Asia Week Ahead: China Inflation Data And South Korea's Unemployment Rate

China releases its CPI inflation data for October on Sunday morning. We expect deflation to persist with a -0.2% YoY read. Non-food prices have been recovering while food prices continue to drag on inflation. The bulk of the data will be out on the coming Friday, where October data is expected to remain under pressure. We expect retail sales to moderate to 2.6% YoY as the impact of the trade-in policy continues to fade. Weak confidence should continue to restrict investment, with FAI expected to slump further to -0.8% YoY ytd. Industrial production is expected to continue to outperform, but purchasing managers' data signals some moderation may be on the way in October. We're forecasting 5.7% YoY growth for the month.

South Korea: Unemployment rate expected to edge up slightlyWe expect a slight increase in the unemployment rate, which should increase to 2.6%. This is largely due to the effects of the longer-than-usual Chuseok holiday in October, which should result in less employment in manufacturing and some services. On a brighter note, we should see an increase in employment in leisure-related sectors such as hotels and dining out. Additionally, we are expecting to see some moderation in the weakness we have been observing in construction throughout this year as recently we saw modest pickup in housing starts. This aligns with our view that the contraction in construction, which has lasted for more than a year, is likely to come to an end in fourth quarter.

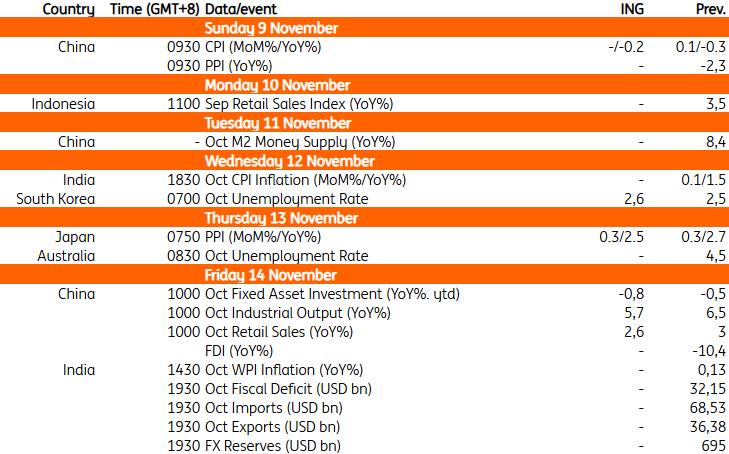

Key events in Asia next week

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment