Silverco Mining Confirms New Discovery Model, Drilling 7.5 M Grading 364 G/T Ageq At Cusi Property, Chihuahua, Mexico

| Hole ID | Zone | From (m) | To (m) | Length (m)(2) | Au g/t | Ag g/t | Pb % | Zn % | AgEq g/t (1) |

| CU-24-01 | Eduwiges | 220.3 | 222.0 | 1.7 | 0.13 | 202 | 0.83 | 4.46 | 287 |

| CU-24-01 | Eduwiges | 415.3 | 415.9 | 0.6 | 0.14 | 116 | 9.47 | 1.76 | 337 |

| CU-24-02 | San Miguel | No Significant intercept | | ||||||

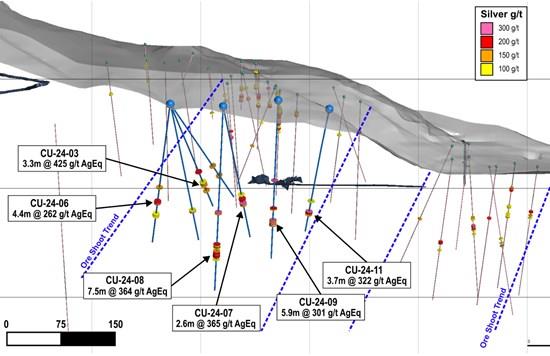

| CU-24-03 | San Miguel | 168.0 | 171.3 | 3.3 | 0.15 | 450 | 0.31 | 0.42 | 425 |

| incl. | 170.7 | 171.3 | 0.6 | 0.41 | 1,766 | 0.76 | 0.70 | 1,634 | |

| CU-24-04 | San Miguel | 190.2 | 193.0 | 2.8 | 0.20 | 306 | 0.28 | 0.29 | 294 |

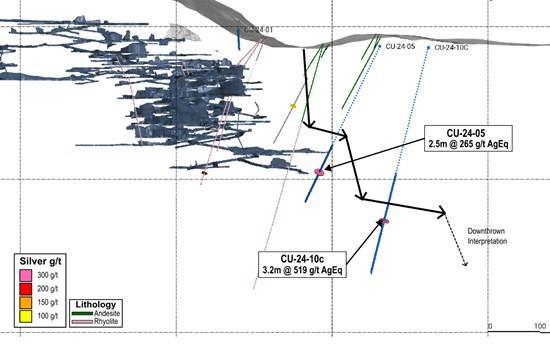

| CU-24-05 | Eduwiges | 332.5 | 334.9 | 2.5 | 0.62 | 236 | 0.81 | 0.62 | 265 |

| CU-24-06 | San Miguel | 178.9 | 183.3 | 4.4 | 0.22 | 270 | 0.33 | 0.17 | 262 |

| incl. | 182.1 | 182.3 | 0.2 | 1.35 | 1,740 | 1.47 | 0.16 | 1,653 | |

| CU-24-06 | San Miguel | 201.0 | 205.3 | 4.4 | 0.06 | 114 | 1.08 | 0.36 | 134 |

| CU-24-07 | San Miguel | 177.5 | 180.0 | 2.6 | 0.26 | 385 | 0.29 | 0.13 | 365 |

| CU-24-07 | San Miguel | 184.5 | 189.9 | 5.4 | 0.14 | 184 | 0.08 | 0.08 | 174 |

| CU-24-08 | San Miguel | 171.4 | 174.4 | 3.0 | 0.20 | 181 | 0.10 | 0.08 | 323 |

| incl. | 171.4 | 171.7 | 0.3 | 2.51 | 1,590 | 20.00 | 5.06 | 2,037 | |

| CU-24-08 | San Miguel | 223.5 | 227.9 | 4.4 | 0.10 | 129 | 0.07 | 0.05 | 122 |

| CU-24-08 | San Miguel | 237.1 | 244.7 | 7.5 | 0.30 | 291 | 2.17 | 2.45 | 364 |

| incl. | 239.0 | 239.7 | 0.7 | 0.96 | 958 | 2.01 | 5.02 | 1,035 | |

| CU-24-09 | San Miguel | 125.8 | 126.5 | 0.7 | 0.13 | 288 | 0.25 | 0.67 | 282 |

| CU-24-09 | San Miguel | 191.4 | 197.2 | 5.9 | 0.16 | 315 | 0.42 | 0.12 | 301 |

| incl. | 193.4 | 194.3 | 0.9 | 0.23 | 803 | 0.76 | 0.06 | 748 | |

| CU-24-10C | Eduwiges | 383.2 | 386.4 | 3.2 | 0.23 | 498 | 1.34 | 1.83 | 519 |

| CU-24-10C | Eduwiges | 647.6 | 649.5 | 1.9 | 0.12 | 78 | 1.76 | 1.53 | 140 |

| CU-24-11 | San Miguel | 165.1 | 168.7 | 3.7 | 0.26 | 304 | 1.28 | 0.66 | 322 |

| CU-24-12 | San Miguel | No Significant intercept | | ||||||

| CU-24-13 | San Miguel | No Significant intercept | | ||||||

| CU-24-14 | San Miguel | No Significant intercept | |

Notes

(1) AgEq = Ag g/t x Ag Recovery + [(Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t)]/Ag price/gram. Metal price assumptions are: $30.00/oz silver, $2400/oz gold, $1.00/lb lead, 1.35/lb zinc. Metallurgical recovery assumptions are 90% for silver, 50% for gold, 90% for lead, and 60% for zinc. Metallurgical recoveries used in this release are based on historical operational results on the Cusi project.

(2) Reported intervals are downhole core lengths. True widths are estimated at ~70-80% based on vein orientation observed in drill core; however, actual true widths may vary with additional drilling.

Table 2: Drill Collar Location

| Hole ID | Easting | Northing | Elevation | Azimuth (1) | Dip (1) | Depth |

| CU-24-01 | 319,751 | 3,125,118 | 2,034 | 356 | -52 | 552.0 |

| CU-24-02 | 320,431 | 3,123,359 | 2,067 | 318 | -35 | 223.5 |

| CU-24-03 | 320,431 | 3,123,358 | 2,067 | 310 | -40 | 220.5 |

| CU-24-04 | 320,431 | 3,123,359 | 2,067 | 304 | -50 | 244.5 |

| CU-24-05 | 320,034 | 3,125,056 | 2,000 | 322 | -46 | 721.5 |

| CU-24-06 | 320,431 | 3,123,358 | 2,067 | 281 | -48 | 255.0 |

| CU-24-07 | 320,462 | 3,123,425 | 2,063 | 302 | -46 | 252.0 |

| CU-24-08 | 320,462 | 3,123,425 | 2,063 | 286 | -58 | 298.5 |

| CU-24-09 | 320,455 | 3,123,508 | 2,071 | 285 | -61 | 249.0 |

| CU-24-10C | 320,107 | 3,125,209 | 2,000 | 325 | -61 | 802.5 |

| CU-24-11 | 320,459 | 3,123,581 | 2,059 | 271 | -58 | 198.0 |

| CU-24-12 | 320,631 | 3,123,980 | 1,973 | 287 | -68 | 256.5 |

| CU-24-13 | 320,741 | 3,123,842 | 1,987 | 310 | -59 | 459.0 |

| CU-24-14 | 321,035 | 3,124,036 | 2,017 | 304 | -64 | 785.5 |

Notes

(1) Hole azimuths and dips are based on average of surveyed intervals

Quality Assurance/Quality Control and Sampling Procedures

All diamond drill core from the 2024 program at the Cusi Project was logged, photographed, and sawn in half using a diamond blade core saw. One half of the core was submitted for geochemical analysis, while the other half was retained in secure storage for reference. Sampling intervals were determined based on geological boundaries and typically ranged from 0.3- 1.5 metres. Control samples comprised approximately 18% of all samples submitted, including certified reference standards, analytical blanks, field duplicates, preparation duplicates and analytical duplicates. QA/QC results were reviewed in real time, and all data have been verified as meeting acceptable thresholds for accuracy, precision, and contamination before inclusion in this release.

Drill core and rock samples were sent to ALS Minerals for analysis with sample preparation in Chihuahua, Mexico and analysis in North Vancouver, British Columbia. Samples remained under Company custody until delivery to ALS; sealed bags were transported by Company personnel to ALS Chihuahua. The ALS Chihuahua and North Vancouver facilities are ISO/IEC 17025 certified. Samples are dried, weighed, and crushed to at least 70% passing 2mm, and a 250 g split is pulverized to at least 85% passing 75 μm (PREP-31). Silver and base metals are analyzed using a four-acid digestion and ICP-AES. Over-limit analyses for silver (>100 ppm), lead (>10,000 ppm), and zinc (>10,000 ppm) are re-assayed using an ore-grade four-acid digestion and ICP-AES (ME-OG62). Samples with over-limit silver assays > 1500 ppm are analyzed by 30-gram fire assay with a gravimetric finish (Ag-GRA21). Gold is assayed by 30-gram fire assay and AAS (Au-AA23)

Technical Disclosure

The scientific and technical information contained in this news release has been reviewed and approved by Nico Harvey, P.Eng., Vice President Project Development of Silverco, a Qualified Person as defined in National Instrument 43-101. Mr. Harvey is not independent of the Company. Mr. Harvey has reviewed the sampling, analytical and QA/QC data underlying the technical information disclosed herein.

No production decision has been made at Cusi. Any decision to restart operations will follow completion of the requisite technical, financial and permitting milestones.

About Silverco Mining Ltd.

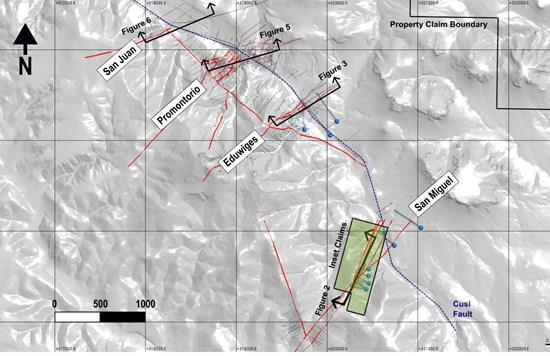

The Company owns a 100% interest in the 11,665-hectare Cusi Project located in Chihuahua State, Mexico (the "Cusi Property"). It lies within the prolific Sierra Madre Occidental gold-silver belt. There is an existing 1,200 ton per day mill with permitted tailings capacity at the Cusi Property.

The Cusi Property is a permitted, past-producing underground silver-lead-zinc-gold project approximately 135 kilometres west of Chihuahua City. The Cusi Property boasts excellent infrastructure, including paved highway access and connection to the national power grid.

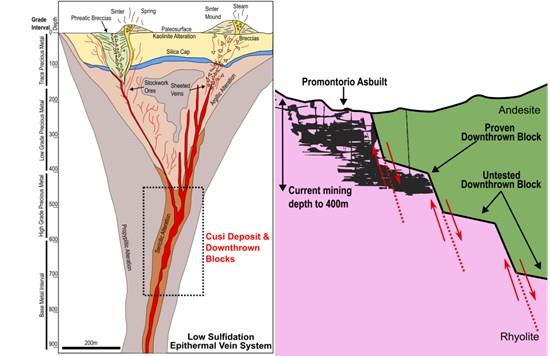

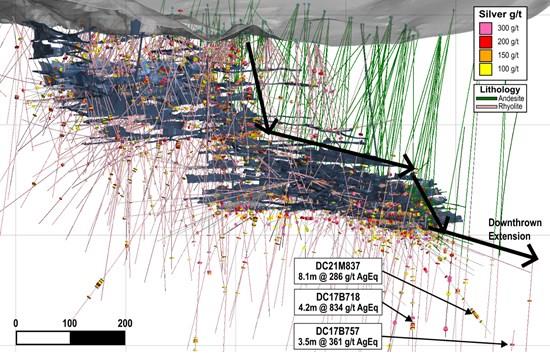

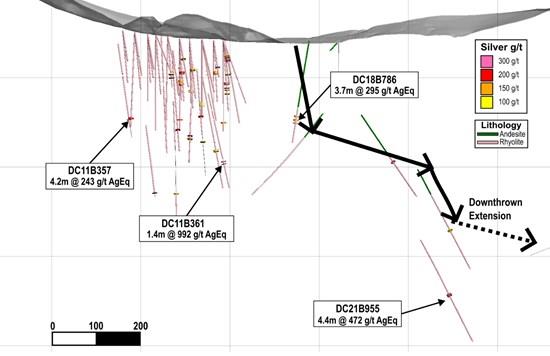

The Cusi Property hosts multiple historical Ag-Au-Pb-Zn producing mines each developed along multiple vein structures. The Cusi Property hosts several significant exploration targets, including the extension of a newly identified downthrown mineralized geological block and additional potential through claim consolidation.

On Behalf of the Board of Directors

"Mark Ayranto"

Mark Ayranto, President & CEO

Email: ...

For further information, please contact:

Investor relations & Communications

Email: ...

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement and Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (together, "forward-looking statements") within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or the Company's future performance and are generally identified by words such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "goal", "intend", "may", "objective", "outlook", "plan", "potential", "priority", "schedule", "seek", "should", "target", "will", and similar expressions (including negative and grammatical variations).

Forward-looking statements in this release include, but are not limited to: the Company's interpretation of geological results at the Cusi Property; the significance of the San Miguel and Eduwiges intercepts; the concept and potential extent of "down-thrown" or fault-displaced vein extensions and the continuity of mineralization at depth and along strike; the Company's plans, timing, scope and budgets for exploration, including the ongoing 2025 drill program (~15,000 metres), the use of results from 2024 and 2025 work to refine high-priority drill targets, and follow-up/underground drilling at Promontorio and San Juan; expectations regarding initial assay results from the 2025 program (anticipated November 2025); estimates or expectations regarding true widths, AgEq calculations, metallurgical recoveries and comparability; the possible expansion and/or upgrading of mineral resources; statements regarding a potential restart of operations as early as late 2026, including any prerequisites and sequencing (technical studies, financing, permitting and approvals, construction/readiness activities); availability and terms of financing; the filing or availability of figures and additional technical information; and any other statements that express management's expectations or beliefs of future events or results.

These forward-looking statements are based on a number of assumptions that, while considered reasonable by the Company as of the date of this release, are inherently subject to significant business, technical, economic and competitive uncertainties and contingencies. Key assumptions include: the accuracy, representativeness and continuity of sampling and assay results; that drill hole orientation and modeling reasonably estimate true widths; that metallurgical recoveries used to calculate AgEq (90% Ag, 50% Au, 90% Pb, 60% Zn) are reasonable proxies based on historical operational data at Cusi; the availability of drill rigs, personnel and analytical laboratory capacity on expected timelines; timely receipt of permits and approvals necessary for planned work; access to surface rights and community support; no material adverse changes to general business, economic, market and political conditions; commodity price and foreign exchange assumptions; inflation and input costs remaining within expectations; and the Company's ability to secure additional financing on acceptable terms when required.

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from those expressed or implied. Such factors include, without limitation: exploration, development and operating risks (including drilling, sampling, assaying, interpretation and modeling uncertainties; variability of mineralization; representativity of samples; true-width estimation; metallurgical variability; water management; geotechnical and ground conditions); risks inherent in estimating or converting mineral resources; the absence of current mineral reserves at the Cusi Property; that AgEq is a reporting metric only and does not imply economic recoverability; permitting, licensing and regulatory risks in Mexico (including changes in mining, environmental, labour, water, land access and related regimes); community relations, social licence and stakeholder engagement risks; title, surface rights, access and environmental liability risks; health, safety and security risks; commodity price and FX volatility (silver, gold, lead, zinc; MXN/CAD/USD); cost inflation, supply-chain disruptions and contractor availability; political and macroeconomic instability; financing and liquidity risks (including the availability and terms of debt and/or equity); TSX Venture Exchange and other regulatory approvals; counterparty risks; limitations and uncertainties relating to historical data and third-party reports (including the risk that historical results cannot be verified to NI 43-101 standards); force majeure events; litigation and enforcement risks; and those additional risks set out in the Company's public disclosure filings available on SEDAR+ at .

Readers are cautioned not to place undue reliance on forward-looking statements. The purpose of forward-looking statements is to provide readers with information about management's current expectations and plans and may not be appropriate for other purposes. No assurance can be given that such statements will prove to be accurate; actual results and future events could differ materially. The Company undertakes no obligation to update or revise any forward-looking statements contained herein, except as required by applicable securities laws

To view the source version of this press release, please visit

SOURCE: Silverco Mining Ltd.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment