Homeland To Acquire Historical Uranium Resources At Skull Creek

Highlights

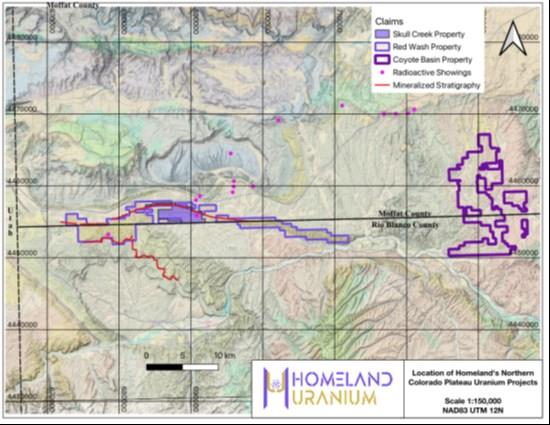

- Historical resource estimate reported for the property of 44.2 M lbs U3O8 at an average grade of 0.31% U3O8 (see cautionary note on historical estimates below). Uranium mineralization has been observed at surface and extends at depth to as much as 800 ft vertical, according to down hole gamma probing data currently in the Company's possession. The Property is 1,489 acres (3,6780 ha) in size and consists of 154 unpatented mining claims administered by the US Bureau of Land Management ("BLM") and one state of Colorado exploration lease. The Property has potential synergies with the adjacent Red Wash project and the Company's nearby Coyote Basin Project. The Company is renaming the mineralization the Cross Bones Deposit.

"We are thrilled to add a substantial historical uranium deposit to our portfolio, strategically located in close proximity to our existing assets in mining-friendly Colorado. This addition offers significant potential for operational synergies and further strengthens our position in the region. With this acquisition, our asset base will be anchored by a dominant land package with two considerable historical uranium deposits with outstanding expansion potential. We are eager to launch a major drill program aimed at systematically upgrading these historical resource estimates to modern standards, while continuing to demonstrate the scale and growth potential of our portfolio," stated Roger Lemaitre, President & CEO of Homeland.

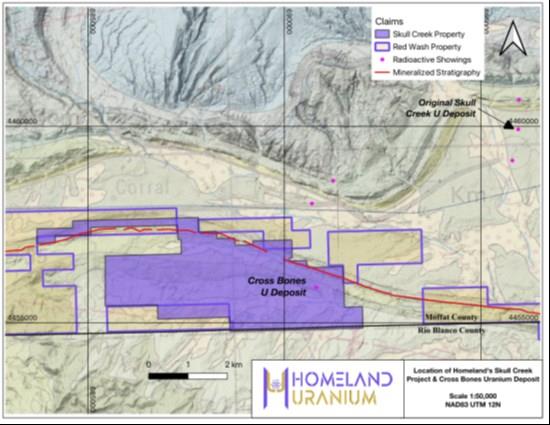

A historical resource estimate was reported for Skull Creek in Energy Metal Corp's September 30, 2006 quarterly financial statements filed with the SEC and was contained within the same table in which the historical resource estimate was reported for the Coyote Basin Project. The historical resource was called the Skull Creek Deposit and was reported to be 44.2 million pounds of U3O8 at an average grade of 0.31% U3O8 (see Energy Metal's SEC disclosure at ). The Company hereby is renaming the mineralization the Cross Bones Deposit, to avoid confusion with a nearby but off-property and older small uranium occurrence that was also named Skull Creek. Based upon the Company's review of historical claim maps, it is believed that the Cross Bones historical resource lies within the acquired Skull Creek mining claims or may possibly extend slightly onto some of the adjacent Red Wash claims that are currently owned by Homeland. However, neither the Company nor the Qualified Person can confirm the exact location of the boundaries of the Cross Bones historical estimate, the quality of the historical resource and how it compares to current CIM and NI 43-101 requirements (as defined below), nor can the Qualified Person provide any opinion on all data verification processes used by the historical operators to determine this historical resource estimate, as that data is not in the possession of the vendor or the Company nor is in the public record.

The Company is not treating this historical resource estimate as current mineral resources and the reader is cautioned not to rely on it. A Qualified Person (as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101")) has not done sufficient work to classify the historical resource estimate as current mineral resources or mineral reserves nor can the Company or the Qualified Person comment on the quality or verify the data obtained from the assay sampling program used to determine the historical resource estimate, as this information was not included in the historical reports acquired by Homeland. The Company is not treating the historical resource estimate as current mineral resources or mineral reserves and the Company and the Qualified Person are unable to compare the historical resources to the CIM's current resource classification system at this time. The Skull Creek Project and any future NI 43-101 mineral resource estimate will require considerable further evaluation.

Uranium mineralization was first found on the Property in the 1950s. Data acquired by the Company shows that two companies, Anschutz Uranium Corp. and Ashland Minerals drilled the first drill holes into the Cross Bones area in 1977 and 1978. The Property was also abandoned in the early 1980's following the historic collapse of the uranium and nuclear industries. The Property was staked in 2005 by Standard Uranium who was acquired by Energy Metals Corp. in 2006. Energy Metals expanded the claim holdings around the core part of the property and subsequently optioned the claims to Bluerock Resources Ltd. There are no records to indicate that Bluerock vested any interest in the Skull Creek Property. The mining claims comprising the Property were allowed to expire after Energy Metals was acquired by Uranium One in 2007. Hightest acquired the current Skull Creek Property by staking in December 2023 and February/March 2024.

The Company currently owns data from 53 historical Anschutz and Ashland holes drilled between 1977 and 1978 are all located in the Cross Bones area that include lithology and gamma probe information. However, the precise collar location of these holes is currently unknown. The data set indicates that anomalous radioactivity was intersected at depths as great as 800 ft from surface, although the vast majority of these historical holes only test the favorable stratigraphy above the 280 ft vertical depth from surface.

Private company reports and summaries from the Colorado Geological Survey (Nelson-Moore, et al, 1978) state that uranium mineralization is located within sandstones, carbonaceous siltstones and shales or thinly-bedded lignites within the Iles Sandstone (sometimes called the Sego Sandstone), a member sandwiched between the Cretaceous-aged Williams Fork and Mancos Shale Formations. The Williams Fork Formation immediately underlies the Paleocene-aged Fort Union Formation, host of the mineralized horizons at the Company's nearby Coyote Basin Project. The stratigraphy in the Skull Creek area dips to the south at 45-55 degrees and lies along the northern limb of the Red Wash Syncline.

All 154 claims comprising the Skull Creek Property are located on federal BLM lands. The single state exploration lease is administered by the State of Colorado (the "SEP Lands").

Pursuant to the Agreement, Homeland will pay Hightest US$300,000 cash and issue 750,000 common shares of Homeland to acquire a 100% interest in the Property. Hightest will retain a 2% NSR royalty on all mineral production from the Property with the exception of production from the SEP Lands where the royalty will be reduced to 1.5%. The royalty can be reduced to 1% should Homeland issue an additional payment of US$1.5 million at any time before delivering to Hightest a notice of the intention to commence commercial production from a mineral deposit located wholly or partially within the Property.

Hightest will also receive potential contingency payments based upon the size of any uranium resource defined on the Property consistent with NI 43-101 standards. Should a mineral resource equal to 10 million pounds U3O8 be defined, Homeland will pay to Hightest an additional U.S.$250,000 in cash and the equivalent of U.S.$250,000 in common shares of Homeland based on the 10-day VWAP immediately prior to the date that Homeland receives the technical report citing resources authored by an independent qualified person. Should the Mineral Resource be equal to or greater than 30 million pounds U3O8, Homeland will pay Hightest an aggregate of U.S.$500,000 in cash and the equivalent of U.S.$500,000 in common shares of Homeland (inclusive of any payments made and shares issued pursuant to previous sentence). If the Mineral Resource is between 10 million pounds and 30 million pounds U3O8 Homeland will pay to Hightest a cash payment and common shares payment determined on a pro rata basis ranging between the 10 million pounds U3O8 and 30 million pounds U3O8 thresholds as described above.

The transaction including all payments, royalties and contingency payments are subject to regulatory and TSX Venture Exchange approval. Common shares issued in connection with the transaction will be subject to a statutory hold period of four months plus one (1) day from the date of issuance.

About Homeland Uranium Corp.

Homeland Uranium is a mineral exploration company focused on becoming a premier US-focused and resource-bearing uranium explorer and developer. The Company is the 100% owner of the Coyote Basin and Red Wash uranium projects in northwestern Colorado.

The Coyote Basin Project is reported by Energy Metals Corporation in its Management Discussion and Analysis dated November 14, 2006 filed with the US Securities and Exchange Commission to contain an estimated historical resource of 8,850,000 tons grading 0.20% U3O8 and 0.10% V2O5 totalling 35.4 million pounds of U3O8 and 17.7 million pounds of V205. This resource was calculated by the previous project operator, Western Mining Resources, based on a 1978-79 program of surface sampling, coring, drill hole chip sampling and gamma logging of 24 widely spaced holes.

The Company is not treating this historical resource as current mineral resources and the reader is cautioned not to rely on it. The reader is cautioned that a qualified person (as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101")) has not done sufficient work to classify the historical resource as current mineral resources or mineral reserves nor can the Company or the QP comment on the quality or verify the data obtained from the assay sampling program used to determine the historical resource estimate, as this information was not included in the historical reports acquired by Homeland. The Company is not treating the historical resource as current mineral resources or mineral reserves and the Company and the Qualified Person is unable to compare the historical resources to the CIM's current resource classification system at this time. The Coyote Basin Project and any future NI 43-101 mineral resource estimate will require considerable further evaluation.

Qualified Person

Roger Lemaitre. P.Eng., P.Geo., the Company's President and CEO, is a Qualified Person as defined in NI 43-101, and has reviewed and approved the technical content of this news release.

For further information, please contact:

Roger Lemaitre

President & Chief Executive Officer

Homeland Uranium Corp.

Tel: 306-713-1401

Email: ...

Investor Relations

Kin Communications Inc.

Tel: 604-684-6730

Email: ...

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things: the completion of the transaction, confirmation of the historical resource estimates, the Company's expectations and strategic plans in relation to the exploration of the Company's uranium mineral properties, including all phases of the exploration program at the Coyote Basin and Red Wash uranium projects in Colorado, and receipt of applicable regulatory approvals to complete the transaction as contemplated.

These forward-looking statements reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include, among other things: the availability of funds; the ability to complete the transaction; receipt of applicable regulatory approvals conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; future demand for energy; the historical basis for current estimates of potential quantities and grades of target zones; the availability of skilled labour and no labour related disruptions at any of the Company's operations; no unplanned delays or interruptions in scheduled activities; all necessary permits, licenses and regulatory approvals for operations are received in a timely manner; the ability to secure and maintain title and ownership to properties and the surface rights necessary for operations; and the Company's ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

The Company cautions the reader that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the availability of funds; the ability to complete the transaction as contemplated; receipt of applicable regulatory approvals; the timing and content of work programs; results of exploration activities and development of mineral properties; receipt of applicable regulatory approvals the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data; general market and industry conditions; and those factors identified under the captions "Risks Factors" and "Risks and Uncertainties" in the Company's disclosure materials filed on SEDAR+ at .

Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Figure 1: Homeland Uranium's uranium holdings in the Northern Colorado Plateau

To view an enhanced version of this graphic, please visit:

Figure 2: The location of the Skull Creek Property and the Cross Bones Uranium Deposit.

To view an enhanced version of this graphic, please visit:

To view the source version of this press release, please visit

SOURCE: Homeland Uranium Corp.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Jpmorgan Product Head Joins GSR Trading MD To Build Institutional Staking Markets

- Kintsu Launches Shype On Hyperliquid

- R0AR Launches Buyback Vault: Bringing 1R0R To R0AR Chain Unlocks New Incentives

- Excellion Finance Scales Market-Neutral Defi Strategies With Fordefi's MPC Wallet

- Ethereum-Based Meme Project Pepeto ($PEPETO) Surges Past $6.5M In Presale

- Falcon Finance Unveils $FF Governance Token In Updated Whitepaper

Comments

No comment