403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Unitedhealth Signal 04/09: Is A Breakout Brewing? (Chart)

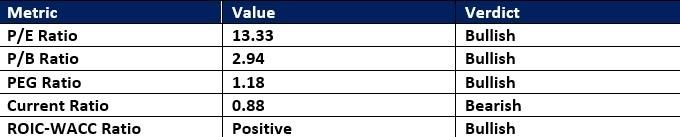

(MENAFN- Daily Forex) Long Trade IdeaEnter your long position between 303.70 (yesterday's intra-day low) and 312.89 (the intra-day high of the last candlestick that pierced the horizontal resistance zone).Market Index Analysis

- UnitedHealth Group (UNH) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500. All three indices try to hold on near record highs, but downside risks continue to rise. The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

- The UNH D1 chart shows a price action inside its horizontal resistance zone with breakout momentum rising. It also shows price action completing a breakout sequence above its Fibonacci Retracement Fan. The Bull Bear Power Indicator has been bullish for sixteen trading sessions with an ascending trendline. The average bullish trading volumes are higher than the average bearish trading volumes. UNH pushed higher as the S&P 500 struggled, a significant bullish trading signal.

- UNH Entry Level: Between $303.70 and $312.89 UNH Take Profit: Between $393.11 and $413.26 UNH Stop Loss: Between $273.85 and $278.22 Risk/Reward Ratio: 3.00

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Moonbirds And Azuki IP Coming To Verse8 As AI-Native Game Platform Integrates With Story

- B2BROKER Taps Finery Markets To Power Institutional Crypto OTC On B2TRADER

- Forex Expo Dubai 2025 Returns October 67 With Exclusive Prize Draw Including Jetour X70 FL

- “Farewell To Westphalia” Explores Blockchain As A Model For Post-Nation-State Governance

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

- Falcon Finance Sets Community Sale Record On Buidlpad With $113M $FF Token Commitment

Comments

No comment