Bitcoin Falls Below $100K As BTC Price Reverses Weekend Gains

- Bitcoin's price retreated to $107,000, erasing weekend gains and signaling potential support retests. Institutional demand drops to seven-month lows, with net outflows from Bitcoin ETFs gaining attention. Market sentiment is cautious amid low network activity and declining active addresses among retail investors. Crypto price predictions suggest limited upside, with markets wary ahead of key economic data and Fed rate decisions. Trade optimism in stock markets contrasts with crypto's subdued performance, amid fears of a hawkish Federal Reserve stance.

Following the daily close, Bitcoin's price slipped back to $107,000, with traders warning of a challenging week in the markets. Data from Cointelegraph Markets Pro and TradingView indicates that BTC/USD wiped out all weekend gains after traders had previously warned about the risk of a“Sunday pump.”

BTC/USD one-hour chart. Source: Cointelegraph /TradingView

Crypto analyst CrypNuevo expressed concern over the week's outlook, stating,“This might be one of the most difficult trading weeks of Q4,” and highlighted the potential for a range-bound environment. He noted that key support around $101,150, aligned with the 50-week EMA, could serve as a bottom, especially after previous dips into this zone during October's crash from all-time highs of $126,200.

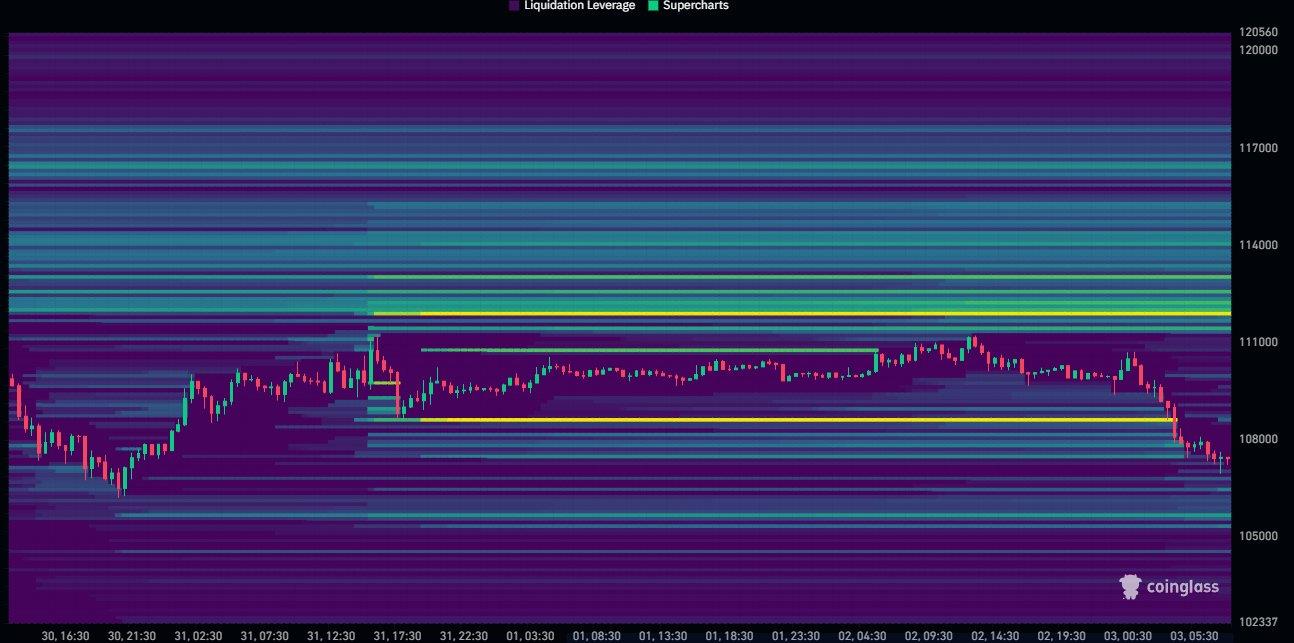

Meanwhile, trader Daan Crypto Trades focused on order-book liquidity, revealing large liquidity clusters around $112,000 and key support levels at $105,000-$106,000. These zones could trigger notable bounces or further declines depending on market action.

BTC order-book liquidity heatmap. Source: Daan Crypto Trades/X

Market watcher Mark Cullen warned that lower liquidity zones could pose a temptation for traders, asking whether Bitcoin might rally before a deeper pullback. He emphasized waiting to see how the US markets will influence the week's direction.

Crypto market outlook: recovery odds diminishDespite the typical bullish expectation for the upcoming months in stocks, Bitcoin shows little sign of following suit. The asset has already declined 2% in November, erasing some of October's worst performance since 2018. Data from CoinGlass indicates that November gains normally average over 40% since 2013, but this year's trend diverges sharply.

BTC/USD monthly returns. Source: CoinGlass

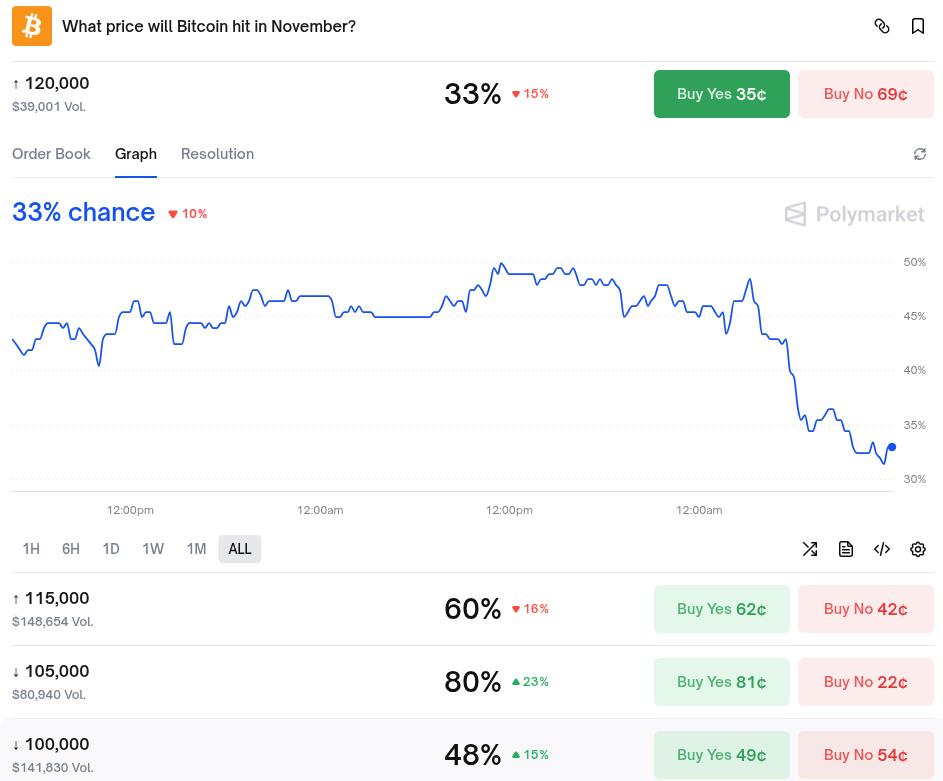

Market sentiment indicators reflect caution, with Polymarket giving only a 33% chance of Bitcoin ending November above $120,000 and 60% probability for $115,000. The Crypto Fear & Greed Index remains in“fear,” signaling continued investor reluctance despite the recent dip below $110,000.

Crypto Fear & Greed Index. Source: Alternative

Recent onchain analytics reveal declining retail activity, with active addresses falling over 26% in a year, which suggests that retail investors are retreating amidst volatility and low network engagement. Research from Santiment highlighted that market expectations remain skewed toward lower prices, with many bearish predictions below $100,000.

Market dynamics: trade optimism but crypto hesitanceWhile stock markets responded positively to recent US-China trade de-escalation, crypto markets remain hesitant, overshadowed by fears of a hawkish Federal Reserve. S&P 500 futures edged higher, buoyed by reduced tariffs on Chinese goods, but Bitcoin's correlation with traditional stocks appears to be weakening according to macro analyst Jordi Visser, indicating a less predictable relationship in current markets.

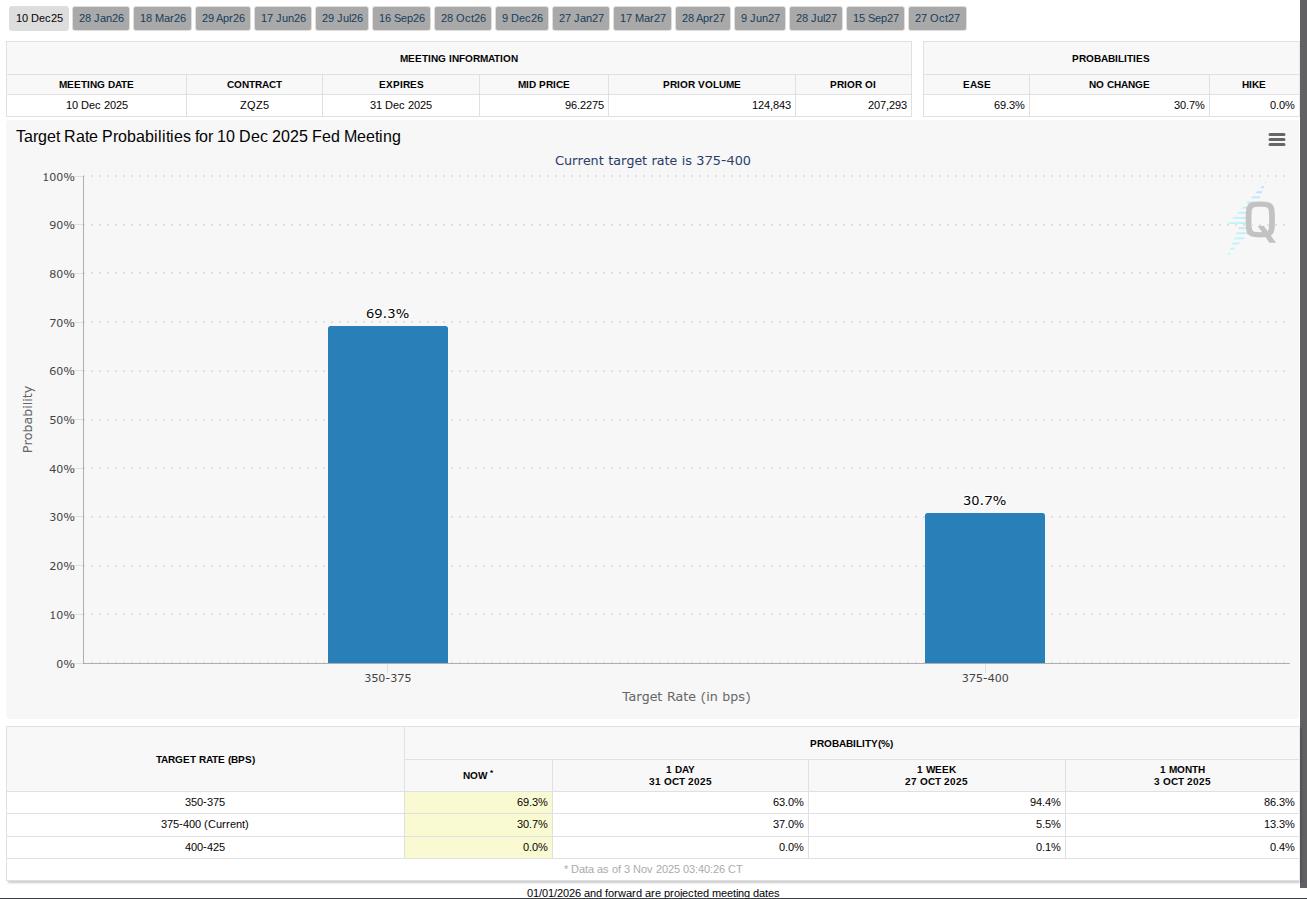

US economic data remain scarce due to the government shutdown, with only private-sector payrolls providing insight into labor conditions. Meanwhile, the Federal Reserve's path remains uncertain, with a 63% chance of a rate cut at December's meeting, even as concerns grow over the Federal Reserve's hawkish stance and the long-term impact on liquidity.

Fed target rate probability. Source: CME Group

Some analysts suggest that the Federal Reserve's plan to halt quantitative tightening (QT) could mitigate liquidity drain, offering some bullish potential for crypto markets. Nonetheless, the ongoing divergence between crypto and stock performance underscores the cautious mood that currently pervades the digital asset space.

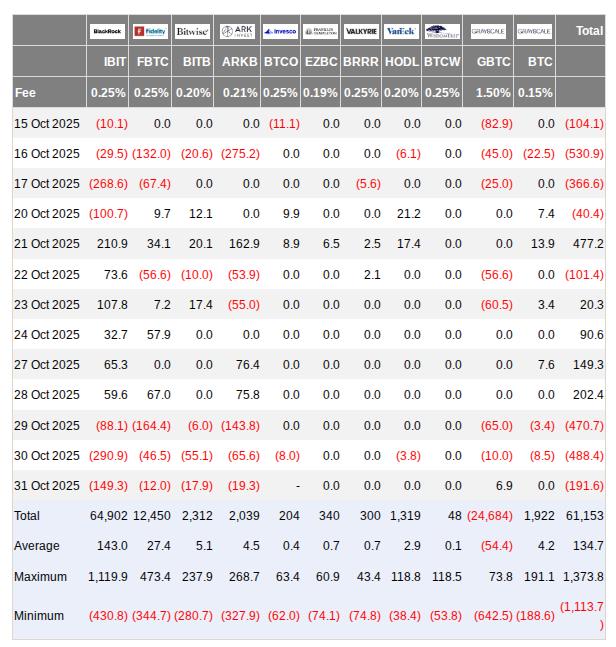

Institutional demand wanes as supply outpaces demandInstitutional Bitcoin demand is showing signs of weakening, with weekly outflows from major exchange-traded funds (ETFs) such as BlackRock 's iShares Bitcoin Trust reaching $500 million in recent days. Data from Farside Investors indicates that demand has not kept pace with the rate of new Bitcoin issuance, echoing previous lows seen in early April.

US spot Bitcoin ETF net flows. Source: Farside Investors

Crypto analyst Charles Edwards emphasized that for the first time in seven months, institutional net buying has fallen below daily mined supply, raising concerns about long-term demand. Historically, such declines precede significant price lows, suggesting a cautious outlook for Bitcoin in the near term.

Despite the maturation of Bitcoin's institutional infrastructure, as noted by industry experts, the overall demand remains fragile amid rising supply. The recent decline in active addresses and overvaluation metrics like Metcalfe's Law also point toward potential downside risks.

Retail investors retreat from BitcoinRetail investor activity has noticeably waned in recent weeks, correlating with Bitcoin's price retreat. Onchain data from CryptoQuant shows a 26% drop in active addresses since October, signaling reduced user engagement. Analysts warn that the retreat of retail participation could prolong market cycles and hinder organic recovery.

Pelin Ay highlighted that the divergence between network valuation and price has increased, with the Metcalfe's Law ratio indicating Bitcoin is now significantly overvalued relative to its network size. She suggested that this overvaluation could trigger a correction, possibly as low as $98,500.

This article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research before trading or investing in cryptocurrencies.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment