US Business Surveys Strengthen The Case For Rate Cuts

The government shutdown means no 'official' economic data, but we continue to get numbers from other organisations. Today's ISM services index for September has come in weaker than predicted, dropping from 52 (growth territory) to 50 (consistent with flat activity). The consensus prediction was 51.7, but the outcome was actually below all individual survey responses provided to Bloomberg.

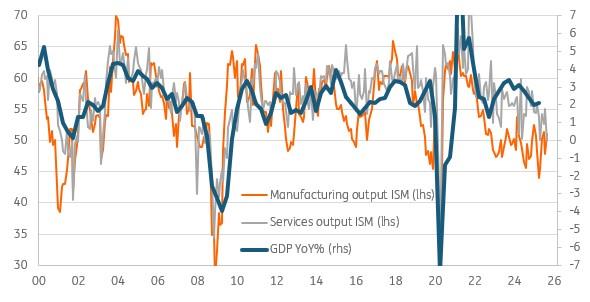

The details show business activity dropping to 49.9 from 55.0. This is the worst outcome since the shutdown period of the pandemic in May 2020, while new orders fell from 56.0 to 50.4. The employment component rose to 47.2 from 46.5, but because it remains below 50, this increase merely means that the pace of job losses slowed last month. The chart below shows the output measures of both the services and manufacturing ISM series versus annual GDP growth, and based on the historical relationship, points to the risk of slowing growth in the coming quarters.

GDP growth (YoY%) versus ISM output metrics advanced 6 months

Source: Macrobond, ING Weaker jobs trumps inflation worries

While we didn't get the jobs report today, the ADP private payrolls numbers earlier in the week suggest the jobs market continues to cool, while the job openings numbers within the JOLTS report show there are now more unemployed people in America than there are job vacancies. At the same time, a slowing quits rate – a measure of job turnover – is pointing to wage growth dropping below 3% in early 2026. This combination of sub-trend growth and weakening jobs numbers will, we believe, drive the Fed's interest rate decisions.

There are lingering concerns about tariffs pushing up prices and inflation, with today's ISM prices paid series doing nothing to dispel them – it rose to 69.4 from 69.2, so well above the 50 break-even level. However, tariffs have come through more slowly than feared in the key inflation metrics the Fed focuses on, of CPI and the PCE deflator. As such, the balance of risks to the Fed's dual mandate of price stability and maximum employment justifies the central bank moving monetary policy closer to neutral with 25bp interest rate cuts at the October and December FOMC meetings expected.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Financewire And Tipranks Partner To Redefine Financial News Distribution

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Motif AI Enters Phase Two Of Its Growth Cycle

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

Comments

No comment