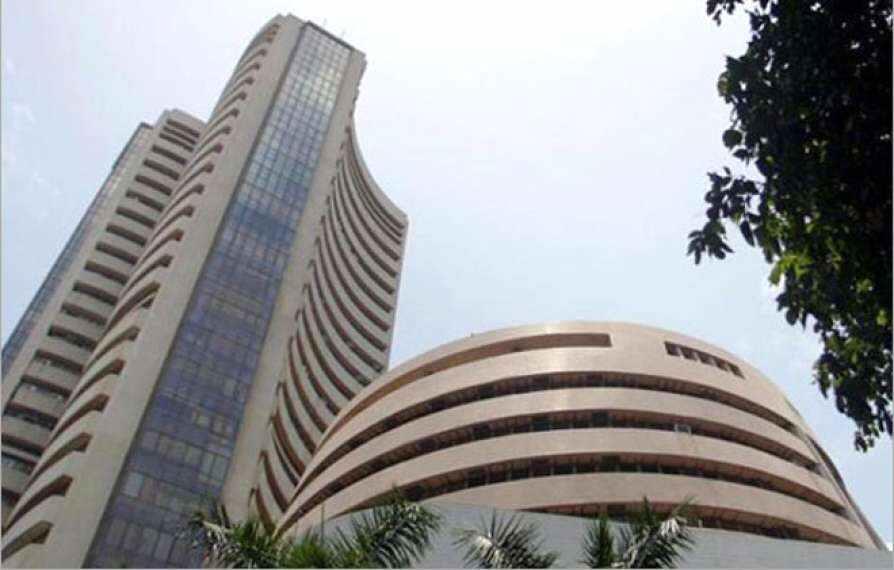

Stock Markets Extend Morning Gains Post RBI Policy

File photo

Mumbai – Benchmark indices Sensex and Nifty extended early gains and were trading significantly higher on Wednesday, helped by buying in bank stocks, after the Reserve Bank of India (RBI) kept its policy interest rate unchanged at 5.5 per cent for the second consecutive time.

The rebound in the equity market came after an eight day slump.

The 30-share BSE Sensex jumped 599.43 points to 80,867.05 in late morning trade. The 50-share NSE Nifty climbed 170.7 points to 24,781.80.

The Reserve Bank of India (RBI) on Wednesday kept its policy interest rate unchanged at 5.5 per cent for the second consecutive time, citing concerns over tariff uncertainties.

Announcing the fourth bi-monthly monetary policy of the current fiscal, RBI Governor Sanjay Malhotra said the Monetary Policy Committee (MPC) unanimously decided to keep the short-term lending rate or repo rate unchanged at 5.5 per cent with a neutral stance.

From the Sensex firms, Tata Motors, Trent, Kotak Mahindra Bank, Axis Bank, Sun Pharma and ICICI Bank were among the major gainers.

However, Bajaj Finance, Larsen & Toubro, Tata Steel and Asian Paints were among the laggards.

“The MPC delivered exactly a“dovish pause” which the market expected. But despite the policy being in tune with market expectations, the market has given a thumbs up to the policy since the central bank delivered some unexpected pro-market initiatives like allowing banks to fund acquisitions...,” V K Vijayakumar, Chief Investment Strategist, Geojit Investments Limited, said.

In Asian markets, South Korea's Kospi traded in positive territory, while Japan's Nikkei 225 index quoted lower.

US markets ended higher on Tuesday.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 2,327.09 crore on Tuesday, while Domestic Institutional Investors (DIIs) bought worth Rs 5,761.63 crore, according to exchange data.

Global oil benchmark Brent crude climbed 0.20 per cent to USD 66.16 a barrel.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment