The Week In Charts: Diwali AQI Surge, Festival's Consumption Boost, Fpis Return

From the capital's worsening post-Diwali air quality and cautious optimism on consumption after GST cuts, to signs of an India–US trade breakthrough and tighter links between executive pay and performance-here's this week's news in numbers.

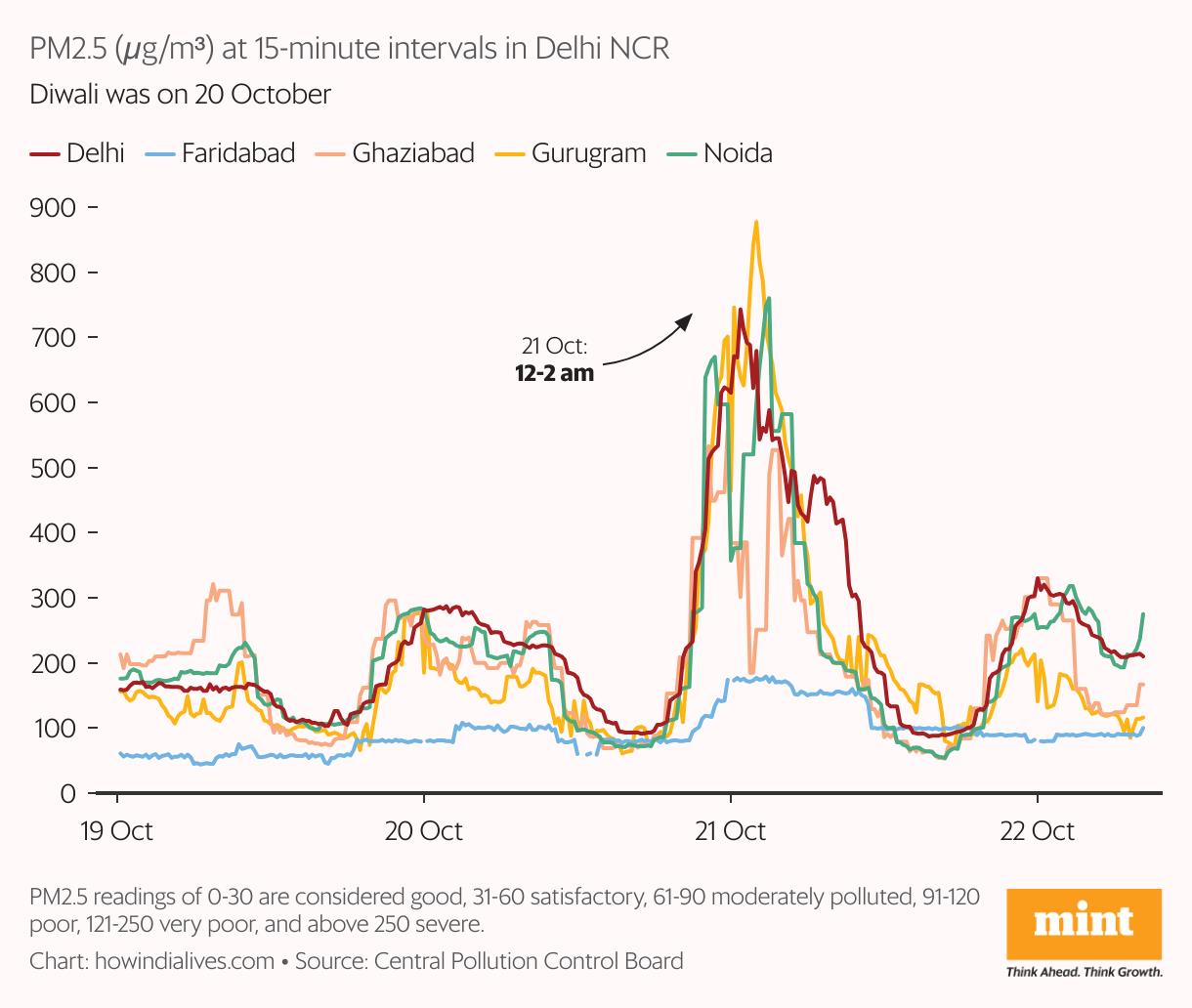

Capital chokesAs the Diwali festive season concludes, pollution levels in Indian cities have dominated headlines again. This annual crisis is particularly severe in Delhi and surrounding regions, where festive fireworks, along with stubble burning from northern states, create hazardous air quality.

Immediately after the celebrations, AQI spiked seven-fold in the National Capital Region between 12-2 am, with Gurugram PM2.5 (μg/m3) reading reaching 877, followed by Noida at 760 and Delhi at 743, showed data from the Central Pollution Control Board (CPCB). Delhi's 24-hour average AQI on Diwali, 20 October, reached 345, marking the highest reading on Diwali since 2021's 382. This worsened further on 21 October at 351.

Festive drive

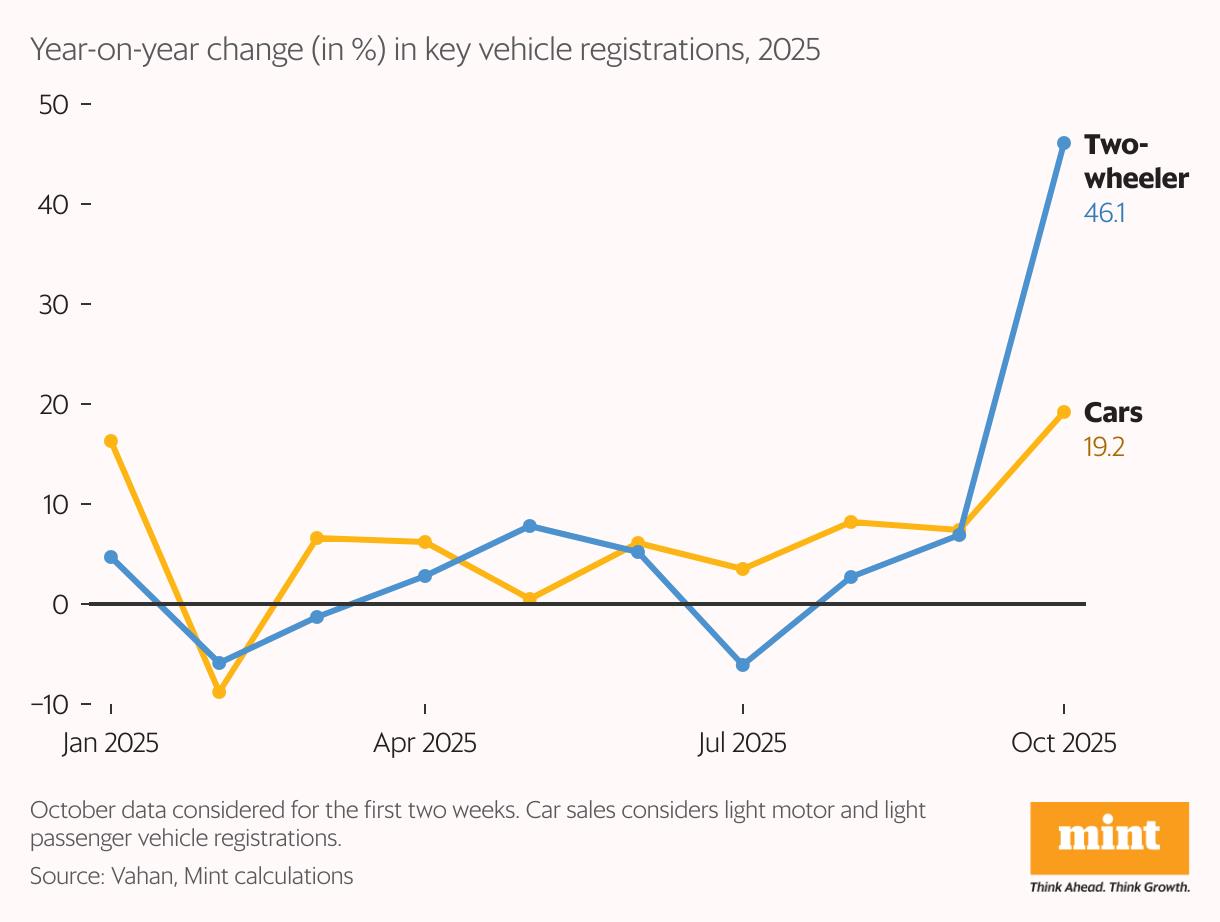

India's consumption picked up rapidly in September and October as festive fervour and the impact of goods and services tax (GST) cuts led to more spending.

A Mint analysis of the transport ministry's Vahan portal, which tracks vehicle registrations, showed that car sales jumped nearly 20% year-on-year in the first two weeks of October compared to the same period last year. On the other hand, two-wheeler sales -seen as a proxy for gauging demand at the lower end of the income spectrum-first rose 6.9% in September and then zoomed 46% in October.

Also Read | How Diwali crackers blow air pollution numbers through the roof. In chaEconomists, however, said it was too early to suggest a recovery in consumption and noted that a sustained momentum in the coming months will confirm the same.

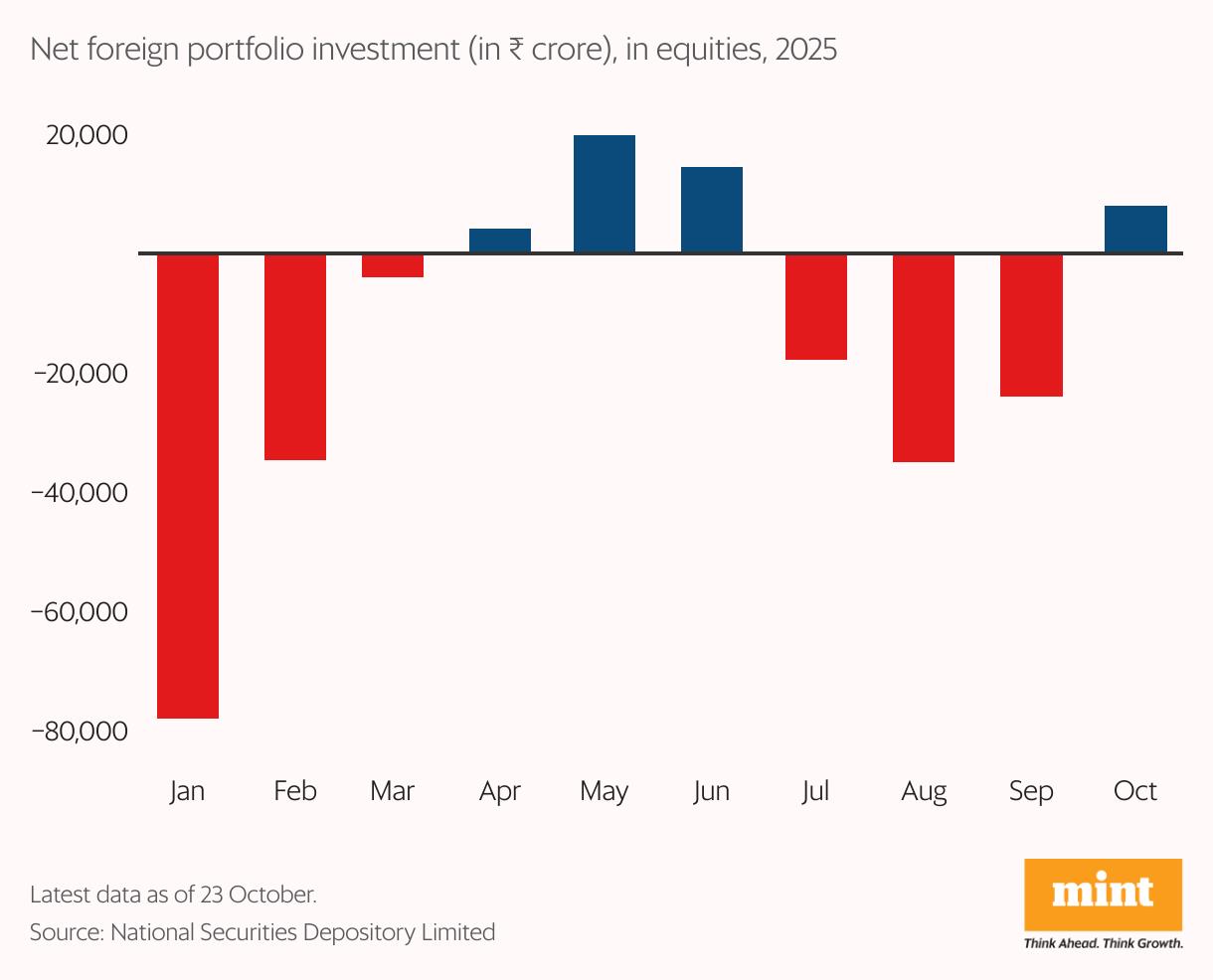

Investors' comeback

Following three consecutive months of selling equities, foreign investors are showing a possible shift in their outlook. After withdrawing nearly ₹76,619 crore between July and September in equities, Foreign Portfolio Investors (FPIs ) have infused ₹7,362 crore into Indian markets during the current month until 20 October, according to the latest data from the National Securities Depository Limited (NSDL).

While this suggests the recent festivities and GST rate cuts lifted sentiments, 2025 has largely seen outflows, with six of the last 10 months seeing net selling. In 2025 so far, Indian equities have witnessed net selling of nearly ₹1.5 trillion.

Numbers talk

15-16%: The possible US tariff rate Indian exporters could face, down from a steep 50%, if a long-pending trade deal is struck between the two countries, Mint reported. India is hoping to conclude the trade deal by November.

49%: The stake Singapore's Keppel Ltd has acquired in pan-Asian solar developer Cleantech Solar from energy major Shell Plc. The deal, valued at around $200 million, has given Keppel full control of the company, Mint reported.

$7.7 billion: That's the amount the Reserve Bank of India (RBI) sold in August to check exchange rate volatility as well as to arrest the decline in value of the rupee against the dollar, the Press Trust of India reported.

3%: The year-on-year growth in India's core sector output in September, down from the 6.5% growth recorded in the previous month. The slowdown was broad-based, with seven of the eight core sectors recording lower growth or contraction.

₹6,600 crore: The value Indian e-commerce company Meesho could unlock through its initial public offering (IPO). The Securities and Exchange Board of India (SEBI) approved the IPO earlier this week.

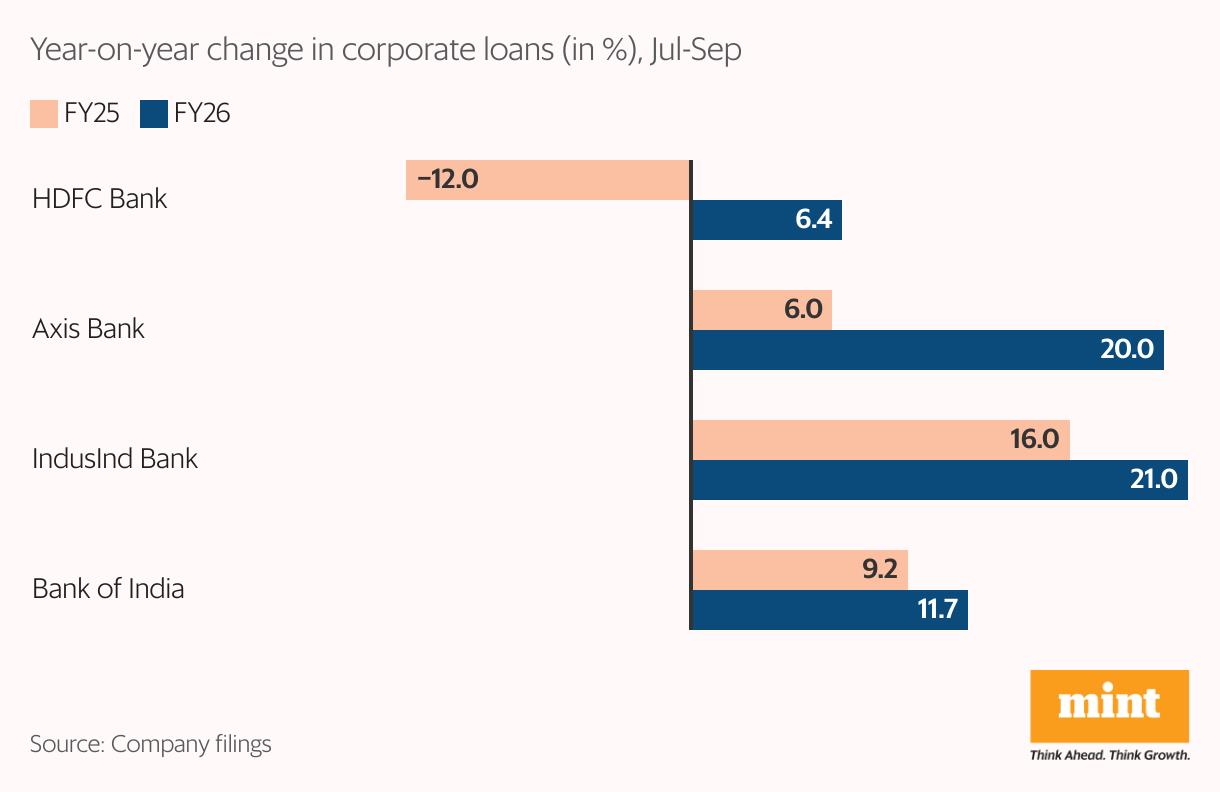

After several subdued quarters, banks in India are witnessing a gradual revival in corporate credit growth, with strong demand pipelines raising hopes for a more robust turnaround in the second half of the current fiscal year.

While the uptick is largely driven by working capital financing, some capex-linked lending and project financing deals are also reemerging in sectors such as infrastructure, renewables, and manufacturing, Mint reported.

HDFC Bank, Axis Bank, IndusInd Bank, and Bank of India reported higher year-on-year growth in their corporate loan books in the second quarter. The corporate credit demand at banks came at a time when 10-year benchmark government bond yields rose 20 basis points (bps) to 6.5% in the September quarter as geopolitical uncertainties mounted.

Compensation correlation

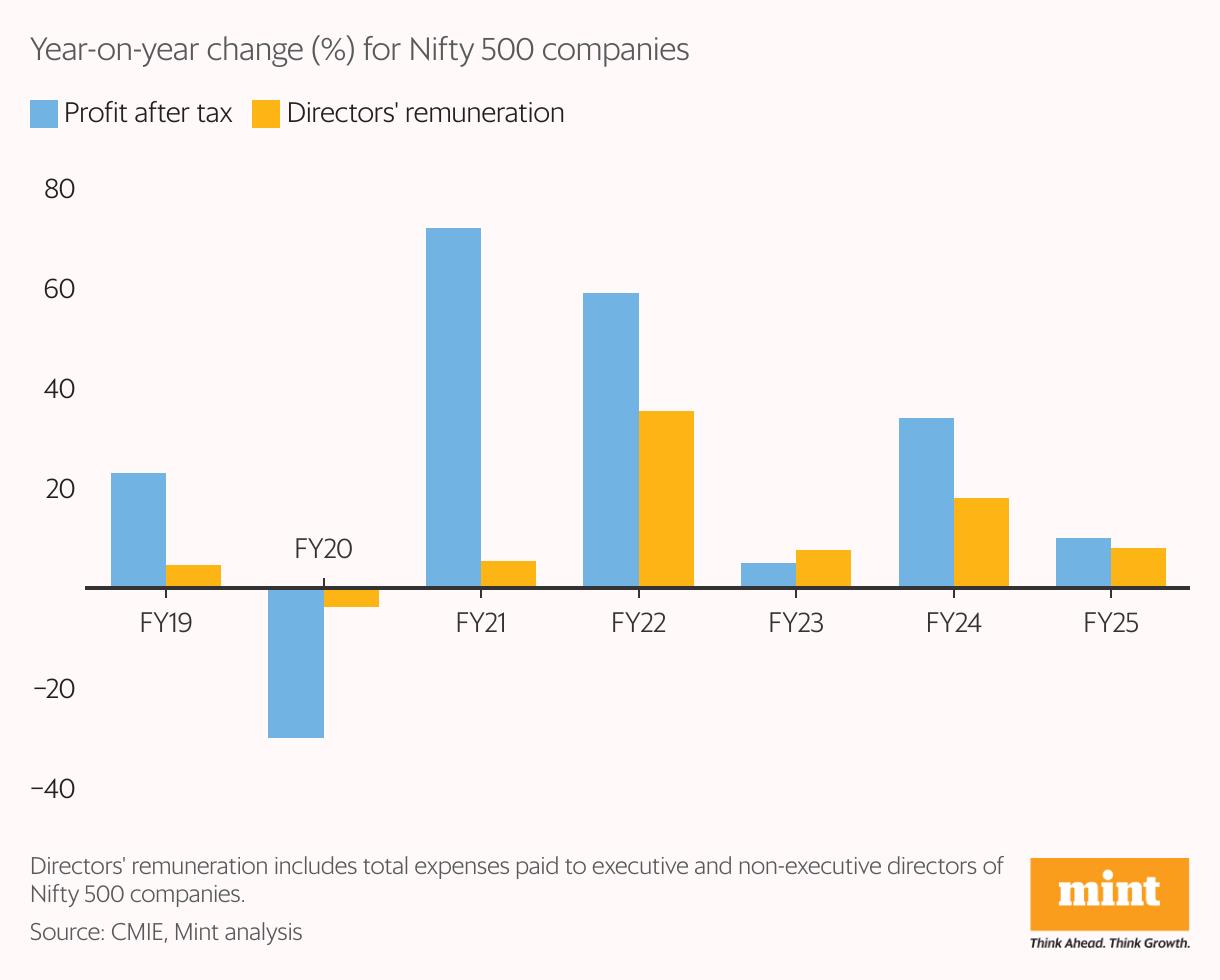

For those in the highest corporate echelons, substantial paycheques are not mere salaries but high-stakes incentive packages directly tied to performance. A Mint analysis of Nifty 500 companies confirms this correlation: in FY22, when profit after tax surged 59% year-on-year, directors' remuneration jumped 35.5%. Similarly, FY24's 34% profit growth translated to an 18.1% pay increase. However, this alignment works both ways.

Also Read | In Charts: What's driving Tata Group's boardroom dra

During FY21's pandemic-driven challenging period, when profits plummeted 28%, directors' pay also declined, albeit modestly. More recently, businesses have grappled with a consumption slowdown, prompting cost optimization measures to protect bottom lines. This trend is reflected in FY25's projected single-digit growth in directors' remuneration amid modest profit recovery.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment