AI Bitcoin Price Prediction Reveals BTC Will Remain Rangebound In October

- Bitcoin reaches new all-time high, but traders anticipate a period of consolidation before further gains toward $150,000. Support levels around $118,000, are key for maintaining bullish momentum amid possible retracements. AI-based price predictions suggest a prolonged range-bound trend rather than swift bullish acceleration. Federal Reserve statements and the US government shutdown continue to influence macroeconomic outlooks for crypto markets. Market sentiment is cautious but optimistic, with the Crypto Fear & Greed Index just shy of“extreme greed.”

Following an extraordinary weekend that saw Bitcoin hit a new all-time high, the cryptocurrency is now consolidating near the upper bounds of its historical trading range. Current data from Cointelegraph Markets Pro and TradingView indicate BTC/USD is trading around $124,000.

BTC/USD one-hour chart showing recent price action. Source: TradingView /CointelegraphThe start of futures trading resulted in a minor“gap” that, according to trader Daan Crypto Trades, was a typical weekend squeeze and retrace.“Bitcoin made a small gap on the CME futures chart, but nothing significant,” he noted. He added ,“The larger gap at $110K remains on the radar, but only if the price nears it - especially if this upward trend extends into the price discovery phase.”

BTC/USDT 15-minute chart illustrating support and resistance levels. Source: Daan Crypto Trades/X

Analysis from trader Crypto Tony emphasizes the importance of holding the $123,000 level to support further bullish movement.“Weekly close above $123K is critical; bulls need to defend this level to sustain upward momentum,” he tweeted. Meanwhile, crypto analyst Ted Pillows pointed out that Bitcoin recently surpassed a key resistance level, which, if reclaimed, could open the door to higher targets.

Looking ahead, industry expectations for Bitcoin's next move remain optimistic, with some analysts projecting a target of $150,000 or higher. Jelle, a crypto market strategist, noted,“Bitcoin's new cycle has begun, and the next major milestone is $150K.” Conversely, Michaël van de Poppe advised caution, suggesting patience and noting that a dip below $121,500 could present a buying opportunity before reaching new highs.

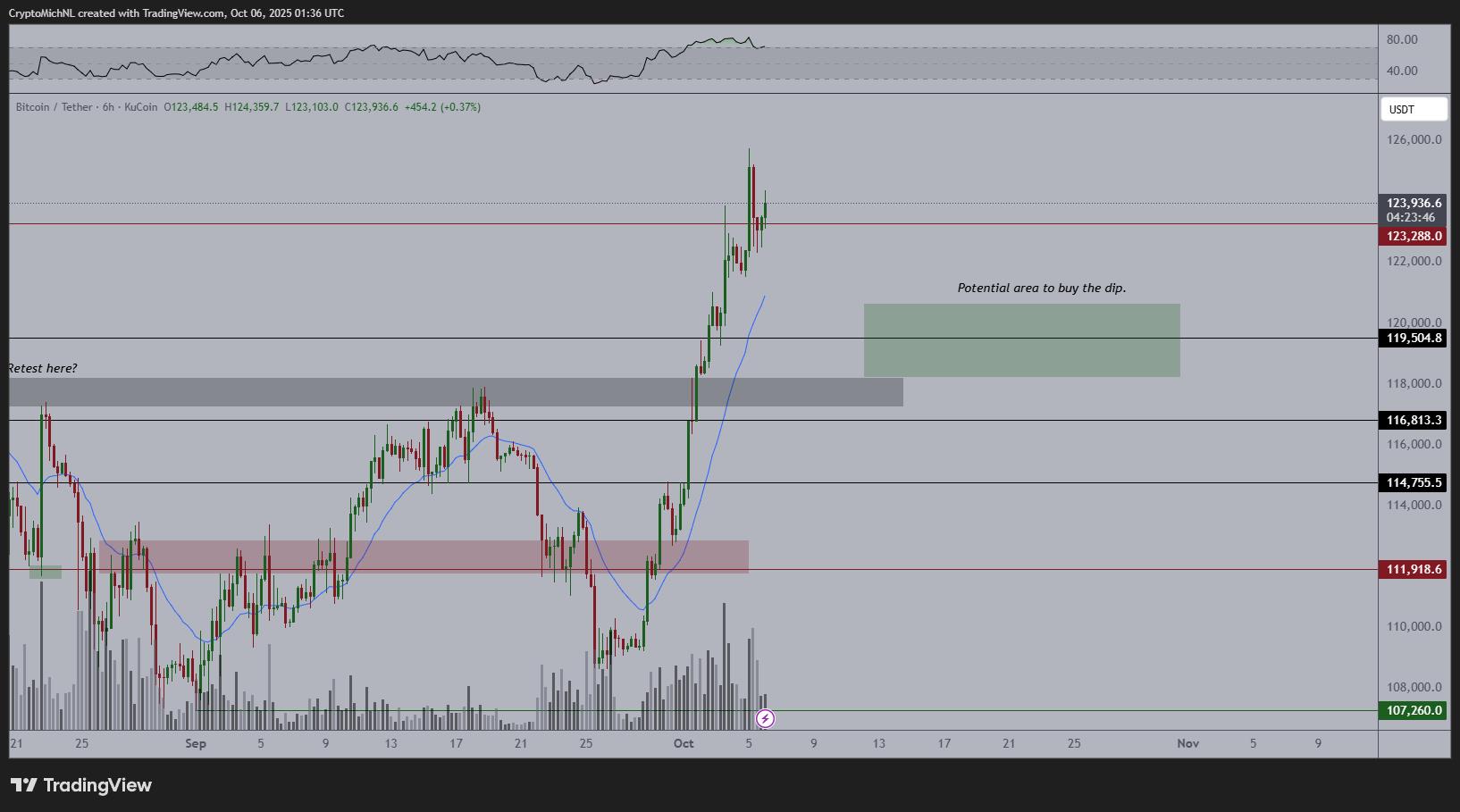

BTC/USDT six-hour chart with RSI indicators. Source: Michaël van de Poppe/XPotential for a Short-Term Pullback

Despite the bullish outlook, market participants expect some retracement from record levels, with retests of support levels looming. The 50-period exponential moving average (EMA) on four-hour charts, currently near $119,250 and climbing, is a key support zone.“A retest of the 4h50EMA seems likely,” said CrypNuevo,“and after that, another move higher could follow.”

Rekt Capital highlighted that recent rejection at roughly $124,000 echoes previous pullbacks, suggesting that a slight dip to around $118,000 would still position Bitcoin for future upside.“Losing that $117K-$118K zone would be concerning, as it's a high-volume support area,” he warned.

BTC/USD daily chart with trading volume and support zones. Source: Daan Crypto Trades/XAI Predicts a Range-Bound October

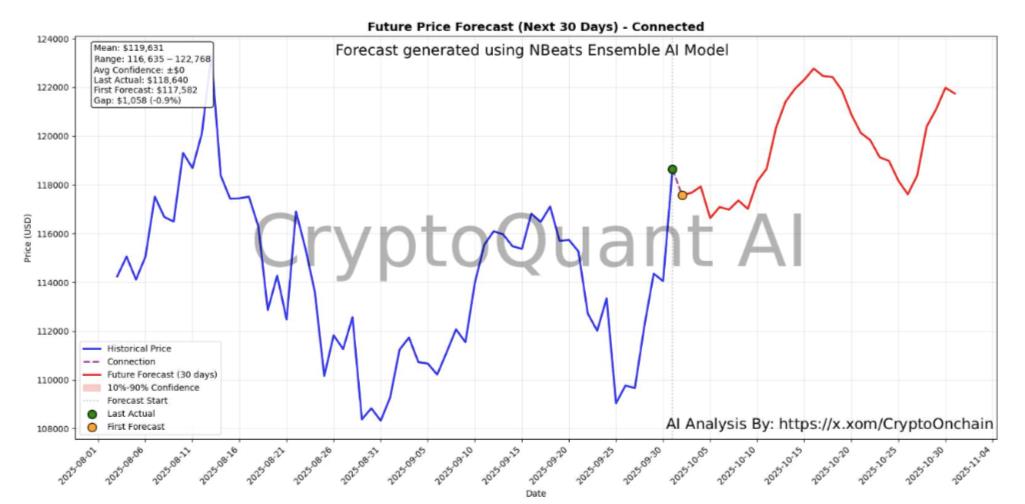

While traders remain bullish, AI-driven analysis suggests a more subdued outlook for October. CryptoQuant's NBeats Ensemble model, which analyzes nearly 400 onchain features, indicates that Bitcoin is likely to remain within its current range, with a slight bias toward upper half of the range. The platform highlights that the probability of a breakout remains low in the near term.

Bitcoin price forecast from CryptoQuant's AI model. Source: CryptoQuant

CryptoQuant concludes that a range-bound movement through October is the most probable scenario, emphasizing the importance of monitoring support around $108,000 and resistance near $123,000. A decisive move beyond either could define the next major trend for Bitcoin's price trajectory.

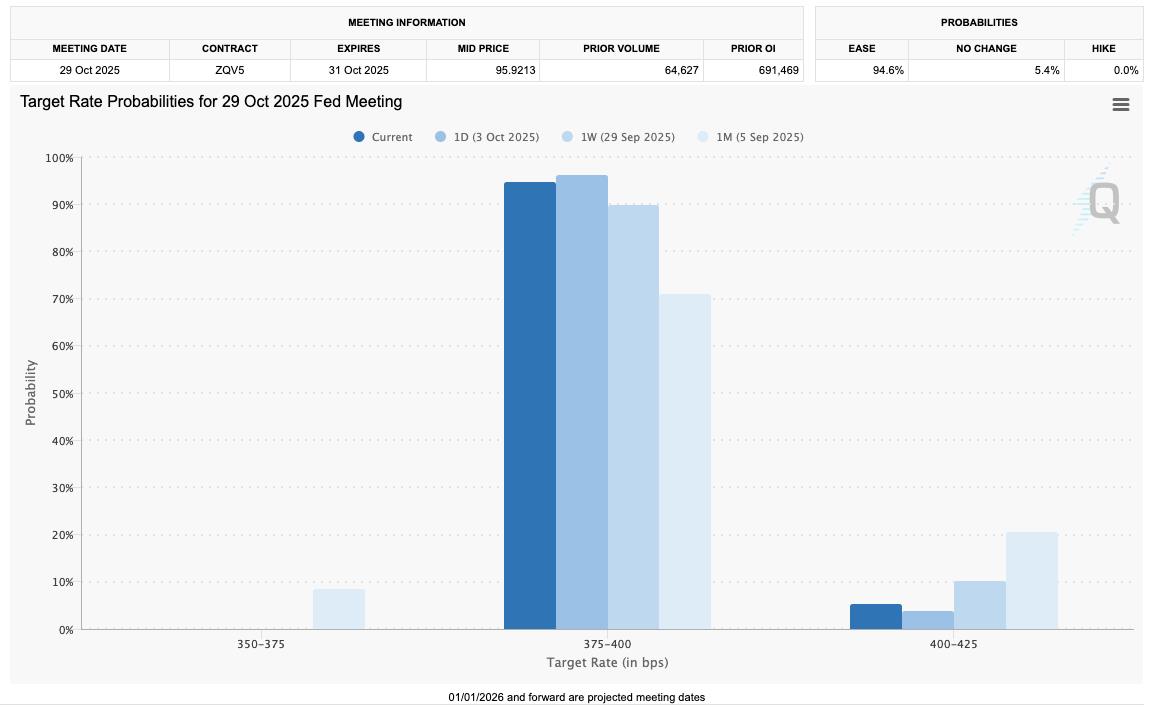

Federal Reserve Damper on Market DataThe ongoing U.S. government shutdown has delayed critical macroeconomic data releases this week, creating uncertainty around the broader economic environment influencing crypto markets. Federal Reserve officials, including Chair Jerome Powell and Vice Chair Michelle Bowman, are scheduled to speak at upcoming events, providing insights into monetary policy amid this backdrop.

Powell, under pressure from political figures, has signaled a cautious approach to interest rate adjustments, with the Fed likely to keep rates steady until the upcoming rate decision in about three weeks. The lack of fresh economic data, especially on labor markets, adds to the market's cautious stance. Nevertheless, optimistic macro indicators, such as sustained stock market gains, suggest the risk-on environment may persist despite these uncertainties.

FOMC rate probability chart based on CME Group FedWatch Tool. Source: CME Group

Overall, the outlook for crypto markets remains cautiously bullish, with macroeconomic factors and institutional participation poised to shape the next phase of Bitcoin's rally. Experts advise traders to keep an eye on support and resistance levels, as well as macro cues, to navigate the evolving landscape effectively.

Crypto Investing Risk Warning

Crypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment