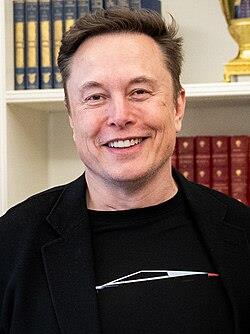

Massive Pay Plan For Elon Musk Gains Shareholder Backing

Shareholders of Tesla, Inc. approved a compensation package for Chief Executive Officer Elon Musk that could deliver up to US $1 trillion in stock over the next decade, with more than 75 per cent of votes cast in favour at the company's annual meeting in Austin, Texas. The package, contingent on a string of ambitious performance targets, is described by the board and supporters as essential to retain Musk's leadership and drive the firm's pivot towards artificial intelligence and robotics.

The award hinges on milestones including delivering 20 million vehicles, deploying 1 million robotaxis, selling 1 million humanoid robots and reaching a market valuation of US $8.5 trillion. If all targets are met, Musk stands to earn shares representing up to 12 per cent of Tesla's stock, though the net value is estimated at around US $878 billion after accounting for share price and vesting conditions. The package's approval ends months of debate among institutional investors and proxy advisers who raised concerns about scope, governance and dilution.

The approval signals confidence among many investors in Musk's capacity to steer Tesla into a future beyond electric vehicles, emphasising his role at the centre of the company's strategy. Musk, who holds approximately 15 per cent of Tesla shares, made clear on stage that his focus is not merely on compensation but on maintaining influence over the company's direction, particularly as Tesla deepens its involvement in robotics and chip manufacturing.“What we are about to embark upon is not merely a new chapter of the future of Tesla, but a whole new book,” he said following the vote.

See also $160 Million Crypto Longs Wiped Out in One HourCritics, however, warn that the structure grants Musk exceptional power and exposes shareholders to significant risk. Among those voting against the package was Norges Bank Investment Management, manager of the world's largest sovereign wealth fund, which cited the award's sheer size, potential dilution for other investors and the concentration of decision-making authority in a single individual as key objections. Proxy advisory firms such as Institutional Shareholder Services and Glass Lewis had also advised against the plan on similar grounds.

Tesla's board chair Robyn Denholm had issued a letter urging shareholders to support the proposal, warning that rejection could risk losing Musk's time, talent and vision at a pivotal moment for the firm. The board has defended the compensation plan as milestone-based and aligned with shareholder interests because the payout only occurs if Tesla meets rigorous performance thresholds. Supporters argue that Musk's vision-extending Tesla's footprint into autonomous mobility, humanoid robotics and AI infrastructure-requires long-term incentives that align his interests with the company's breakthrough goals.

Even as investors backed the package, many emphasised that achieving the required targets remains a tall order. Tesla's current market capitalisation sits well below the US $8.5 trillion target, and its robot- and self-driving ambitions face regulatory, technical and competitive headwinds. Some analysts regard the pledge to deliver millions of humanoid robots and robotaxis as speculative, pointing out that Tesla has yet to mass-produce such products. Others observe that Musk's prior promises-including fully autonomous cars and rapid ramp-ups of production-have been met with delays and regulatory challenges, prompting scepticism among governance watchers.

See also Bitwise Advances Spot Dogecoin ETF Launch with Section 8 FilingThe vote also underscores Musk's increasingly prominent role across multiple business ventures including xAI and SpaceX, and the extent to which Tesla's governance is intertwined with his broader ambitions. The compensation plan's structure gives Musk additional voting control tied to his share stake, a move applauded by advocates who say it ensures continuity of leadership, and criticised by opponents who say it entangles corporate oversight and creates“key-person risk”.

Arabian Post – Crypto News Network

Notice an issue? Arabian Post strives to deliver the most accurate and reliable information to its readers. If you believe you have identified an error or inconsistency in this article, please don't hesitate to contact our editorial team at editor[at]thearabianpost[dot]com. We are committed to promptly addressing any concerns and ensuring the highest level of journalistic integrity.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment