

By End Use Analysis

The dairy segment dominated the whole milk powder market in 2025 due to higher demand for convenience, dairy-based products, and nutritional products. The growing food and beverage and bakery industries are other major factors driving market growth. Whole milk powder is useful in these industries for making a range of sweet and savory dishes, which supports market growth. Lower storage costs and extended shelf life are other major factors driving market growth.

The bakery segment is expected to grow in the foreseeable period due to its higher usage in the bakery industry. It helps retain flavor, browning, and moisture in bakery items such as cakes, cookies, and breads, further fueling market growth. Higher demand for processed bakery items to extend their shelf life and make them easier to carry is another major factor driving market growth.

Feel Free to Get in Touch with Us for Orders or Any Questions at: ...Additional Topics Worth Exploring:

- Dietary Supplements Market: The dietary supplements market Frozen Food Market: The global frozen food market Vegan Food Market: The global vegan food market Sugar-Free Food Market: The global sugar-free food market Food Additives Market: The global food additives market Ethnic Food Market: The global ethnic food market Meal Kits Market: The global meal kits market Baking Ingredients Market: The global baking ingredients market Fresh Produce Market: The global fresh produce market Beverage Packaging Market: The global beverage packaging market Coconut Products Market: The global coconut products market size Pet Food Market: The global pet food market size Organic Food Market: The global organic food market size

Top Companies in the Whole Milk Powder Market

- Agri-Dairy Products, Inc. – A U.S.-based dairy ingredient supplier specializing in milk powders, whey proteins, and functional dairy products for foodservice and industrial clients, focusing on high-quality and consistent dairy solutions. All American Foods – Provides custom dairy and non-dairy ingredients, including whole milk powder, for bakery, confectionery, and beverage industries, emphasizing innovation and tailored solutions for manufacturers. Amul (GCMMF) – India's largest dairy cooperative, producing a wide range of milk powders and dairy products; known for its strong domestic presence and growing international exports. Arla Foods amba – A European dairy cooperative headquartered in Denmark, offering organic and conventional whole milk powders and other dairy ingredients for global markets, with a focus on sustainability. Chicago Dairy Corporation – U.S.-based manufacturer of whole milk powders and other dairy ingredients, serving both domestic and export markets with a focus on quality and product versatility. Dairy Farmers of America, Inc. – One of the largest dairy cooperatives in the U.S., producing whole milk powder, cheese, and butter; emphasizes supply chain efficiency and innovation in dairy processing. Fonterra Co-Operative Group Limited – New Zealand's leading dairy exporter, supplying high-quality whole milk powders to global markets, with strong R&D capabilities for product innovation. Lactalis Ingredients – A global dairy ingredient supplier headquartered in France, producing whole milk powder, whey, and functional dairy ingredients for food, nutrition, and industrial applications. Vinamilk – Vietnam's largest dairy company, manufacturing whole milk powders, infant formulas, and other dairy products, with expanding export operations in Asia and the Middle East. Westland Milk Products – New Zealand-based cooperative offering whole milk powders and dairy ingredients, known for high-quality, pasture-fed milk products targeting international markets. Z Natural Foods – U.S. company providing functional dairy and natural food ingredients, including whole milk powders, for nutraceuticals, bakery, and beverage applications with an emphasis on innovation and customization.

Segments Covered in the Report

By End Use Insights

- Dairy Infant Formula Bakery Confectionery Others

By Region

North America

- U.S. Canada

Asia Pacific

- China Japan India South Korea Thailand

Europe

- Germany UK France Italy Spain Sweden Denmark Norway

Latin America

- Brazil Mexico Argentina

Middle East and Africa (MEA)

- South Africa UAE Saudi Arabia Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific-are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: Feel Free to Get in Touch with Us for Orders or Any Questions at: ... Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It's your strategic edge in the food and beverage industry:About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we'll navigate this transformative journey.

Web:Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials | Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals AnalyticsFor Latest Update Follow Us:

LinkedIn Medium TwitterDiscover More Market Trends and Insights from Towards FnB:

➡️ Salt Market: insights/salt-market ➡️ Protein Bar Market: insights/protein-bar-market ➡️ Gluten-Free Bakery Market: insights/gluten-free-bakery-market ➡️ Canned Food Market: insights/canned-food-market ➡️ Dry Fruit Market: insights/dry-fruit-market ➡️ Frozen Meat Market: insights/frozen-meat-market ➡️ Fish Oil Market: insights/fish-oil-market ➡️ Soft Drink Concentrates Market: insights/soft-drink-concentrates-market ➡️ Coffee Beans Market: insights/coffee-beans-market ➡️ Soybean Market: insights/soybean-market ➡️ Beef Market: insights/beef-market ➡️ Cheese Market: insights/cheese-market ➡️ Food Packaging Market: insights/food-packaging-market

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment