The Week In Charts: GST Overhaul, Monsoon Mayhem, E-Waste Recycle

Tax cheer

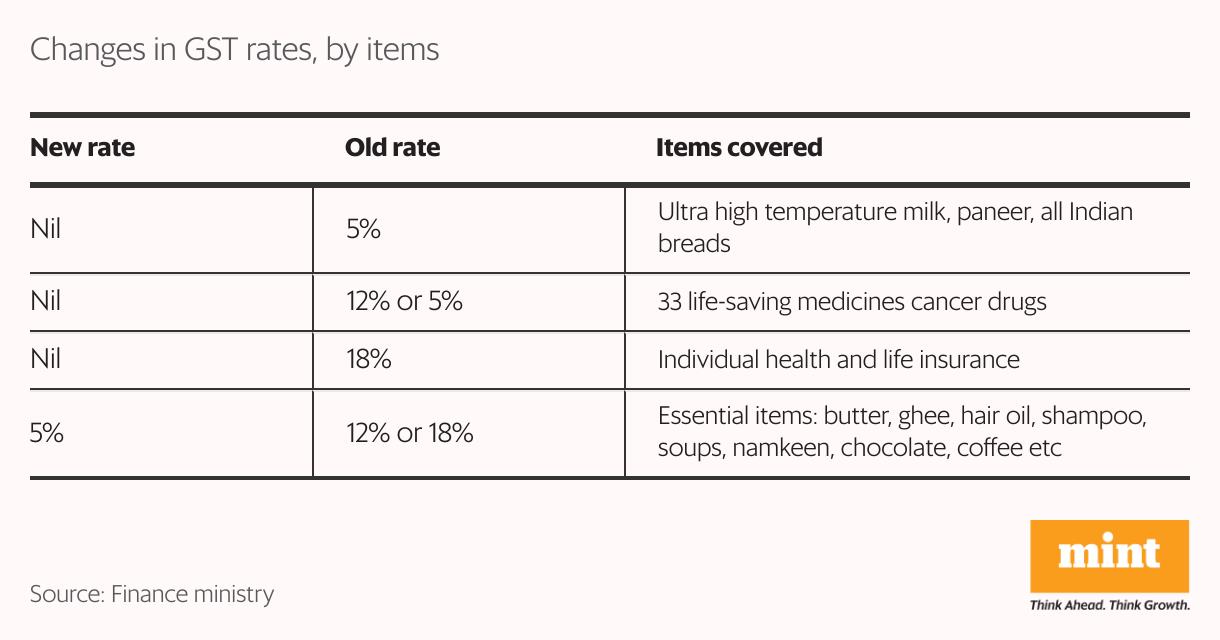

The Goods and Services Tax (GST) Council announced significant tax cuts on Wednesday, covering essential and aspirational goods from packaged foods to consumer electronics. The reform streamlines India's indirect tax structure from four to two tax slabs. This consumer-friendly move, effective 22 September, aims to provide relief during the festive season. Additionally, a few items, such as tobacco and related products and luxury vehicles, will be taxed in the extreme 40% bracket. However, implementation faces challenges as several states have raised concerns about fiscal implications, demanding compensation from the central government.

Also Read | GST overhaul: More than meets the consumer's ey

Rain rampage

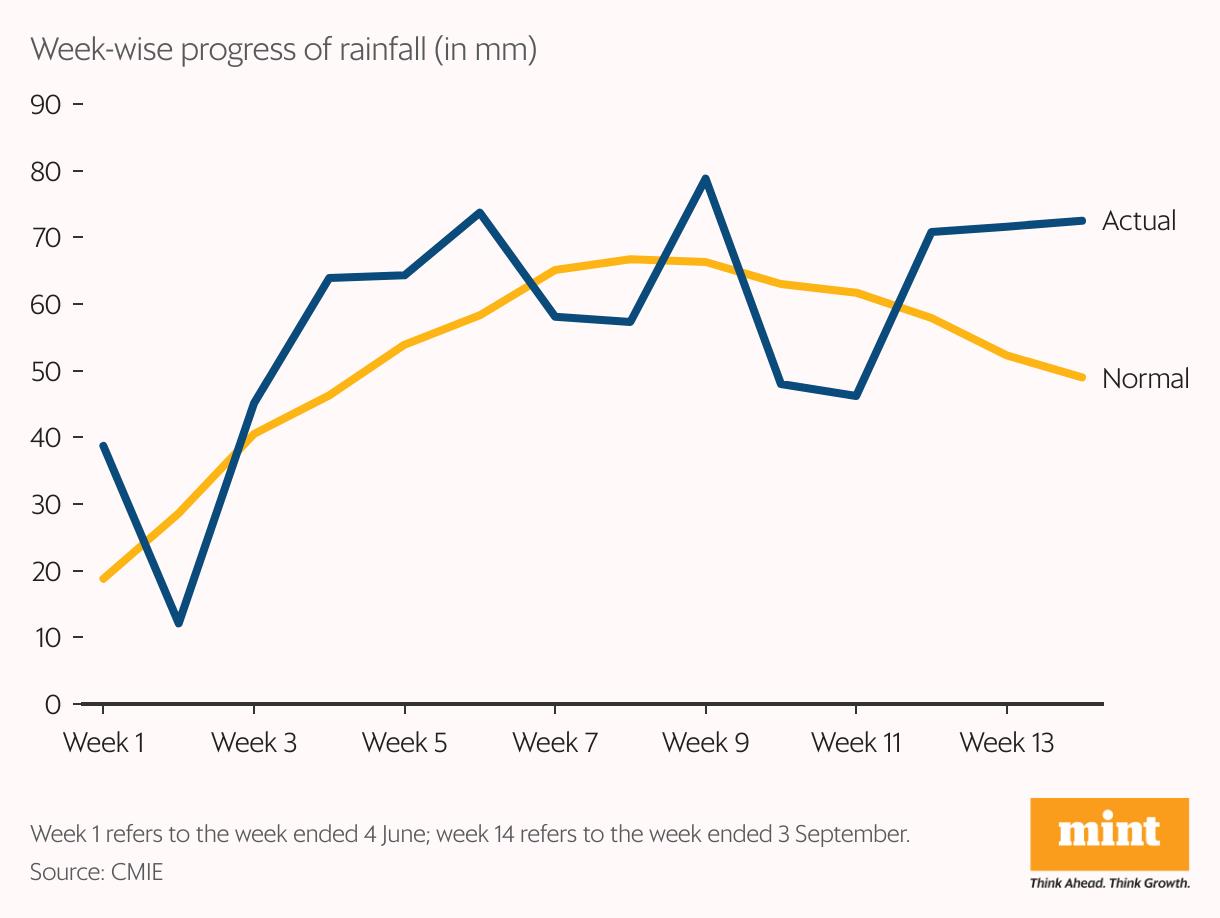

After a turbulent August marked by cloudbursts and landslides in many areas, India is bracing for an unusually wet finale to the southwest monsoon season. From 1 June to 3 September, the country received 781 mm of rainfall, 8.3% above normal. After an early onset, rainfall slowed in early weeks but picked up pace from mid-June and has largely surpassed normal levels in most weeks since then, data from the India Meteorological Department (IMD) shows. The IMD now forecasts September rainfall to be above normal, likely exceeding 109% of the monthly long-period average of 167.9 mm, signalling an extended and vigorous monsoon.

Mineral mission

₹1,500 crore: This is the value of a new Union Cabinet-approved scheme to boost recycling of battery waste and e-waste to extract critical minerals such as lithium, cobalt and nickel, vital for electronics, electric vehicles and renewable energy. The six-year plan offers a 20% capital subsidy on plant and machinery and staggered operational subsidies, with one-third of the outlay reserved for startups. Officials expect it to attract ₹8,000 crore investment, create about 70,000 jobs and add 270 kilotonnes of annual recycling capacity, building a more resilient, self-reliant domestic supply chain for these minerals.

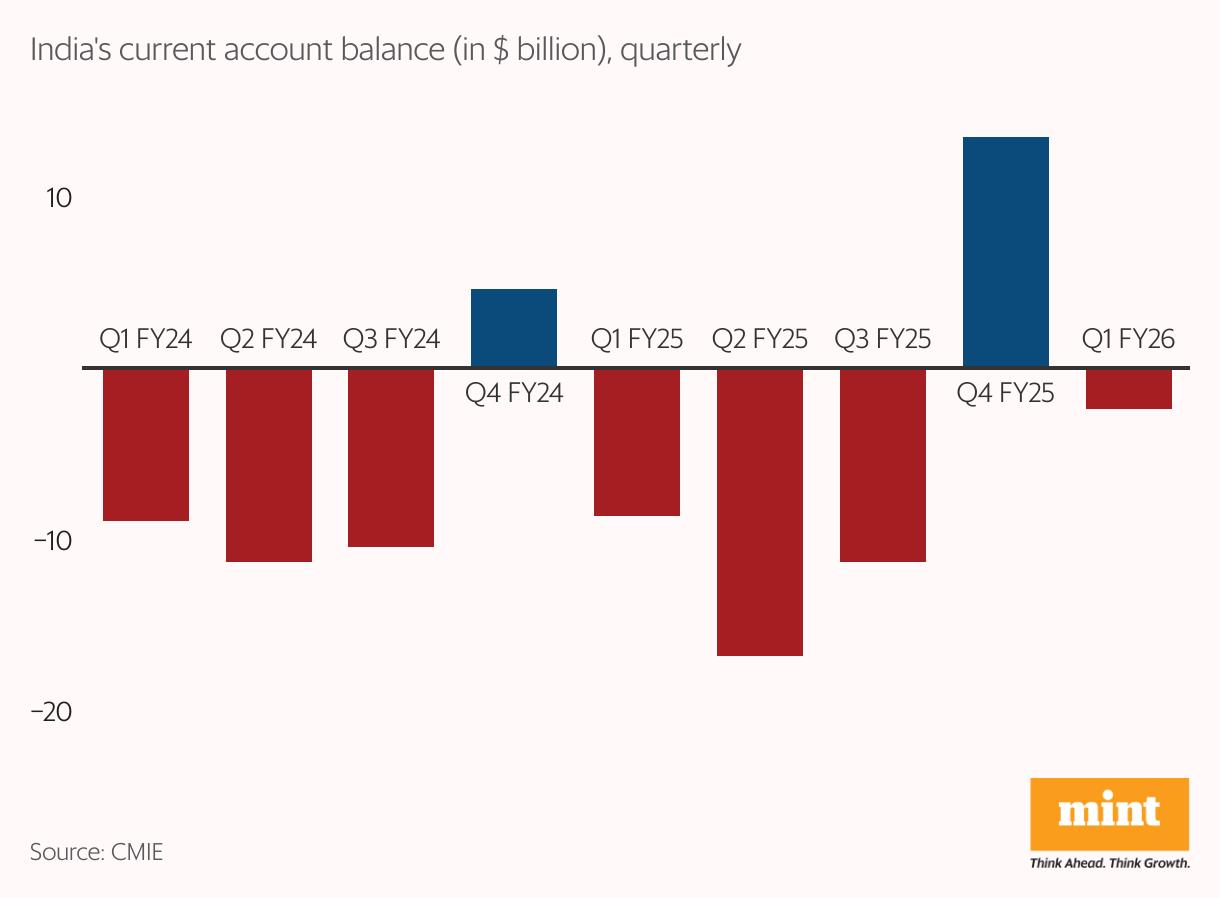

Deficit narrowsIndia's current account deficit (CAD) in the first quarter (Q1) of 2025-26 narrowed sharply to $2.4 billion from $8.6 billion a year ago, Reserve Bank of India data showed. The previous quarter had recorded a $13.5-billion surplus due to a jump in remittances and net services receipts. However, the surplus could not be sustained in Q1 as a wider goods trade deficit and relatively lower net services receipts offset gains, a Mint report said. The lower deficit was aided by a 21% rise in services receipts, an 18% increase in remittances, and front-loaded US exports.

Also Read | India's current account deficit narrows in Q1. Is it sustainable

Traffic tumble

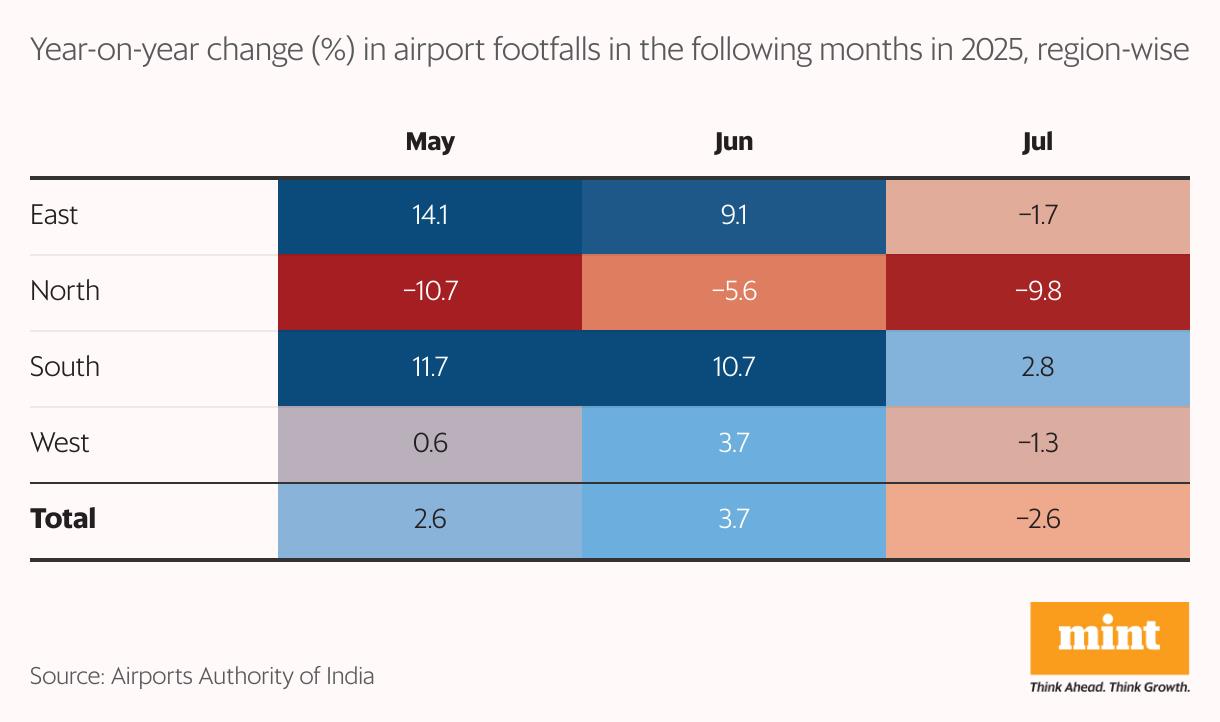

India's aviation sector saw a broad-based slowdown in air passenger traffic in July, following disruptions from the India-Pakistan conflict, the Air India crash, and heavy monsoon rains. Airport footfall data from the Airports Authority of India (AAI) showed the northern region was the worst hit, with declines of 10.7% in May, 5.6% in June, and 9.8% in July, marking contraction for three consecutive months, a Mint analysis showed. By July, all regions except the south recorded year-on-year declines. Capacity cuts, route suspensions, and seasonal monsoon impacts further dampened travel demand across the country.

Farm funds

₹1.15 trillion: That's the total investment attracted by the government's Agriculture Infrastructure Fund since July 2020, Mint reported . The fund, which aims to reduce post-harvest losses and boost farmer incomes, has financed over 123,650 projects across India so far. It provides financial assistance, including an interest subvention of 3% per annum for up to seven years, to support projects like custom hiring centres, warehouses, and processing units. The scheme has so far sanctioned loans worth ₹71,720 crore and disbursed around ₹49,500 crore.

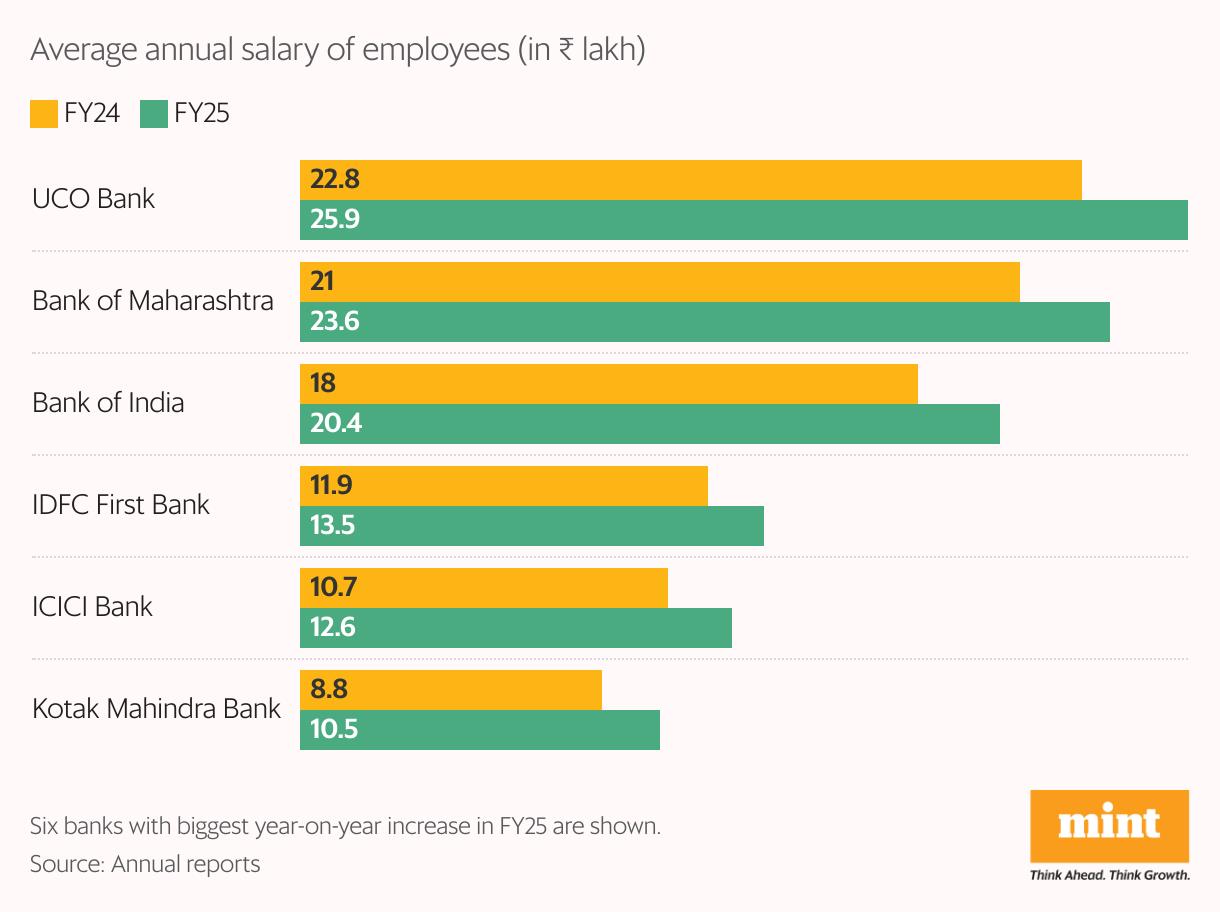

Bank bucksSalaries at India's private and public sector banks rose sharply in 2024-25. UCO Bank led public banks with an average salary of ₹25.9 lakh, followed by Bank of Maharashtra at ₹23.6 lakh and Bank of India at ₹20.4 lakh, data compiled by Mint showed. Among private banks, the average salary at IDFC First Bank reached ₹13.5 lakh, ICICI Bank ₹12.6 lakh, and Kotak Mahindra Bank ₹10.5 lakh. The data reflects robust year-on-year growth, with PSBs benefiting from structured pay scales and private banks offering competitive performance-linked increments.

Also Read | Beyond salaries: Why Indian companies are doubling down on Esop

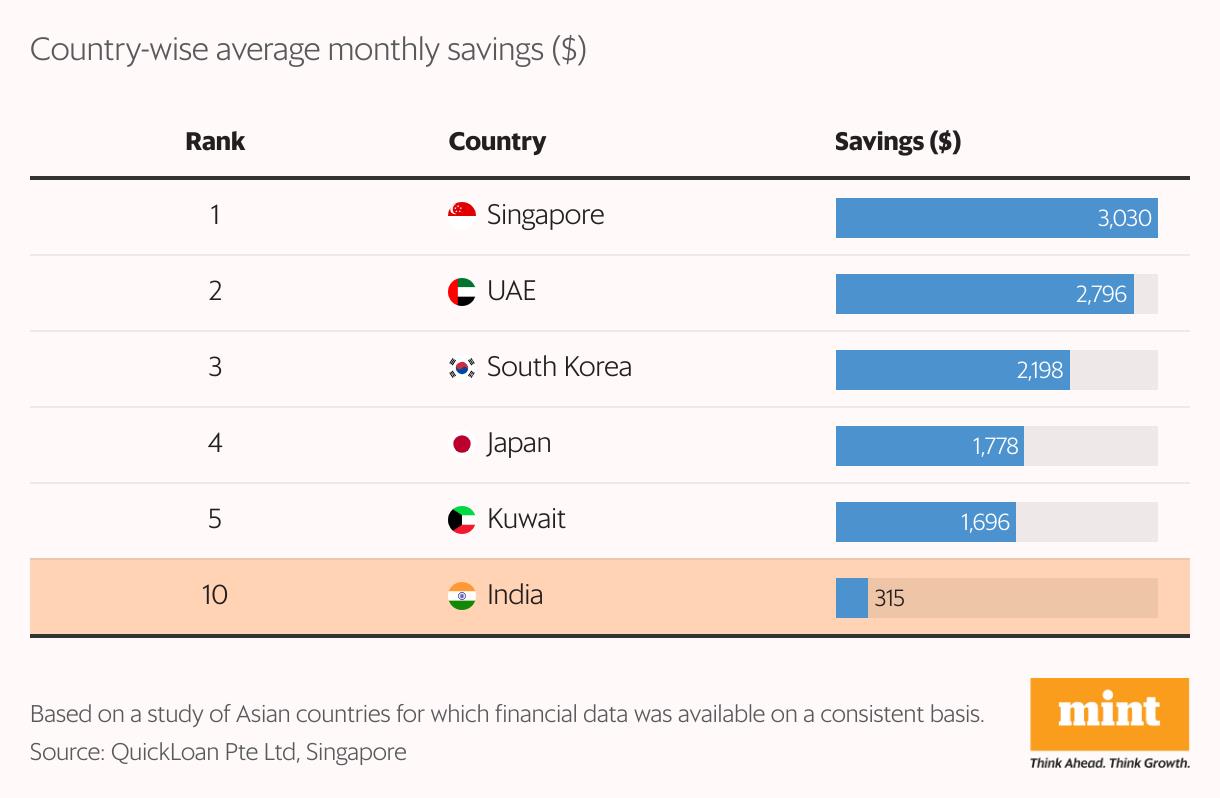

Chart of the week: Savings strain

Indians lag far behind global peers in monthly savings, with an average of just $315, placing the country 10th in the ranking in Asia. In comparison, Singapore leads at $3,030, followed by the UAE ($2,796) and South Korea ($2,198), highlighting a stark gap in household financial security and the limited ability of Indian households to save.

Follow our data stories on the“In Charts " and“Plain Facts " pages on the Mint website.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Latin America Mobile Payment Market To Hit USD 1,688.0 Billion By 2033

- BTCC Announces Participation In Token2049 Singapore 2025, Showcasing NBA Collaboration With Jaren Jackson Jr.

- PLPC-DBTM: Non-Cellular Oncology Immunotherapy With STIPNAM Traceability, Entering A Global Acquisition Window.

- Bitget Launches PTBUSDT For Futures Trading And Bot Integration

- Ecosync & Carboncore Launch Full Stages Refi Infrastructure Linking Carbon Credits With Web3

- Bitmex And Tradingview Announce Trading Campaign, Offering 100,000 USDT In Rewards And More

Comments

No comment