With An Eye On Safety, India Mulls QCO On Food Processing Machines As Chinese Imports Soar

New Delhi: India, home to the world's sixth-largest food processing industry, may put in place new technical standards to curb the inflow of substandard imported machinery after a government study found that China accounts for 41% of India's $843 million worth food-processing equipment imports. The food processing and consumer affairs ministries are looking to draft standards that will form the basis of upcoming Quality Control Orders (QCOs) that will mandate minimum safety, hygiene and performance requirements for all such machinery sold domestically, three senior officials involved in the development told Mint.

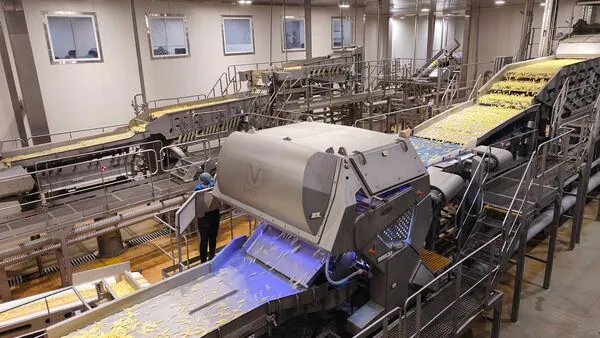

The proposal comes amid concern over frequent breakdowns, low efficiency and safety risks associated with some imported machines-issues that are odds with the needs of a sector expanding into higher-value processed foods and global export opportunities. By making compliance with Bureau of Indian Standards (BIS) norms compulsory, the proposed QCOs aim to lift manufacturing quality and reduce India's heavy reliance on low-cost Chinese equipment.

This move for quality control norms comes even as India is rolling back some QCOs covering sectors such as key textile, plastic and metal inputs to boost manufacturing. However, the absence of robust technical standards for the food processing sector has allowed low-quality products to enter the Indian market, undermining productivity as well as food safety.

Also Read | China-led magnet imports more than halve. Automakers see no turning bThese norms could, however, also reshape supply chains, raise certification costs and test India's ability to roll out standards without disrupting thousands of small and medium food-processing units.

A growing industryAs per the commerce ministry-led Indian Brand Equity Foundation (IBEF), India's food-processing market reached ₹30.50 trillion (about $367.5 billion) in 2024 and is expected to grow to ₹45.84 trillion (about $552.29 billion) by the end of FY26. The global packaged food market is estimated at around $2.3 trillion.

According to the study, primary vegetables and grain milling processing machinery for bread are the major imports from China.

“The market has been flooded with low-cost, low-quality machinery that does not meet Indian safety or hygiene standards. This poses risk not only to processors but also to consumers," said the first of the three officials cited above.

In terms of imports of food-processing machinery, China dominates Indian imports due to its attractive price points. As of FY24, the share of China in the overall food-processing machinery and parts imports was 41%, followed by Germany (8%), Italy (7.4%), the Netherlands (7.4%) and Turkey (4.8%).

“We import a number of machines for manufacturing packaged food items. Apart from quality issues, we also face problems whenever Chinese machinery breaks down. The mobility of technicians from China becomes a major hurdle, it is difficult and time-consuming to get visas, and this adds to both delays and costs," said an industry executive from one of the country's leading food-processing companies.“If India becomes self-reliant in machinery manufacturing, it will be a big relief for the food-processing industry. A QCO could help move us in that direction."

According to a food processing ministry study conducted by Crisil Intelligence, the total demand for such equipment is estimated at ₹350-400 billion and has been growing at an average annual rate of 5–7% over the past decade. India's import dependency for food-processing machinery is currently at about 17.5%.

India is one of the world's largest producers of milk, fruit and vegetables, wheat, rice and spices. Its overall agriculture exports were at ₹4.2 lakh crore (about $51 billion) in FY25, while imports were at ₹3.1 lakh crore (around $37 billion). The share of processed food in India's agri-food exports has also risen sharply: from 13.7% in FY15 to 23.4% in FY24, food processing ministry data shows.

As an importer of food-processing equipment, India ranks ninth globally, trailing Germany, Canada, Russia, France, the Netherlands, the UK and Mexico. The US was world's largest importer of food-processing machinery in calendar year 2023.

The ministry's study said small food-processing units rely heavily on Chinese machinery, with many processors choosing these imports to keep upfront costs low, especially in segments such as grains, vegetables, spices, bakery, snacks and beverages. The study also noted that poor manufacturing quality, frequent breakdowns and the lack of reliable spare parts often lead to operational disruptions for these units.

“One of the major concerns is non-compliance with mandatory standards set by the Bureau of Indian Standards. Several machines reportedly arrive without proper certification for material safety, electrical components or food-contact surfaces," said the second official cited earlier. In many cases, the stainless-steel grades used in such machines do not meet food-grade requirements and raise the risk of contamination, this official added.

The government's study through Crisil study suggested that the proposed regulations should clearly specify the permissible stainless-steel grades and other metals that can be used in food-contact machinery, and make compliance with these standards mandatory to get and maintain licences. It recommended that manufacturers be required to mark the composition of metals used in their equipment and adopt a uniform quality-standardization framework. The report noted that enforcing stricter quality norms would help curb low-grade imports to ensure safety.

Also Read | India may ease imports of specialty steel to address supply gAccording to the third official in the know, the proposal is at the discussion stage, and some rounds of inter-ministerial meetings have been held in this regard.

Queries sent to the food processing and consumer affairs ministries and Crisil Intelligence on 28 November remained unanswered till press time.

What the planned QCOs may meanExperts say the proposed QCO could reshape the industry, but only if the implementation is phased and testing capacity is expanded.“A standards regime is welcome, but it must reflect ground realities. Many Indian and foreign suppliers will need time to redesign equipment and complete BIS testing. If the rollout is rushed, MSMEs will face higher machinery costs and delivery delays. A calibrated approach will help improve quality without disrupting ongoing investments," said Arun Kumar Garodia, former chairman of the Engineering Export Promotion Council (EEPC).

If implemented, the QCO for food-processing machinery could trigger supply sortages as it is likely to hit imports, especially of low-cost equipment from China. Chinese manufacturers will need BIS certification to sell in India, and many may not qualify, industry experts said.

Vinod Kumar, president of the India SME Forum, said the impact of a new QCO would be felt most sharply by small processors, who depend on affordable imported machinery.“MSMEs are already struggling with rising input costs, and any sudden certification requirement will hit them disproportionately. While quality standards are essential, they must be introduced with clear timelines and adequate support," said Kumar.

“The certification may add 20–30% to machinery costs, many small food units will simply postpone expansion or drop out of the market. The government should ensure that standards do not become a barrier to entry for small manufacturers," Kumar added.

Machinery used for primary processing of vegetables and grain milling is mainly imported from China. A review of 52 machinery categories shows China is the most cost-effective supplier in a majority of these equipment.

More advanced and specialized equipment-such as those used for confectionery, chocolates, dairy, bakery, macaroni and flour processing-is typically sourced from European manufacturers.

Large food sector companies import about 40% of their machinery requirements, while medium-scale units import around 12–15%, says the study report.

Also Read | Why India's WTO farm import quotas saw no tak The QCO regimeQCOs are government mandates that require products to meet Bureau of Indian Standards' norms before manufacture, import or sale. They started with consumer goods and later expanded to petrochemicals, polymers, plastics, chemicals, machinery, electrical equipment and other industrial inputs. The regime grew rapidly after 2014, crossing 700 products by 2025, before the government began deferring deadlines and rolling back several QCOs mid-2024 onwards.

The recent rollback of 15 QCOs has reduced the number of products under these mandatory quality norms to 743. The Centre had earlier targeted to bring more than 700 additional products under compulsory standards in FY26.

For industries, a standard is a technical guideline that companies are encouraged to follow, but is voluntary. A QCO, on the other hand, makes the standard legally binding for manufacturers and importers, and they cannot sell any product in India without certification.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment