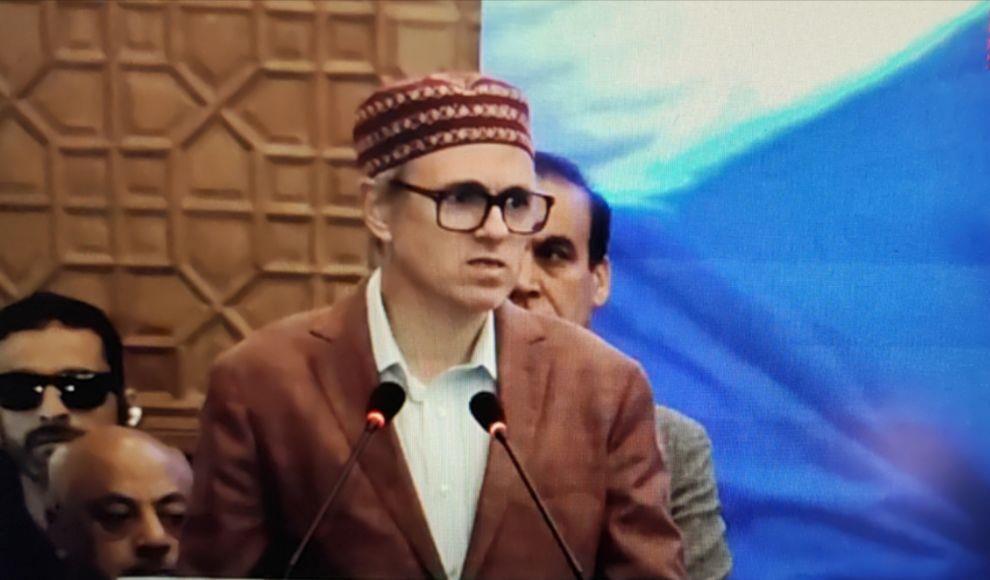

GST Revision May Cut J & K Revenue By ₹1,000 Cr: Omar Abdullah

Photo Credit-Internet

Srinagar – The revision in GST rates is expected to reduce the tax collection of Jammu and Kashmir by up to Rs 1,000 crore this fiscal, Chief Minister Omar Abdullah said here on Tuesday.

Abdullah, addressing the national executive meeting of FICCI here, also said that the fallout of the Pahalgam terror attack, which was a setback to the image of Jammu and Kashmir, along with heavy rains during the summer of 2025, has severely affected the economy of the Union Territory.

“The revision of GST rates alone will reduce our earnings by Rs 900 to Rs 1000 crore, and for a state like Jammu and Kashmir, which is already in deficit, it is a lot of money,” he said.

ADVERTISEMENTThe chief minister said the torrential rains across Jammu and Kashmir from July to September have severely affected the agriculture and horticulture sectors of the union territory.

“This has been a major dent to the economy,” he added.

Abdullah said the Pahalgam terror attack was not only a setback to the tourism industry of Jammu and Kashmir but also to the perception of the region as well.

“Pahalgam was a setback to how we perceive Jammu and Kashmir as a home,” he said.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- CEA Industries ($BNC) Announces BNB Holdings Of 480,000 Tokens, And Total Crypto And Cash Holdings Of $663 Million

- Whale.Io Launches Battlepass Season 3, Featuring $77,000 In Crypto Casino Rewards

- Kucoin Appeals FINTRAC Decision, Reaffirms Commitment To Compliance

- Daytrading Publishes New Study Showing 70% Of Viral Finance Tiktoks Are Misleading

- Bitmex Launches Uptober Carnival Featuring A $1,000,000 Prize Pool

- PU Prime Launches Halloween Giveaway: Iphones, Watches & Cash Await

Comments

No comment