How Low Will Prices Drop Next? Surprising Trends & Predictions

- XRP has repeatedly tested the $3 resistance but failed to establish a sustained breakout, prompting fears of a deeper correction. A bearish fractal indicates a possible 15% decline toward $2.60, echoing similar patterns seen earlier this year. Technical indicators, including the RSI, suggest XRP's momentum may be waning as it corrects from overbought levels. Liquidity data reveals significant long liquidation zones that could accelerate a sell-off if breached. The crucial support levels are near $2.93 and $2.52, with a close below $3 potentially triggering a cascade of liquidations leading to a sharper decline.

XRP is currently mimicking a bearish fractal pattern that could lead to a notable decline. Since its surge past $3 in October, XRP has repeatedly challenged that level but has yet to sustain a breakout. The recent price action shows a formation of a rounded top, followed by consolidation within a bearish flag pattern on the four-hour chart-an archetype often signaling further declines.

XRP/USD four-hour price chart. Source: TradingViewThis setup points toward a potential drop of up to 15%, aiming for the $2.60 level, near the 200-day exponential moving average (EMA). The current RSI, which has been correcting from overbought territory above 70, provides further confirmation that XRP may be ripe for a downtrend before any rebound.

In the short-term, XRP could test the flag support around $2.93. A decisive close below this level would validate the bearish scenario, increasing the likelihood of a move down to $2.60-the next significant support zone aligned with the 200-day EMA.

XRP/USD daily price chart. Source: TradingView

Conversely, a bounce from the current levels or the EMAs at $2.93 and $2.52 might invalidate the bearish outlook, potentially prompting a quick return to breakeven or above the $3 mark.

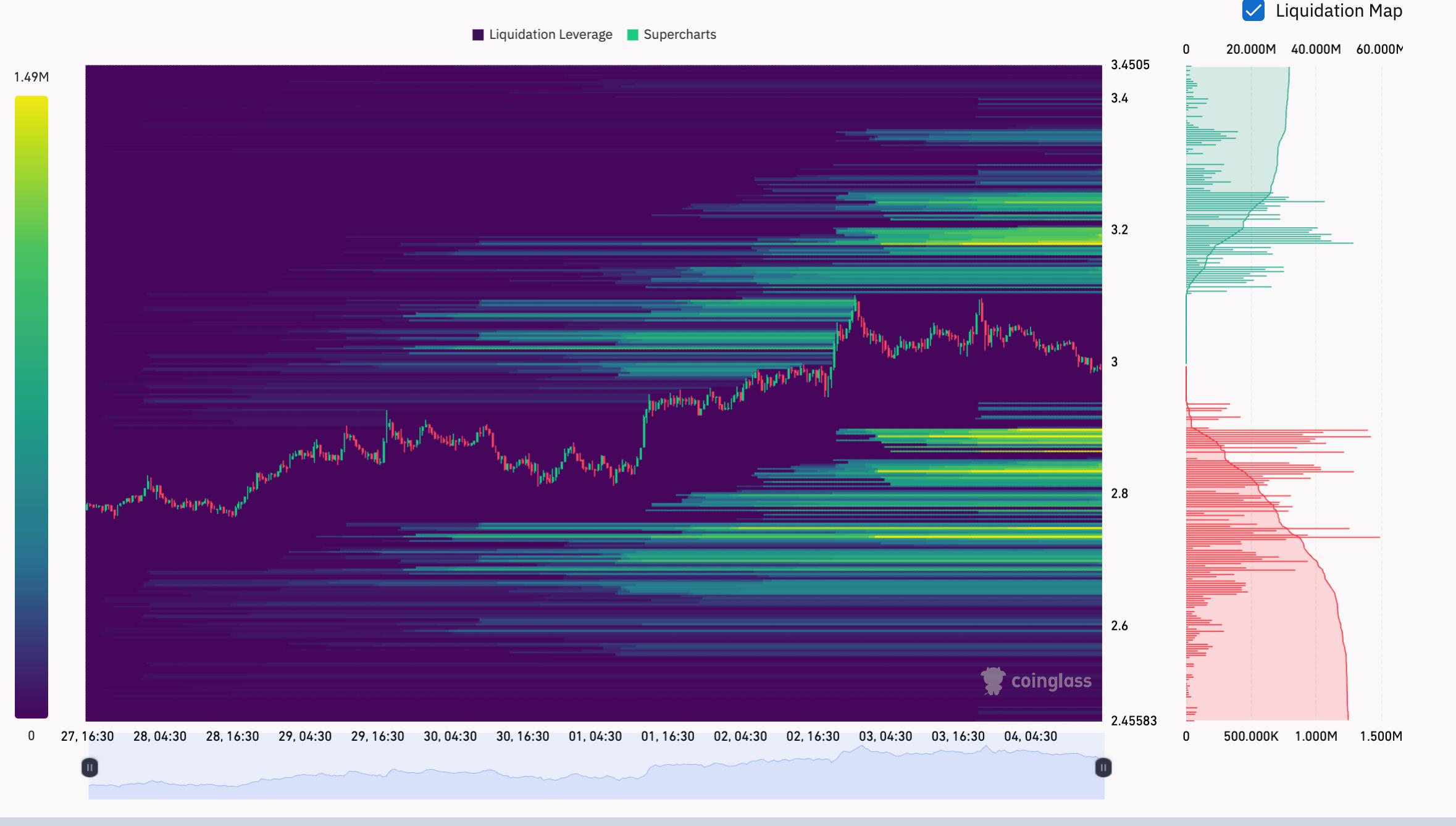

Liquidity levels warn of a potential sell-off riskData from CoinGlass indicates substantial liquidity concentrations at key levels, highlighting the risk of sharp price movements. Notably, XRP's $3 support region sits between two major liquidity zones: a cluster of long liquidation points around $3.18 to $3.40 and a larger concentration of over $500 million in liquidations between $2.73 and $2.89.

XRP/USDT liquidation heatmap (1-week). Source: CoinGlass/HyperLiquid

If XRP drops below $3, a cascade of long liquidations could accelerate toward the $2.89–$2.73 range, intensifying the downward trend. Conversely, if bulls defend the $3 level, it could trigger a short-term stop-run towards the $3.20–$3.40 area, where additional liquidations might occur.

This analysis does not constitute financial advice. Cryptocurrency investing is highly speculative, and traders should conduct thorough research before making any decisions.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment