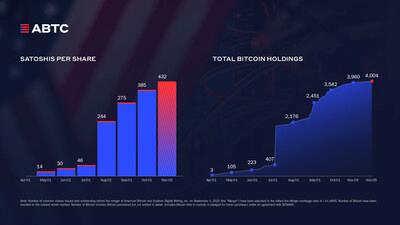

American Bitcoin Adds 139 Bitcoin, Increasing Strategic Reserve To 4,004 Bitcoin

| |

As of November 5, 2025 |

% Change |

| Satoshis Per Share |

432 |

3.35 % |

| Note: 1 Bitcoin = 100,000,000 Satoshis |

Bitcoin Reserve2, 3, 4

| |

As of October 24, 2025 |

As of November 3, 2025 |

As of November 5, 2025 |

| Bitcoin Reserve |

3,865 |

3,960 |

4,004 |

| Note: (1) Number of common shares issued and outstanding before the merger of American Bitcoin and Gryphon Digital Mining, Inc. on September 3, 2025 (the "Merger") have been adjusted to reflect the Merger exchange ratio of ~14.4995; (2) Number of Bitcoin have been rounded to the nearest whole number; (3) Number of Bitcoin includes Bitcoin purchased but not settled in wallet; (4) Includes Bitcoin held in custody or pledged for miner purchases under an agreement with BITMAIN. |

Supplemental Materials and Upcoming Communications

The Company expects to make available on its website and/or official social media channels certain materials and updates, including regarding its Bitcoin holdings, SPS, and related performance metrics. For important news and information regarding the Company, visit the Investor Relations section of the Company's website, abtc/investors, and its social media accounts, including on X, Instagram, and LinkedIn. The Company uses its website and social media accounts as primary channels for disclosing key information to its investors, some of which may contain material and previously non-public information.

About American Bitcoin

American Bitcoin Corp., a majority-owned subsidiary of Hut 8 Corp., is a Bitcoin accumulation platform focused on building America's Bitcoin infrastructure platform. The Company delivers institutional-grade exposure to Bitcoin through an industry-first business model that integrates scaled self-mining operations with disciplined accumulation strategies. For more information, visit abtc and follow the Company on X at @ABTC.

Cautionary Note Regarding Forward-Looking Statements

This press release includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements, include, but are not limited to, statements relating to the Company's ability to update and grow its SPS.

Forward-looking statements are not statements of historical fact, but instead represent management's expectations, estimates, and projections regarding future events based on certain material factors and assumptions at the time the statement was made. While considered reasonable by the Company as of the date of this press release, such statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance, or achievements to be materially different from those expressed or implied by such forward-looking statements, including, but not limited to: the price of Bitcoin and concentration of Bitcoin holdings; failure to grow hashrate; the purchase of miners; competition from other methods of investing in Bitcoin; uncertainty in the development and acceptance of the Bitcoin network; reliance on third-party mining pool service providers; hedging transactions; Bitcoin halving events; failure to realize the anticipated benefits of the merger transactions; dependence on Hut 8; liquidity constraints and failure to raise additional capital; failure of critical systems; competition from current and future competitors; changes in leasing arrangements; hazards and operational risks; electrical power requirements; geopolitical, social, economic, and other events and circumstances; cybersecurity threats and breaches; Internet-related disruptions; dependence on key personnel; having a limited operating history; rapidly changing technology; predicting facility requirements; acquisitions, strategic alliances or joint ventures; operating and expanding internationally; legal, regulatory, governmental, and technological uncertainties; physical risks related to climate change; involvement in legal proceedings; stock price volatility; the Company's multi-class capital structure and status as a controlled company; and other factors that may affect the future business, results, financial position and prospects of the Company. Additional factors that could cause results to differ materially from those described above can be found in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024, the proxy statement/prospectus filed by the Company with the U.S. Securities and Exchange Commission (the "SEC") on July 31, 2025, in the Company's Current Report on Form 8-K filed with the SEC on September 3, 2025 and in other documents filed by the Company from time to time with the SEC.

SOURCE American Bitcoin Corp.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment