German Housing Market To Gain Momentum Despite Worsening Affordability

More than half of Germans lived in rental homes in 2024, making Germany the eurozone's standout tenant nation. According to our latest ING Consumer Survey, 50% of German tenants cited affordability as the main barrier to homeownership – renting, for many, is not a deliberate choice but a necessity. For the other half of the surveyed tenants, renting is the result of the desire for flexibility, including the ability to relocate easily, not having to bear responsibility for maintenance, or other financial considerations.

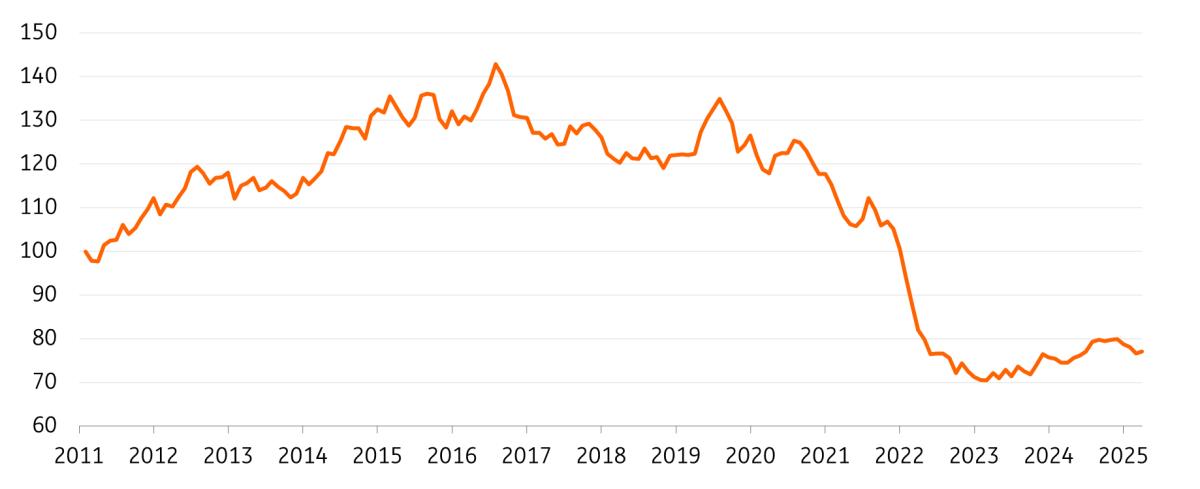

Between 2011 and 2020, during a decade of rapid growth in the German real estate market – marked by a 60% rise in property prices and improved affordability due to low interest rates – homeownership remained well above 50%. With affordability deteriorating again since 2020, homeownership has now fallen back to 47%. However, it is not only interest rates and prices affecting affordability, but also high incidental purchase costs, which are holding back Germans from buying real estate.

At the same time, German rents increased by some 20% between 2011 and 2024, with almost half of the rise being recorded between 2020 and 2024, when demand for rental homes increased more sharply than in previous years due to the decline in affordability of purchasing a home. When interpreting these numbers, however, don't forget that around one third of the German rental market is regulated under the so-called“rent brake,” which limits rent increases for new lettings in tight housing markets. Furthermore, the share of rental contracts where rent increases are linked to inflation is increasing, especially in major cities.

ING Affordability Index

Source: LSEG Datastream, ING

In our latest ING Consumer Survey, conducted in September, 15% of mortgage holders reported difficulty meeting monthly payments. While this is still an improvement from 2023 – when nearly one in five struggled – it marks a three percentage point increase compared to last year, showing that higher interest rates are gradually feeding through to the economy.

The“Green Renoflation”Financial constraints are not only limiting prosperity, they're also slowing the green transition. For most German homeowners, sustainability remains a financial decision. Our survey shows that those who undertook green renovations in the past three years were primarily motivated by energy cost savings. Meanwhile, those who held back cited high upfront costs and insufficient government support as the main reasons.

Yet, the urgency to act is growing. The European Commission's revised Energy Performance of Buildings Directive (EPBD) sets ambitious targets: by 2030, average primary energy consumption across the housing stock must fall by 16% compared to 2020. For Germany, this means improving the average energy efficiency class from F to E within just four years.

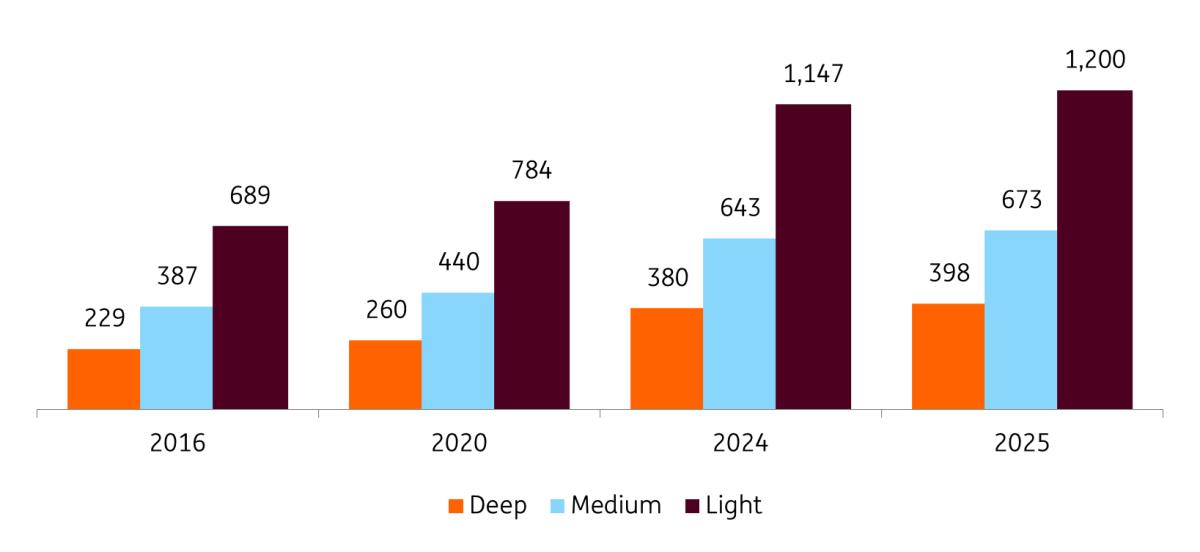

Going green comes at a price. Back in 2016, the estimated cost of renovating Germany's housing stock ranged from €230bn to €690bn, depending on whether energy savings were to be achieved through extensive“deep renovations” or smaller-scale“light renovations”. Today, due to what we call“green renoflation” – a 75% increase in construction costs for key renovation components – those figures have ballooned to between €400bn and €1.2tr.

Development of estimated total costs for green renovation in the German housing market by depth of renovation(in billions of euros)

Source: European Commission; Destatis; ING

In just over a decade, the price of the green transition of the housing market has gone from compact to premium car. However, inaction also carries a cost. Ancillary costs for unrenovated properties are likely to rise sharply in the coming years. Furthermore,“green renoflation” is expected to accelerate in the coming years as a result of the government's infrastructure fund and construction turbo. In short, not investing will still come at a cost.

Looking ahead, the outlook for the German real estate market remains challenging: wage growth is expected to slow amid a cooling labour market, and financing costs are likely to stay elevated. At the same time, however, the lack of housing supply and the recent increase in rents are still likely to push up prices and homeownership ratios. Even if this means that new homeowners will need to allocate a larger share of their income to housing.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment