Memecoins Fall To July Lows While Bitcoin & Ether Drive Market Bounce Back

- The memecoin sector's market cap fell to $44 billion on October 11, a 40% drop in just one day. As of now, the market stabilizes around $57 billion, down from recent peaks. Major memecoins like Dogecoin, Shiba Inu, and Pepe experienced weekly losses exceeding 13%, with some plunging over 20%. Other crypto sectors, including NFTs and Bitcoin, rebounded swiftly after initial sell-offs. Ethereum and Bitcoin have regained significant ground, with ETH surpassing $4,000 and BTC trading above $111,000.

The recent downturn in memecoins reflects the broader volatility affecting the cryptocurrency markets, with their collective value dropping by almost 40% from the previous day's peak. CoinMarketCap reports that on October 11, the memecoin sector dipped to approximately $44 billion, marking a significant correction from the $72 billion level seen prior. A modest recovery followed, pushing the combined valuation back to about $53 billion on October 12, reaching levels last observed before the summer's Solana -based memecoin frenzy.

Over the past four months, meme tokens maintained robust retail interest, predominantly driven by ecosystems on Solana and BNB Chain. However, the recent sharp decline signals a potential change in market momentum. Currently, the entire memecoin sector trades at roughly $57 billion, indicating a cautious stance among investors.

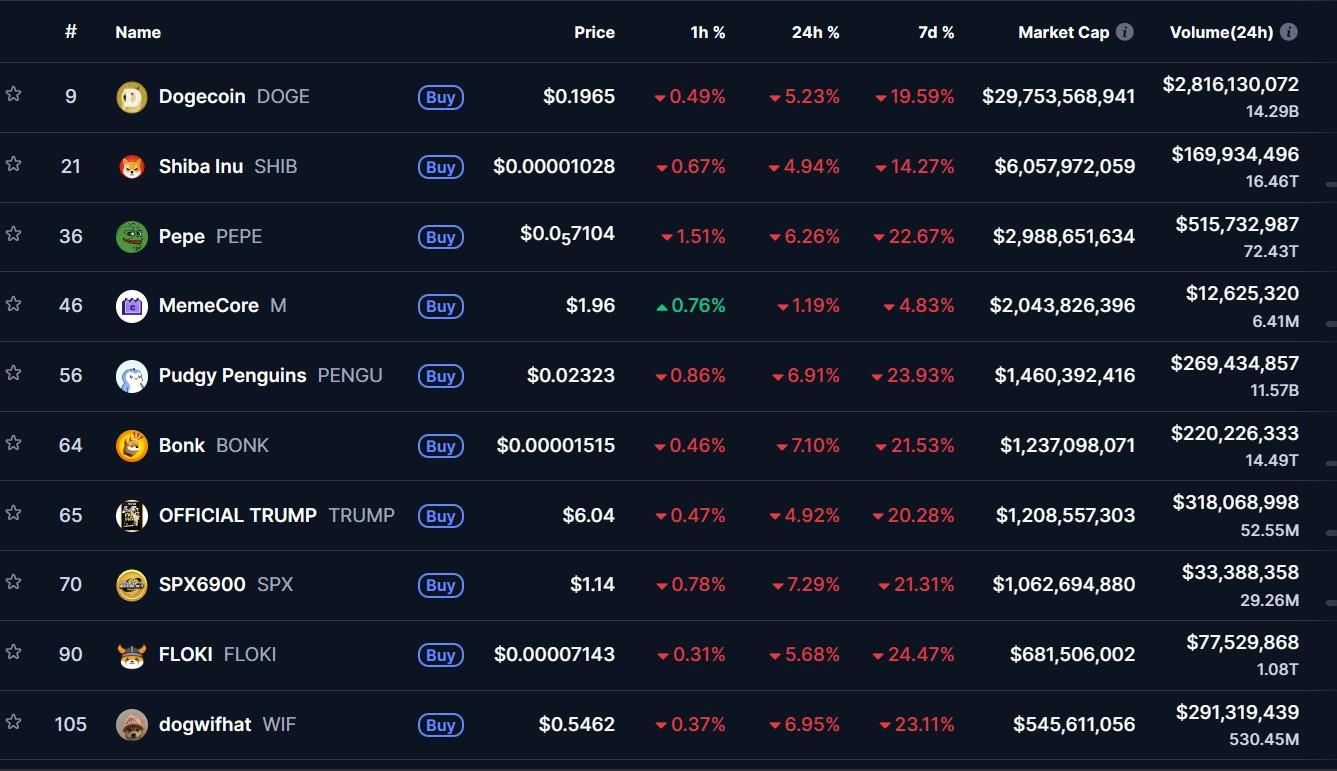

Memecoin market cap's seven-day chart. Source: CoinMarketCapTop memecoins struggle to recover after Friday's downturnThe top 10 memecoins, which constitute over 82% of the sector's total market value, are collectively valued at around $47 billion. At present, these tokens are all in the red across both 24-hour and weekly charts. Popular tokens like Dogecoin (DOGE ), Shiba Inu (SHIB ), and Pepe (PEPE ) reported weekly losses exceeding 13%. Other tokens such as Bonk (BONK ) and Floki (FLOKI ) fell by over 20%. Even the memecoin inspired by former U.S. President Donald Trump has seen a 20% decline over the week.

Top memecoins down by double-digit percentages. Source: CoinMarketCap Related: High-leverage crypto trader James Wynn liquidated again, this time for $4.8MOther crypto sectors stabilize quickly after the crash

While memecoins are still feeling the impact of recent market declines, other segments such as NFTs and established cryptocurrencies have shown rapid resilience. Just a day after the market correction, the NFT space began bouncing back, recouping approximately 10% of its value loss after a 20% drop that erased about $1.2 billion from the sector.

Crypto ETFs also demonstrated quick recovery, with fresh inflows following the initial outflows triggered by the market sell-off. Notably, Bitcoin spot ETFs saw net inflows of $102 million, and Ether ETFs gained $236 million in the same period.

Leading cryptocurrencies also rebounded significantly. Bitcoin, which briefly dipped below $102,000, is now trading above $111,000. Similarly, Ether, which fell below $3,700, recovered to over $4,000, indicating strong institutional interest and investor confidence returning to the market.

Magazine: Sharplink executive expresses shock over BTC and ETH ETF holdings: Joseph Chalom Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment