CNB Preview: Rates Steady, But The Governor's Guidance Will Be Key

| 3.50 |

CNB key rate

No change expected |

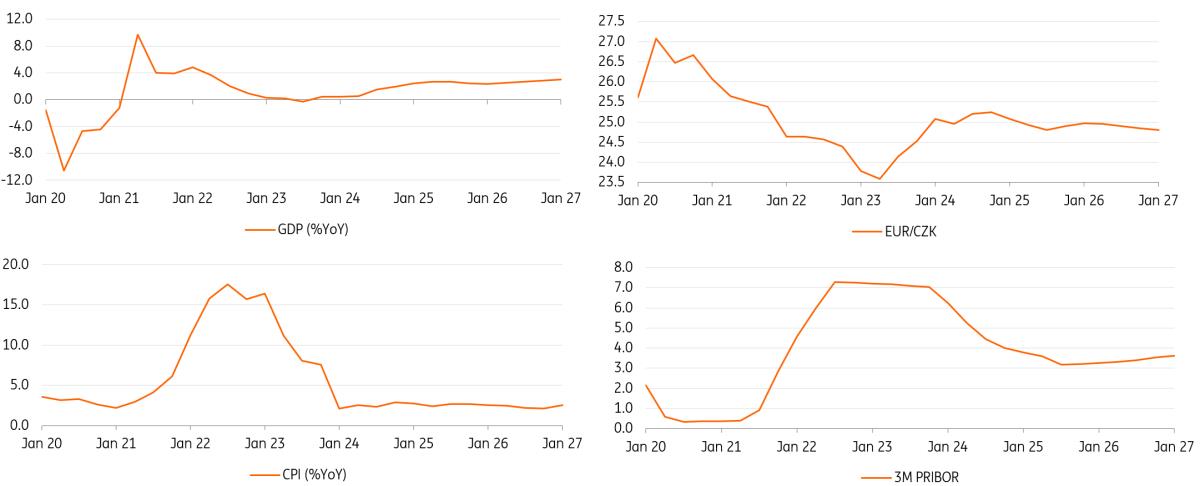

The CNB's August forecast is more or less coming true, and we have not seen any significant deviations except for wages. GDP in the third quarter grew by 0.7% QoQ and 2.7% YoY, roughly in line with the central bank's forecast, supporting the CNB's and our bullish view and above market consensus. Headline inflation in September was 2.3% YoY, 0.3pp below the CNB's forecast, mainly due to lower food and energy prices. Core inflation remains at 2.8%, in line with the forecast. Overall, we are unlikely to see any major changes in the forecast here.

More interesting are wages and FX. Wage growth surprised upwards in 2Q with a growth of 7.8%, 1.1pp above the CNB's forecast. At the same time, the government approved a minimum wage increase of 7.7% next year, and an increase above the CNB's forecast can also be expected for civil servants, pushing the entire profile significantly upwards. EUR/CZK is down about 2.3% compared to the August forecast in Q3 for now, but this will be the least of the problems for the central bank, which welcomes a stronger CZK in the fight against inflation. Overall, the rates path should see only minor changes, probably upwards, also due to a higher Euribor.

CNB August forecasts

Source: Macrobond, CNB No change for longer as our baseline, but details are changing

Overall, next week's meeting should be a pulse check on how the CNB reacts to the latest changes in the outlook rather than the latest data. This will be the first meeting after the general election, which gave us a new government promising lower energy prices and higher investment, but perhaps at the cost of a higher deficit (not our baseline for now).

At the same time, we are watching for signs of some changes in ETS2, which could reduce or postpone the impact on inflation in 2027, which the CNB estimates in the baseline at 0.6pp. Energy prices are already coming into focus for January inflation. The new government promises to subsidise part of the regulated component of energy prices for households and businesses, while suppliers are promoting price cuts of 10-15%. This should push the headline figure down, giving the CNB some relief, but it does not affect core inflation, where service prices and imputed rents remain a problem.

Overall, the CNB is in no rush to do anything and can wait a while longer and continue to provide balanced forward guidance with hawkish detail. Our forecast here also remains the same: no change in rates for the foreseeable future.

Our market viewsFX was rather stagnant in October, and EUR/CZK held a narrow range of 24.250-400, and for the first time this year, the CZK did not show a gain on a monthly basis. Indeed, on the global side, the US dollar rebounded and on the local side, we saw some slowdown in inflation, which calmed market bets on CNB rate hikes. However, looking further ahead, we do not see much reason to change anything to the bullish CZK story.

EUR/USD should head up again after some pause with 1.20 our forecast for the end of the year. The Czech economy continues to recover and, after Poland, it is currently showing the best numbers in the CEE region. We believe that although headline inflation is seeing some relief due to lower energy and food prices, higher core inflation and service prices will keep CNB hawkish later. Market positioning has probably switched to neutral or short in October. Therefore, overall, we believe that higher wages, fiscal spending and a hot housing market will keep the CNB on the hawkish side, and the CZK will remain supported towards 24.00 EUR/CZK.

After the peak in CNB hawkishness at the end of September, the market has returned from pricing in rate hikes back to a flat curve without any strong bias in either direction. The FRA curve is at the fixing level up to the 1y horizon, and only in the 1.5-2.0y horizon we see an 80% chance of a 25bps rate hike priced in. Although a CNB rate hike is not on the table in the near term, we remain on the hawkish side, and see a potential surprise in this direction given the number of inflation risks. We would not be surprised if the market again prices in a slightly higher probability of rate hikes.

At the long end of the curve, however, the situation seems to be the opposite. We saw a significant sell-off at the long end of the IRS and CZGBs curve before the October general election as fiscal expansion and a more hawkish central bank came into focus. However, the formation of the new government indicates that fiscal policy will not change much, and we expect an unwinding of the term premium at the long end of the curve, resulting in some curve flattening.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment