Kenorland And Auranova Announce Completion Of Fall Drill Program At The South Uchi Project, Ontario

2025 Fall Drill Program

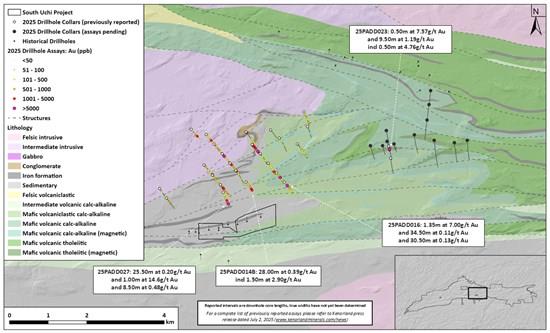

The Phase 2 program comprised 13 diamond drill holes totaling 7,075 metres, following the maiden 2025 winter campaign that outlined widespread gold mineralisation along a five-kilometre-long structural corridor (see press release dated July 2, 2025). Drilling aimed to test the continuity of mineralisation intersected in 25PADD023, located at the eastern extent of the Papaonga target area. Step-out drilling extended the deformation zone by two kilometres to the east, while additional holes to the northeast targeted a wide structural corridor concealed beneath deep overburden. Assay results are expected in Q1 2026.

Figure 1. Plan map showing geology and drill hole locations in the Papaonga target area

To view an enhanced version of this graphic, please visit:

Papaonga Target

The program successfully intersected mineralisation in broad step-outs both east and west of 25PADD023, extending the mineralised corridor by approximately two kilometres to the east and identifying a new mineralised deformation corridor to the northeast. The program refined the understanding of controls on mineralisation including vein generations, sulphide assemblages, and the structural and lithological controls at Papaonga. Mineralisation consists of multi-stage, sulphide-rich quartz-carbonate veining with associated sericite, Fe-carbonate and silica alteration. Trace, localised visible gold was observed in association with veining and sulphides. Subparallel shear zones and intersecting structures were delineated, which appear to influence the distribution and intensity of veining, alteration and associated sulphide mineralisation. Localisation of mineralisation within the structural corridor favorably occurs along lithological contacts, including between iron-rich tholeiitic and calc-alkaline volcanic rocks and interbedded volcaniclastic sedimentary and volcanic rocks. Although mineralisation is present within the recently completed holes, it does not necessarily indicate economically significant grades.

Next Steps

Following the completion of the 2025 fall drill program at the Project, Kenorland will maintain the camp and infrastructure at Papaonga for an additional three months in preparation for a potential subsequent winter drill program.

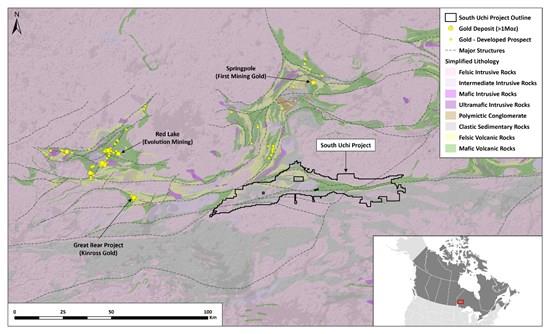

Figure 2. Regional geology with significant gold deposits and South Uchi Project location

To view an enhanced version of this graphic, please visit:

About South Uchi Project

The South Uchi Project was first identified and staked by Kenorland based on the under-explored region's prospectivity to host significant gold mineralised systems. The Project covers a portion of Confederation Assemblage volcanic rocks, as well as the boundary between the Uchi geological subprovince to the north and the English River geological subprovince to the south. Multiple major east-west striking deformation zones associated with the subprovince boundary transect the Project, resulting in zones of strong shearing and folding of the supracrustal stratigraphy, which are favourable settings for orogenic gold mineralisation. Prior to Kenorland staking the Project, records indicated little to no systematic exploration had been completed, and the land package remained under-explored. The majority of gold deposits in the Red Lake District (Red Lake, Madsen, Hasaga, and others) are located on the northern margin of the Confederation Assemblage. However, recent discoveries such as the LP Fault Zone on the Dixie Project by Great Bear Resources Ltd. (acquired by Kinross Gold and renamed Great Bear Project) highlight the prospectivity of the entire Confederation Assemblage along the southern margin of the Uchi subprovince.

Kenorland announced on December 2, 2024, that it had entered into a definitive agreement with Auranova, granting Auranova the right to earn up to a 70% interest in the Project. Pursuant to the agreement, Auranova may earn an initial 51% interest in the Project by making cash payments totalling $500,000 to Kenorland, completing a diamond drilling program with at least $8,000,000 in qualifying expenditures or completing 15,000 metres of drilling within two years of receiving a drill permit, issuing Kenorland 19.9% of Auranova's common shares, and maintaining Kenorland's 19.9% share position until Auranova raises a minimum of $10,000,000 through share issuances, after which Kenorland's stake will remain at 10% on a pro-rata basis through to the completion of a Preliminary Economic Assessment (the " PEA ").

Kenorland has received the $500,000 in cash payments and currently holds 9,242,267 common shares of Auranova and confirms that Auranova has now earned a 51% ownership interest in the Project (see press release dated July 2, 2025). Further, Auranova may earn an additional 19% interest, for a total of 70%, by incurring an additional $10,000,000 in qualifying expenditures on or before the third anniversary of Auranova's election to proceed with the second option. Kenorland will also retain a 30% carried interest in the Project through to the completion of the PEA, at which point a joint venture will be formed.

Kenorland also holds a 2% net smelter return royalty on the Project (see press release dated September 16, 2024).

Qualified Persons

Janek Wozniewski, B.Sc., P.Geo. (EGBC #172781, APEGS #77522, EGMB #48045, PGO #3824, APEGNB #L7273), Vice President of Operations at Kenorland, a "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

William Yeomans, P.Geo., a "Qualified Person" under National Instrument 43-101, has also reviewed and approved the scientific and technical information in this press release. Mr. Yeomans is a gold exploration professional with over 40 years of experience in all stages of gold exploration throughout the Americas, including the Superior Province throughout Quebec and Ontario. He gained extensive exploration management experience across the entire Guiana Shield with BHP and has generated projects which resulted with significant NI 43-101 gold resources. He has worked as a consultant to IAMGOLD and Dundee Precious Metals Inc., identifying acquisition opportunities across Canada, the USA and South America. He is currently the President of Yeomans Geological Inc. as well as 1127637 B.C. Ltd. and has many years of experience as a board member for several junior mining companies.

Marketing Agreements

Kenorland announces it has engaged the services of Atrium Research Corporation (" Atrium "), a leading company sponsored research firm. Atrium will publish various research reports on the Company based on publicly available information, industry data, and discussions with Kenorland management. Atrium will also host three recorded interviews with the Company's management team to present the investment case in an interview format. In exchange for its research services, Atrium will receive cash compensation in the amount of $3,000 per month for the services listed above. The services will be provided for 24 months beginning on November 1, 2025. This engagement is subject to TSX Venture (" TSXV ") approval. Atrium and the Company are arm's-length parties, and neither Atrium nor its insiders holds any shares or options to purchase shares in the issued and outstanding capital of the Company.

The Company also announces that is has engaged Triomphe Holdings Ltd., doing business as Capital Analytica (" Capital Analytica "), an arm's-length service provider, to provide certain marketing and social media services to the Company, in accordance with the policies of the TSXV and applicable securities laws. Based in Nanaimo, British Columbia, Capital Analytica specializes in marketing, social media, and public awareness within the mining and metals sector. Capital Analytica will provide social media services, capital markets consultation, and social engagement reporting for an initial six-month term for a fee of $150,000, payable in two tranches with an option to renew the Agreement for an additional six months at a rate of $75,000 unless terminated earlier in accordance with the terms of the Agreement. The engagement remains subject to the approval of TSXV. Capital Analytica has no direct or indirect interest in the Company or its securities and has no current intention or right to acquire any such interest during the engagement, other than the potential grant of stock options in the future.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSXV: KLD) is a well-financed mineral exploration company focused on project generation and early-stage exploration in North America. Kenorland's exploration strategy is to advance greenfields projects through systematic, property-wide, phased exploration surveys financed primarily through exploration partnerships including option to joint venture agreements. Kenorland holds a 4% net smelter return royalty on the Frotet Project in Quebec which is owned by Sumitomo Metal Mining Canada Ltd. The Frotet Project hosts the Regnault gold system, a greenfields discovery made by Kenorland and Sumitomo Metal Mining Canada Ltd. in 2020. Kenorland is based in Vancouver, British Columbia, Canada.

Further information can be found on the Company's website .

About Auranova Resources

The Company is an unlisted reporting issuer in the Provinces of British Columbia, Alberta, Saskatchewan and Manitoba. Its directors and major shareholders are Thomas Obradovich, Chris Taylor, Timothy Young, William Rand and Blair Zaritsky. The Company is focused on the discovery of new gold systems in the Birch Uchi Belt in partnership with Kenorland Minerals Ltd. as well as expanding its presence in the greenstone belts of Ontario.

Further information about Auranova can be found on .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment