XRP Wallet Growth Sparks Price Stability Checks-Is A Bottom Coming?

Introduction

Recent developments in the cryptocurrency market reveal intriguing activity surrounding XRP, despite its ongoing price weakness. While XRP faced this downward momentum, onchain data indicates a surge in network participation and unusual trading activity, hinting at potential shifts beneath the surface. Market analysts are closely monitoring whether these signals point to a bottoming process or are driven by non-organic trading behaviors, making XRP a key asset to watch as broader crypto markets remain cautious.

- Over 21,000 new XRP wallets were created within 48 hours, marking the strongest growth in eight months. Record-breaking activity on the XRP Ledger 's decentralized exchange (DEX) coincided with a notable price decline, suggesting non-organic trading influences. Whale wallet outflows have stabilized after a total of $650 million sold, possibly indicating a market bottom in sight. Futures data shows traders are rotating into XRP amid declining interest in Bitcoin and Ethereum futures.

XRP (XRP ) closed Tuesday's daily candle at $2.20, its lowest since July 4. However, it rebounded by approximately 16% to $2.40 from recent lows of $2.06 on Thursday. Despite this recovery, the cryptocurrency continues to face challenges in reclaiming its bullish momentum, as overall market sentiment remains guarded amid ongoing regulatory and macroeconomic uncertainty.

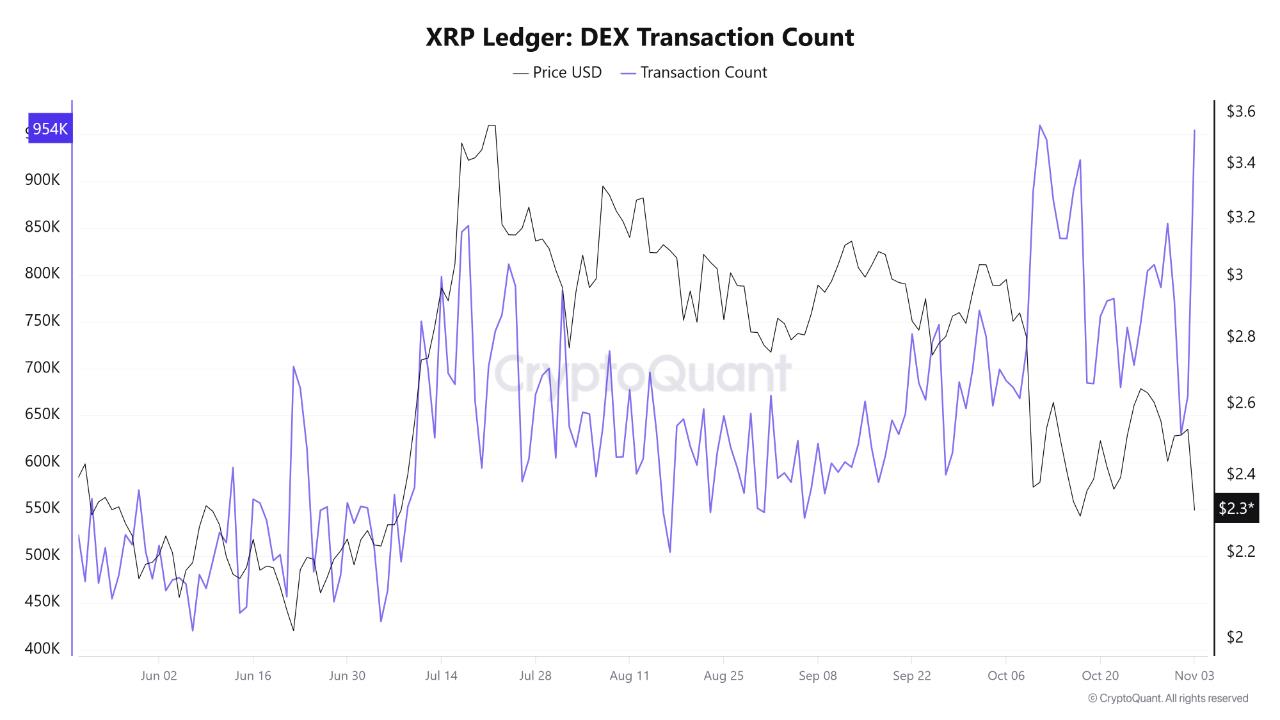

XRP one-day chart. Source: TradingViewOnchain Activity and Underlying Market DynamicsDespite the price dip, onchain data from analytics firm Santiment revealed a surge in XRP network activity, with over 21,000 new wallets created in just two days, the highest growth rate in nearly a year. Similarly, CryptoQuant recorded a record-breaking 954,000 transactions on the XRP Ledger's decentralized exchange (DEX), signifying heightened network engagement. However, this spike in activity coincided with declining prices, raising questions about the nature of the trading-whether organic or driven by large traders and arbitrage bots.

XRP Ledger DEX transaction count. Source: CryptoQuant

This disconnect between activity and price suggests that a significant volume of transactions may originate from large traders or automated trading strategies, rather than sustained organic buying, which could imply market manipulation or strategic positioning ahead of a potential move.

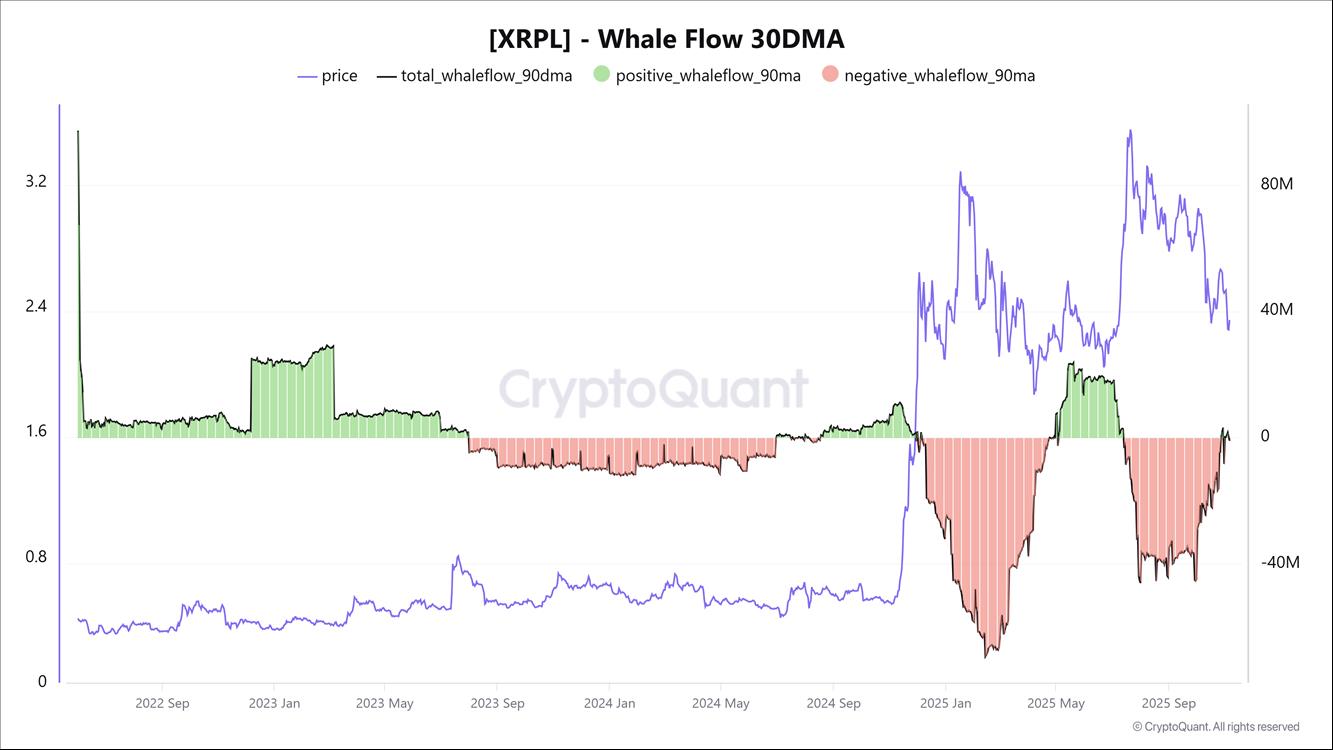

Whale Flows and Market Bottom IndicatorsXRP's recent price decline follows a period of persistent whale selling, with over $650 million leaving large wallets since July's peak of $3.66. Nevertheless, recent data from CryptoQuant indicates that whale outflows are now stabilizing, hinting at a possible market bottom. Meanwhile, futures data from Binance shows a divergence in trader sentiment-while Bitcoin and Ether futures recorded significant declines in open interest, XRP futures remained comparatively resilient, suggesting traders are diversifying their holdings and accumulating XRP during downturns.

XRP Whale Flow 90-day moving average. Source: CryptoQuant

Market analyst Crazzyblockk noted that while major cryptocurrencies like Bitcoin and Ethereum see decreasing open interest-reflecting risk-off sentiment-investors appear to be rotating into XRP, capitalizing on dips to position for a potential rebound. These onchain and derivatives trends suggest a stabilization sentiment, though confirmation through price action remains crucial before any bullish case can be confirmed.

As XRP navigates these complex market signals, traders and investors are advised to observe both onchain activity and broader crypto market dynamics for clearer directional cues in the coming weeks.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves significant risk, and readers are encouraged to conduct thorough research before making any investment decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment