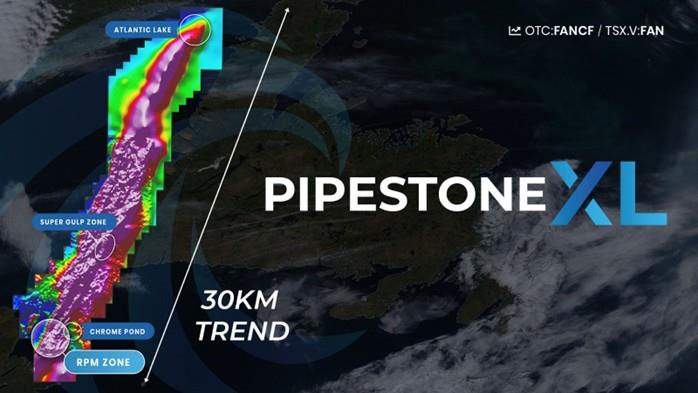

First Atlantic Nickel Renames Atlantic Nickel Project To Pipestone XL To Reflect 100% Ownership Of 30 Km Pipestone Ophiolite Complex And Provides Updates On RPM Phase 2X Program

| Drill Hole | Zone | Section | From meters | To meters | Interval meters | Magnetically Recovered (DTR) Nickel % | Magnetic Concentrate Nickel Grade (Ni %) | Mass Pull (%) | Comment |

| AN 24 - 02 | RPM | S1 | 11.0 | 394.1 | 383.1 | 0.13 | 1.37 | 9.50 | NR - March 12, 2025 |

| AN 24 - 03 | RPM | S1 | 18.0 | 234.0 | 216.0 | 0.11 | 1.32 | 9.12 | NR - April 15, 2025 |

| AN 24 - 04 | RPM | S1 | 12.0 | 378.0 | 366.0 | 0.14 | 1.46 | 9.53 | NR- June 24, 2025 |

| AN 24 - 05 | RPM | S2 | 6.0 | 357.0 | 351.0 | 0.12 | 1.47 | 8.21 | NR - July 9, 2025 |

| AN 25 - 06 | RPM | S2 | 5.65 | 453 | 447.35 | 0.11 | 1.27 | 9.02 | NR - August 12, 2025 |

| AN 25 - 07 | RPM | S2 | 495.0 | pending | pending | samples submitted | |||

| AN 25 - 08 | RPM | S3 | 491.0 | pending | pending | samples submitted | |||

| AN 25 - 09 | RPM | S3 | 480.0 | pending | pending | samples submitted | |||

| AN 25 - 10 | RPM | S1 | samples submitted |

Figure 3: RPM Zone Phase 2X drilling map at Pipestone XL.

CEO STATEMENT

Adrian Smith, CEO of First Atlantic, commented: "The Pipestone XL name reflects our 100% ownership of the 30-kilometer ophiolite belt of ultramafic rocks and the multi-zone potential of this district-scale discovery. At RPM, we have already demonstrated consistent DTR nickel mineralization across a 400m x 500m area, now being expanded through Phase 2X drilling. Combined with recent Super Gulp discovery and numerous untested targets along trend, we are beginning to demonstrate the true scale of the Pipestone Ophiolite Complex. The recent announcement by FPX Nickel and JOGMEC (Japan Organization for Metals and Energy Security) designating the Advocate property in Newfoundland as their first designated project - selected from more than 50 targets across 10 jurisdictions worldwide - further validates the exceptional potential of ophiolite-hosted awaruite deposits in our province. As nickel demand grows to support batteries, stainless steel and future technologies, Pipestone XL is well positioned to become a crucial North American source of this essential metal. Our awaruite's unique magnetic properties enable direct concentration without traditional smelting, offering a cleaner, more sustainable pathway to supply the industries and infrastructure that power our modern economy."

NEWFOUNDLAND MINING ADVANTAGE

Newfoundland and Labrador consistently ranks in the world's top 10 mining jurisdictions, according to the Fraser Institute's 2024 Annual Survey of Mining Companies. The province combines world-class geology with supportive government policies and well-established infrastructure. As the survey notes: "Two Canadian provinces, Saskatchewan and Newfoundland & Labrador, appear in the list of top ten most attractive jurisdictions for mining investment."1 Newfoundland and Labrador also offers one of the most efficient regulatory environments in Canada. The province's streamlined permitting process has enabled First Atlantic to advance from acquisition to drilling in under 12 months, with exploration permits often granted in as little as three weeks.

Figure 4: Ranking of attractive mining destinations in North America, from the Fraser Institute's 2024 Annual Survey of Mining Companies2.

The recent successful construction and commissioning of Equinox Gold's Valentine Lake Mine demonstrate Newfoundland's ability to support major mining projects from exploration through to production. On September 15, 2025, Equinox Gold Corp. announced its first gold pour at Valentine Lake, noting: "Once fully operational, Valentine will be Equinox Gold's second-largest mine, the largest gold mine in Atlantic Canada."3 Located in central Newfoundland, Valentine Lake validates the region's infrastructure and skilled workforce, both critical for advancing large-scale mining operations.

In addition, FPX Nickel's partnership with JOGMEC to acquire the Advocate awaruite project in Newfoundland, announced on September 23, 20254, highlights growing international recognition of the province's potential for this rare nickel mineral. FPX has been a pioneer in awaruite exploration through their Decar project in British Columbia, and its entry into Newfoundland further validates the prospectivity of the region's ultramafic rock belts.

AWARUITE - RARE & PURE NATURAL NICKEL-IRON-COBALT ALLOY MINERAL

The sulfur-free nature of awaruite (Ni3Fe), a naturally occurring nickel-iron-cobalt alloy already in metallic form, eliminates the need for secondary processes such as smelting, roasting or acid leaching that are typical of sulfide or laterite nickel ores. Unlike sulfides, which are not natural alloys, awaruite avoids the challenge of sourcing smelter capacity - a bottleneck in North America's nickel supply chain. With an average nickel grade of approximately 76%, awaruite significantly exceeds the ~25%5 nickel grade characteristic of pentlandite. Awaruite's strong magnetic properties enable concentration through magnetic separation, as demonstrated by Davis Tube Recovery (DTR) testing at First Atlantic's RPM Zone drill core.

Awaruite eliminates the electricity requirements, emissions, and environmental impacts associated with conventional smelting, roasting or acid leaching processes of common nickel minerals. Moreover, awaruite's sulfur-free composition removes the risks of acid mine drainage (AMD) and related permitting challenges commonly posed by sulfide minerals.6 As noted by the United States Geological Survey (USGS) in 2012: "The development of awaruite deposits in other parts of Canada may help alleviate any prolonged shortage of nickel concentrate. Awaruite, a natural iron-nickel alloy, is much easier to concentrate than pentlandite, the principal sulfide of nickel."

Figure 5: Quote from USGS on Awaruite Deposits in Canada

Investor Information

The Company's common shares trade on the TSX Venture Exchange under the symbol " FAN ", the American OTCQB Exchange under the symbol“ FANCF ” and on several German exchanges, including Frankfurt and Tradegate, under the symbol " P21 ".

Investors can get updates about First Atlantic by signing up to receive news via email and SMS text at . Stay connected and learn more by following us on these social media platforms:

FOR MORE INFORMATION:

First Atlantic Investor Relations

Robert Guzman

Tel: +1 844 592 6337

...

Disclosure

Adrian Smith, P.Geo., a director and the Chief Executive Officer of the Company is a qualified person as defined by NI 43-101. The qualified person is a member in good standing of the Professional Engineers and Geoscientists Newfoundland and Labrador (PEGNL) and is a registered professional geoscientist Mr. Smith has reviewed and approved the technical information disclosed herein.

Analytical Method & QA/QC

Samples were split in half on site, with one half remaining in the core box for future reference and the other half securely packaged for laboratory analysis. The QA/QC protocol included the insertion of blanks, duplicates, and certified reference material (standards), with one QA/QC sample being inserted every 20 samples to monitor the precision and accuracy of the laboratory results. All analytical results successfully passed QA/QC screening at the laboratory, and all Company inserted standards and blanks returned results within acceptable limits.

Samples were submitted to Activation Laboratories Ltd. (“Actlabs”) in Ancaster, Ontario, an ISO 17025 certified and accredited laboratory operating independently of First Atlantic. Each sample was crushed, with a 250 g sub-sample pulverized to 95% - 200 mesh. A magnetic separate was then generated by running the pulverized sub-sample through a magnetic separator which splits the sub-sample into magnetic and non-magnetic fractions. This involves running a 30 g split of the pulp through a Davis Tube magnetic separator as a slurry using a constant flow rate, a magnetic field strength of 3,500 Gauss, and a tube angle of 45 degrees to produce magnetic and non-magnetic fractions.

The magnetic fractions are collected, dried, weighed and the magnetic fraction is fused with a lithium metaborate/tetraborate flux and lithium bromide releasing agent and then analyzed on a wavelength dispersive XRF for multiple elements including nickel, cobalt, iron and chromium. The magnetically recovered nickel grade was then calculated by multiplying the XRF fusion nickel value by the weight of the magnetic fraction and dividing by the total recorded feed weight or magnetic mass pulled from the sample.

True widths are currently unknown. However, the nickel bearing ultramafic ophiolite and peridotite rocks being targeted and sampled in the Phase 1 drilling program at the Pipestone XL (formerly the Atlantic Nickel Project) are mapped on surface and in drilling as several hundred meters to over 1 kilometer wide and approximately 30 kilometers long.

About First Atlantic Nickel Corp.

First Atlantic Nickel Corp. (TSXV: FAN) (OTCQB: FANCF) (FSE: P21) is a Canadian mineral exploration company developing the 100%-owned Pipestone XL (formerly the Atlantic Nickel Project), a large-scale nickel project strategically located near existing infrastructure in Newfoundland, Canada. The Project's nickel occurs as awaruite, a natural nickel-iron-cobalt alloy containing approximately 75% nickel with no-sulfur and no-sulfides. Awaruite's properties allow for smelter-free magnetic separation and concentration, which could strengthen North America's critical minerals supply chain by reducing foreign dependence on nickel smelting. This aligns with new US Electric Vehicle US IRA requirements, which stipulate that beginning in 2025, an eligible clean vehicle may not contain any critical minerals processed by a FEOC (Foreign Entities Of Concern)7.

First Atlantic aims to be a key input of a secure and reliable North American critical minerals supply chain for the stainless steel and electric vehicle industries in the USA and Canada. The company is positioned to meet the growing demand for responsibly sourced nickel that complies with the critical mineral requirements for eligible clean vehicles under the US IRA. With its commitment to responsible practices and experienced team, First Atlantic is poised to contribute significantly to the nickel industry's future, supporting the transition to a cleaner energy landscape. This mission gained importance when the US added nickel to its critical minerals list in 2022, recognizing it as a non-fuel mineral essential to economic and national security with a supply chain vulnerable to disruption.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information.

Forward-looking information in this news release includes, but is not limited to: statements regarding: the timing, scope and results of the Company's Phase 1 and Phase 2X drilling programs; future project developments; the Company's objectives, goals, and future plans; statements and estimates of market conditions; the viability of magnetic separation as a low-impact processing method for awaruite; the strategic and economic implications of the Company's projects; and expectations regarding future developments and strategic plans; Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining and clean energy industries. Additional factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no mineral reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information, except as required by applicable securities laws.

1

2

3

4

5

6

7

Photos accompanying this announcement are available at

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment