China's Manufacturing PMI Shows Steeper-Than-Expected Downturn

| 49.0 | China's October official manufacturing PMI |

| Lower than expected |

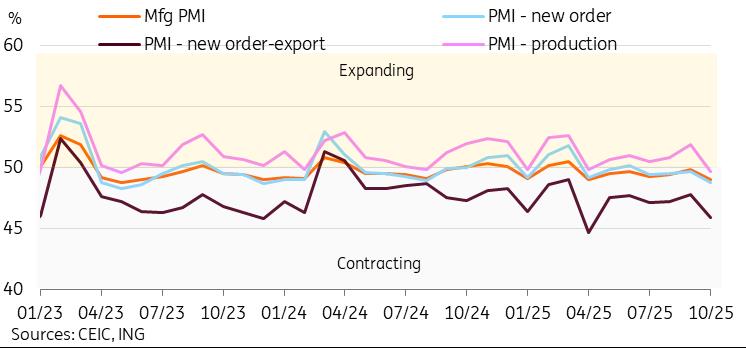

China's official manufacturing purchasing managers' index slowed to 49.0, down from 49.8. This marked a 6-month low, tying April for the lowest level of the year. It came in below expectations for a smaller moderation to 49.6.

The slowdown was seen across all the major subcategories. Production fell into contraction for the first time in 6 months, down to 49.7. This was the lowest level since May 2023. The new orders subindex also fell after two consecutive months of increases, down to 48.8, the lowest level since August 2024. New export orders contributed to this decline, falling to a 6-month low of 45.9. Employment remained in contraction for a 32nd consecutive month. Yet, it saw a relatively smaller downturn of just 0.2pp to 48.3.

We saw large, medium, and small-sized enterprises all sliding into contractionary territory for the first time since April. The trend of larger enterprises outperforming continued in the month.

The downturn in the PMI marks a poor start to the fourth quarter and may cause some concern, given that growth has been supported by external demand and industrial activity. On a brighter note, the PMI has been in contractionary territory since April, but this has not translated into weakness in hard activity data. Come next month's PMI data, it will be interesting to see if the tariff reduction and extended trade truce with the US help support a recovery of new export orders.

Manufacturing PMI saw a broad-based downturn to reach a 6-month low

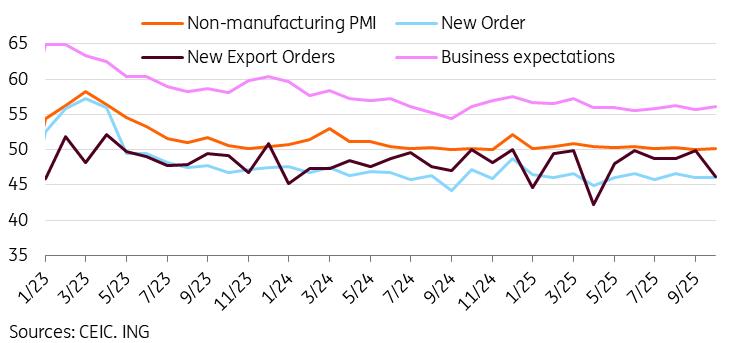

Non-manufacturing PMI continues to hover near the key threshold

The non-manufacturing PMI fared better on the month, rising slightly to 50.1 and barely returning to expansionary territory. This maintained the 34-month streak of neutral or expansionary non-manufacturing PMI.

However, the sub-indices did not provide much to cheer about. New orders remained unchanged at 46.0, with new export orders seeing a sharp drop of 3.6pp to 46.2. The main reasons behind the recovery appeared to be tied to an uptick in business expectations to 56.1, as well as slight recoveries in input prices (49.4) and selling prices (47.8), which nonetheless remained in contraction.

Non-manufacturing PMI edges back into expansion

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment