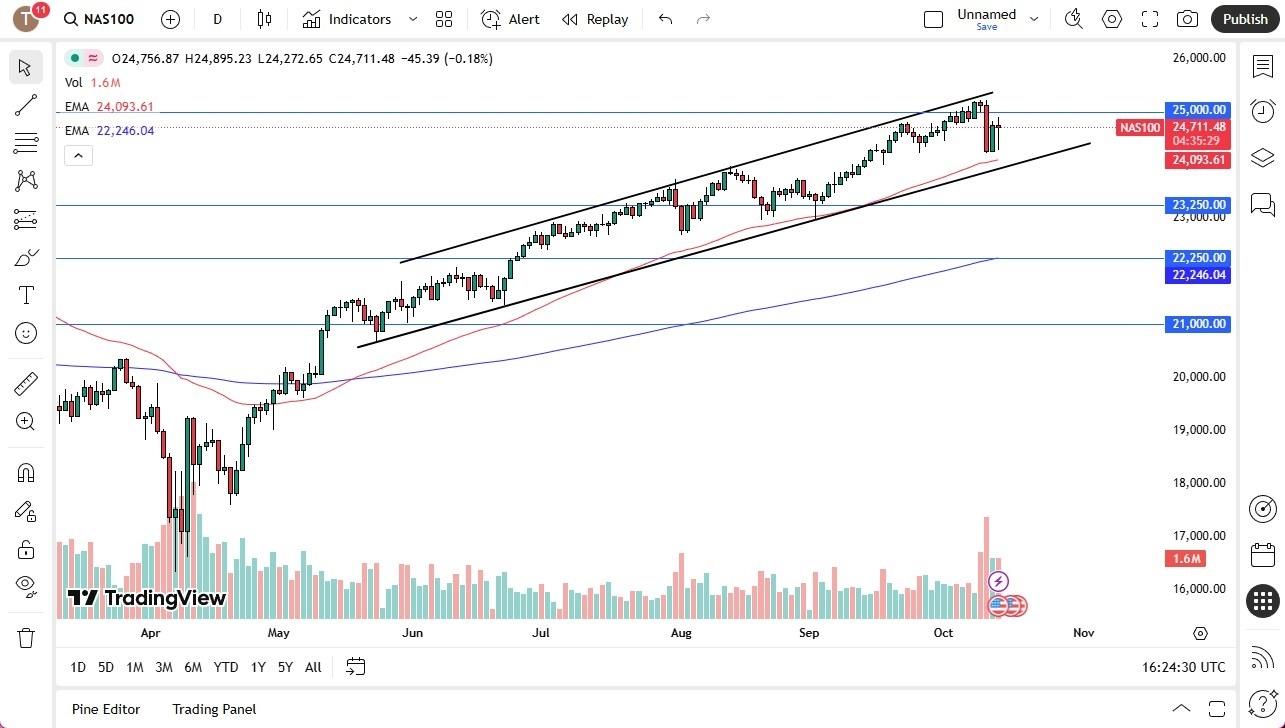

Nasdaq Forecast Today 15/10: Recovers Nicely (Chart)

- The NASDAQ 100 plunged during the early hours on Tuesday as New York came back to work but then turned around to show signs of life again. This suggests to me that we are at least going to have a bit of a fight on our hands, and that the buyers are willing to jump in and try to pick things up. The 50 Day EMA sits at the 24,093 level underneath, offering a bit of support at this juncture.

We are still very much in an upward trend, as despite the fact that the last couple of days have offered a little bit of negativity, the reality is that we are still in an up trending channel, and that is something worth paying close attention to. Furthermore, we are sitting just above the 50 Day EMA, and just below the 25,000 level.

EURUSD Chart by TradingViewThe 25,000 level has a certain amount of psychology attached to it, so if we can break above there then it's likely that we could go higher. A breakdown below the uptrend line of the channel opens up the possibility of a move to the 23,250 level. The 23,250 level of course is an area that a lot of people will be paying close attention to based on“market memory.” If we break down below there, then we could see quite a bit of negativity in this market. Alternatively, if we can break above the 25,250 level, then I think we are ready to go higher again.Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment