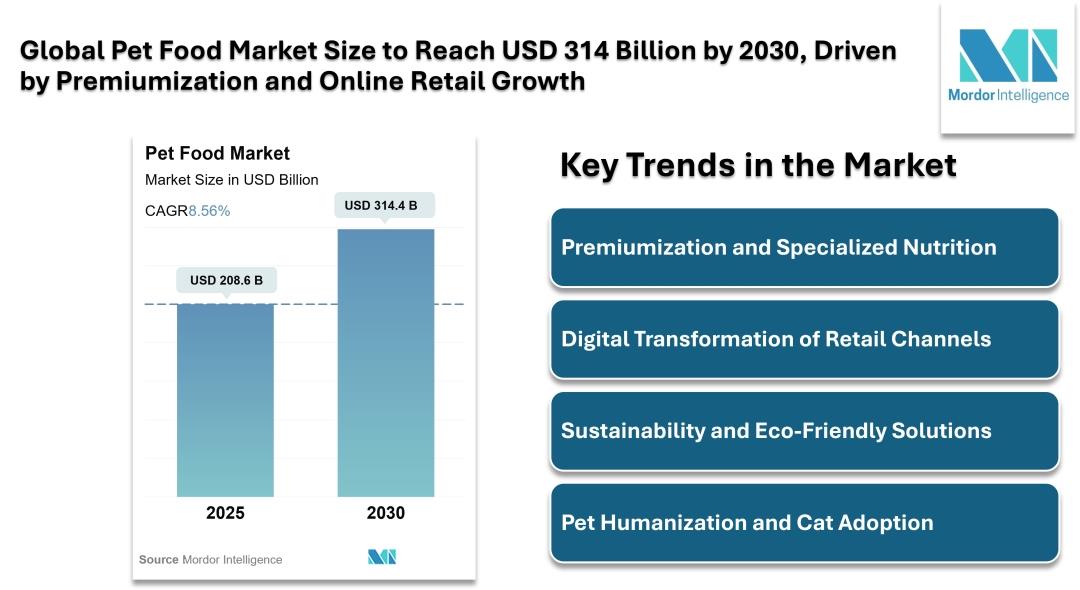

Global Pet Food Market Size To Reach USD 314 Billion By 2030, Driven By Premiumization And Online Retail Growth

"Pet Food Market Size & Trends | Mordor Intelligence"TL;DR: The global pet food market size is projected to reach USD 314.4 Bn by 2030 at a CAGR of 8.56%. Growth is driven by premiumization, digital retail expansion, pet humanization, and rising consumer focus on pet health. Dogs lead the market, while cats & other pets show rapid growth. Key trends include sustainable ingredients, specialized nutrition, online sales, and eco-friendly packaging. North America, Europe, and the APAC dominate, with emerging opportunities in Africa and South America.

Introduction to the Pet Food Market

The global pet food market size is estimated at USD 209 billion in 2025 and is projected to reach USD 314 billion by 2030, growing at a CAGR of 9%. Rising pet adoption, premiumization trends, digital retail transformation, and increasing consumer focus on pet health and nutrition fuel growth. Manufacturers are innovating with sustainable ingredients, specialized nutrition, and eco-friendly packaging, while online channels and subscription models reshape consumer purchasing behavior.

Report Overview:

Key Trends in the Pet Food Market

Premiumization and Specialized Nutrition

Consumers are increasingly opting for premium and natural pet food, with 40% of pet parents choosing premium products in 2022. Companies like Hill's Pet Nutrition are introducing MSC-certified pollock and insect protein products. Veterinary diets and functional ingredients targeting health conditions such as cancer, obesity, and kidney disease are driving innovation and growth.

Digital Transformation of Retail Channels

Online pet food sales rose from 32% in 2020 to 40% in 2022, encouraging omnichannel strategies. Direct-to-consumer models and subscription services strengthen customer relationships, provide valuable insights, and enable convenient delivery options.

Sustainability and Eco-Friendly Solutions

Manufacturers are emphasizing environmentally conscious products, including alternative protein sources and sustainable packaging. The shift toward eco-friendly practices aligns with growing consumer awareness and corporate social responsibility initiatives.

Pet Humanization and Cat Adoption

The rise of pet humanization has boosted cat adoption globally, particularly in Europe and urban centers. Cats' independent nature, compatibility with indoor living, and pandemic-driven companionship needs contribute to increased pet food demand.

Growing Pet Expenditure

Global pet expenditure rose by 24.8% between 2017 and 2022, with food accounting for the largest share. Premiumization and health-focused products are driving higher spending across dogs, cats, and other pets.

Pet Food Market Segment Analysis

By Product

Food Segment: Dominates with ~71% share, led by dry and wet food; premiumization drives growth.

Veterinary Diets: Fastest-growing segment (~10% CAGR), driven by preventive and specialized health nutrition.

Treats & Supplements: Focus on dental health, training, and preventive care with functional ingredients.

By Pet Type

Dogs: Largest segment (~39% market share), driven by population size, dietary needs, and strong adoption trends.

Cats: A Growing segment, especially in Europe and urban regions, with specialized nutrition driving market expansion.

Other Pets: Includes fish, birds, small mammals, and reptiles, benefiting from niche diets and urban pet adoption trends.

By Distribution Channel

Specialty Stores: Lead with ~33% share, offering expert guidance and premium product ranges.

Online Channels: Fastest-growing, driven by convenience, subscriptions, and AI-powered recommendations.

Others: Supermarkets, hypermarkets, convenience stores, veterinary channels, and D2C sales contribute to market diversity.

Regional Insights

Africa & South Africa

Asia-Pacific & China

Europe & the United Kingdom

North & South America

Competitive Landscape

The pet food market is consolidated, dominated by global players investing in innovation, premiumization, sustainability, and e-commerce expansion. Companies focus on R&D, veterinary partnerships, and direct-to-consumer channels, while mergers and acquisitions strengthen market presence.

Key Pet Food Industry Leaders

ADM

Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

Mars Incorporated

Nestle (Purina)

The J. M. Smucker Company

Industry Related Reports

Europe Pet Food Market - The Europe Pet Food Market report segments the industry into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels), and Country (France, Germany, Italy, Netherlands, Poland, Russia, Spain, United Kingdom, Rest of Europe).

Get More Insights:

Argentina Pet Food Market - The Argentina Pet Food Market report segments the industry into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). Get five years of historical data alongside five-year market forecasts.

Get More Insights:

United States Pet Food Market - The United States Pet Food Market report segments the industry into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels).

Get More Insights:

Canada Pet Food Market - The Canada Pet Food Market report segments the industry into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels).

Get More Insights:

Italy Pet Food Market - The Italy Pet Food Market report segments the industry into Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels).

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment