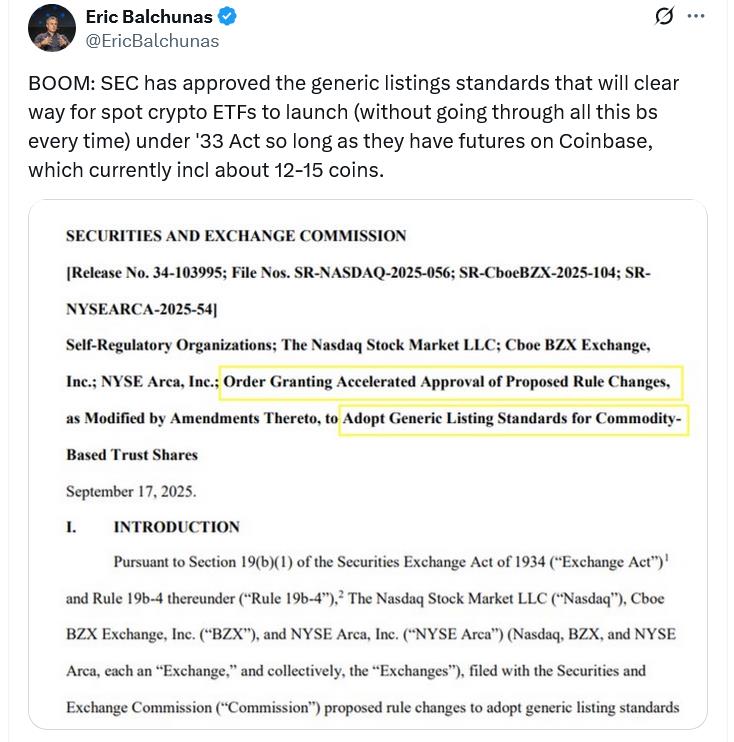

SEC Approves New Listing Standards For Commodity-Based Etfs

In a recent filing referencing major stock exchanges like Nasdaq , NYSE Arca, and Cboe BZX, the SEC outlined its move to adopt standardized listing rules under Rule 6c-11. This adjustment aims to reduce approval times that previously stretched over several months, facilitating quicker market entry for innovative digital assets and ETFs tied to cryptocurrencies .

SEC Chair Paul Atkins emphasized the importance of maintaining America's competitive edge in digital asset innovation. He stated,“By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets.”

This regulatory update comes at a pivotal time, as several spot ETF applications for cryptocurrencies like Solana (SOL ), XRP , Litecoin (LTC), and Dogecoin (DOGE ) await official approval. The SEC also faces upcoming decision deadlines for proposals related to Avalanche (AVAX ), Chainlink (LINK), Polkadot (DOT), and Binance Coin (BNB ).

Industry experts regard this move as bullish for the crypto markets. Bloomberg ETF analyst James Seyffart remarked,“This is the crypto ETP framework we've been waiting for,” anticipating a wave of new investment products launching in the United States shortly.

Source: Eric Balchunas

Clarifying Standards for Crypto ETF Listings

The SEC has outlined clear criteria for listing spot crypto ETFs. To qualify, a fund must hold a commodity that trades on a market within the Intermarket Surveillance Group offering surveillance-sharing agreements, or it must underlie a futures contract listed on a designated contract market for at least six months with comparable surveillance arrangements. Alternatively, a crypto asset may qualify if it is tracked by an ETF with at least 40% exposure listed on a national securities exchange.

When seeking to list and trade crypto ETFs that fall outside these standards, exchanges are required to submit specific rule filings to the SEC, ensuring transparency and oversight.

Concerns Over Investor ProtectionsWhile the move is seen as a positive step for digital assets, SEC Commissioner Caroline Crenshaw raised concerns about potential risks. She warned that the new standards might lead to a flood of unvetted products entering the market, potentially compromising investor protection and market stability.

As the crypto market continues to evolve, regulatory clarity remains vital for fostering sustainable growth and safeguarding investor interests in the burgeoning blockchain space.

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- 1Inch Becomes First Swap Provider Relaunched On OKX Wallet

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Leverage Shares Launches First 3X Single-Stock Etps On HOOD, HIMS, UNH And Others

- GCL Subsidiary, 2Game Digital, Partners With Kucoin Pay To Accept Secure Crypto Payments In Real Time

- Kintsu Launches Shype On Hyperliquid

- PLPC-DBTM: Non-Cellular Oncology Immunotherapy With STIPNAM Traceability, Entering A Global Acquisition Window.

Comments

No comment