Crypto Markets Hold Steady Amid US Government Shutdown Uncertainty

- The U.S. government shutdown has halted the SEC's approval process for at least 16 pending crypto ETF applications. Political deadlock continues as Republicans and Democrats clash over budget and fiscal policies, prolonging the shutdown. The delay could impact the upcoming wave of approvals, potentially delaying a new era of crypto investment products. Analysts suggest that the end of the shutdown may trigger a surge in crypto ETF approvals, boosting the broader cryptocurrency market.

As the U.S. government enters its third week of shutdown, the crypto industry faces mounting uncertainty. Over 16 proposed exchange-traded funds, many focused on Bitcoin and other cryptocurrencies, await regulatory approval. The shutdown, triggered on October 1 after failed negotiations between Republicans and Democrats, has significantly slowed the operations of regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), which is responsible for vetting these innovative financial products.

No clear end in sight for the government shutdownThe stalemate continues, with no immediate resolution on the horizon. The core disagreement revolves around fiscal policy; Republicans aim to trim spending to reduce the national debt-now exceeding $37.8 trillion-while Democrats push for increased funding in health and social programs. Both chambers of Congress are currently out of session, and the Senate is not scheduled to reconvene until Tuesday, leaving a deadlock that may stretch on indefinitely.

For the shutdown to end, Congress must pass either comprehensive budget legislation comprising 12 appropriations bills or a temporary continuing resolution to keep government operations afloat until a full agreement is reached. President Donald Trump would then sign these measures into law, reopening the government and resuming pending regulatory processes, including crypto ETF approvals.

This shutdown marks the 11th in U.S. history and the first since the December 2018–January 2019 closure, which lasted 35 days and remains the longest on record. Despite Republican control of both legislative chambers, the narrow margins prevent the passage of spending bills without Democratic support, complicating a swift resolution.

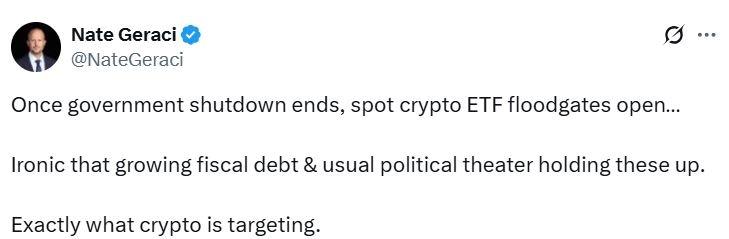

Source: Congressional Research Service Crypto markets wait on government decisionWhile political gridlock persists, the prospects of an imminent approval wave for crypto ETFs remain uncertain. Noted ETF analyst and NovaDius Wealth Management President Nate Geraci expressed optimism on social media, suggesting that once the shutdown ends, the floodgates for spot crypto ETF approvals could open wide. He highlighted that ongoing fiscal concerns and political theatrics are ironically targeting the very assets that crypto investors seek to capitalize on.

Source: Nate Geraci

Earlier predictions by Bitfinex analysts indicated that a new altcoin season could be on the horizon if these ETF applications are approved, providing exposure to less risky cryptocurrencies and attracting more retail investors. These developments could mark a shift in the market, fueling further interest in blockchain-based assets and decentralized finance (DeFi) projects.

As the political impasse continues, crypto markets remain cautious but optimistic about a potential surge once regulatory approvals resume. The situation underscores how macroeconomic politics and blockchain innovation are increasingly intertwined, shaping the future trajectory of digital assets and crypto regulation efforts worldwide.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment