Bitcoin Surges In Its Biggest Month Of Growth Following Red October

- Bitcoin has historically seen remarkable gains in November, with an average increase of over 40% since 2013. Current macroeconomic signals, including potential U.S. Federal Reserve rate cuts and easing trade tensions between the U.S. and China, could bolster Bitcoin's rally. Global economic uncertainties, such as the U.S. government shutdown and trade tariffs, continue to impact the crypto markets. Easing trade tensions and monetary policy shifts are factors that could positively influence crypto investments and DeFi growth. Market analysts emphasize the need to consider multiple macro factors alongside seasonal patterns when forecasting Bitcoin's short-term movements.

As the world's premier cryptocurrency enters its most volatile and potentially rewarding month, investors are closely monitoring key geopolitical and economic developments. Market sentiment remains bullish, especially if macroeconomic policies favor risk-on assets like Bitcoin and Ethereum, which stand to benefit from lower interest rates and expansive monetary policies.

US / China Easing Trade TensionsA high-profile meeting between U.S. President Donald Trump and Chinese President Xi Jinping on Thursday signaled a possible thaw in ongoing trade disputes-an encouraging sign for the global economy. The leaders agreed to reduce tariffs on China, in exchange for Beijing's crackdown on fentanyl production, a resumption of U.S. soybean imports, and a one-year halt on restrictions of rare earth exports.

Bitcoin monthly returns since 2013. Source: CoinGlassTrump expressed optimism about reaching a comprehensive trade deal, stating,“I expect a trade deal with China pretty soon.” Historically, tensions such as threatened tariffs have caused market volatility, including significant crypto liquidations, like the $19 billion wiped out during the October 11 crash. This event highlighted how geopolitical uncertainty can dampen market sentiment, with some experts describing the recent talk as merely a“pause” in the trade war rather than a resolution.

Meanwhile, analysts note that any resolution in trade tensions could serve as a tailwind for the cryptocurrency market, bolstering investor confidence and institutional entry.

Federal Reserve and Monetary Policy OutlookRecent decisions by the Federal Reserve to cut interest rates by a quarter point have lowered the benchmark rates to their lowest in three years. The upcoming Fed meeting on December 10 will be crucial, with market expectations of a potential rate cut priced in at 63%. Fed Chair Jerome Powell's comments signaling uncertainty have kept traders cautious.

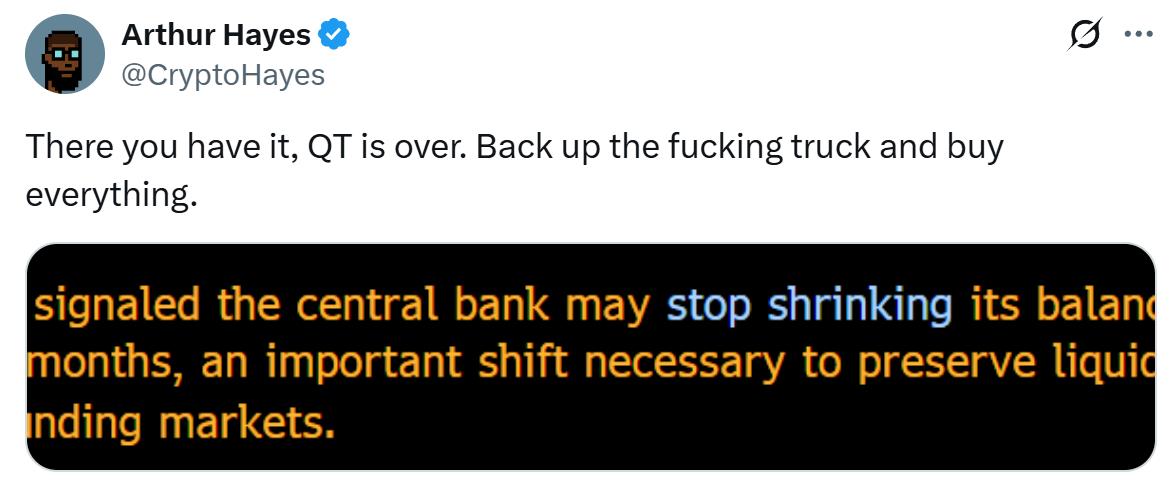

Lower rates typically stimulate risk assets, including cryptocurrencies, by reducing borrowing costs and encouraging investment. Besides rate cuts, the Fed's planned cessation of its quantitative tightening (QT) program on December 1 could lead to an influx of liquidity into the markets, further supporting crypto prices.

Source: Arthur Hayes

The reversal of quantitative tightening to quantitative easing (QE) injections into the economy could further stimulate crypto markets, as new liquidity often finds its way into alternative assets like Bitcoin and NFTs.

US Government Shutdown and Market ImpactsThe prolonged government shutdown, approaching its fifth week, continues to weigh on investor sentiment. The deadlock between Democrats and Republicans over spending bills hinders progress on crypto-friendly legislation, including ETF approvals and regulatory clarity measures like the Crypto Law and the CLARITY Act.

Recently, former President Trump called for the abolition of the Senate filibuster, calling attention to political divisions that could delay these critical policy advancements. The resolution of the shutdown could unlock positive momentum for the crypto sector, with increased regulatory clarity expected to attract institutional interest.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment