South Korea's Inflation Rebounds, But Not Enough To Halt Rate Cuts

| 2.1% YoY | Consumer price inflation |

| Higher than expected |

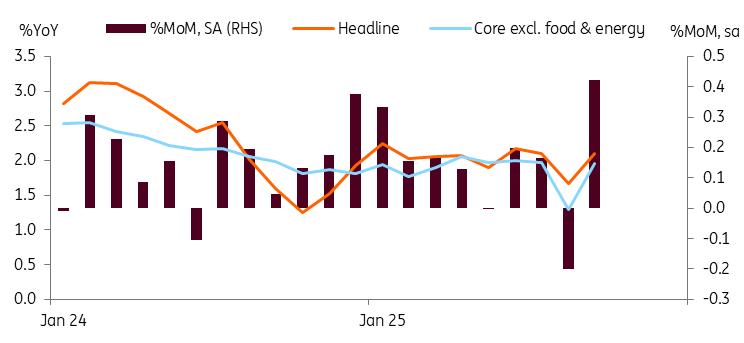

Consumer price inflation rose to 2.1% year-on-year in September from 1.7% in August, broadly in line with market consensus. The rebound was primarily attributed to the end of one-off mobile service charge discounts. Communications prices rose 0.1% following a 13.3% drop in August.

Also, ahead of the early October Chuseok holiday, vegetable and meat prices rose, while oil prices fell thanks to lower global commodity prices. Core inflation, excluding food and energy, also jumped to 2.0% (vs 1.3% in August). Yet today's inflation data is not likely to prompt any material change in the Bank of Korea's policy easing stance.

Inflation rebounded but underlying pressures remained soft

Source: CEIC BoK watch

We still expect the BoK to cut rates by 25 basis points in October, although rising house prices could push this back to November. We believe that the recent weakness of exports and economic activity points to the need for looser monetary policy. Regarding housing prices, the BoK will rely on government measures, which are likely to be tightened in order to stabilise the housing market. Therefore, the BoK will prioritise supporting growth.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Financewire And Tipranks Partner To Redefine Financial News Distribution

- Ethereum-Based Defi Crypto Mutuum Finance (MUTM) Reaches 50% Completion In Phase 6

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

- Citadel Launches Suiball, The First Sui-Native Hardware Wallet

- Motif AI Enters Phase Two Of Its Growth Cycle

- Dubai At The Centre Of Global Finance: Forex Expo 2025 Redefines The Trading Landscape

Comments

No comment