403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

The Best Undervalued Stocks To Buy Now

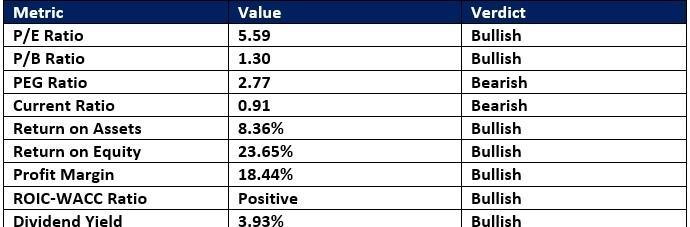

(MENAFN- Daily Forex) What are Undervalued Stocks?Undervalued stocks are publicly listed companies that trade at a discount on their fair intrinsic value. Many investors use the price-to-earnings (P/E) ratio to find undervalued stocks. Investors must understand why a stock traded below its value, but many undervalued stocks have well-established track records are Stocks Undervalued?Several factors can make a stock undervalued. Sometimes, overall market sentiment drags companies lower, or a sector-related issue can create an undervalued stock. Companies may report a disappointing earnings release and weak outlook, which can cause a sell-off Consider Investing in Undervalued Stocks?Investing in undervalued stocks is like buying something on sale. For example, if an item that retails at $50 is available at $30, it would make sense to buy more and take advantage of the discount. Therefore, investing in undervalued stocks can deliver outsized returns, but investors should understand the reason behind the discount.Here are a few things to consider when evaluating undervalued stocks:

- Look for undervalued stocks that have an established track record of profitability. Avoid undervalued companies with high debt levels. Invest in undervalued stocks that pay sustainable dividends. Understand the reason behind the discounted share price. Be careful with undervalued stocks that undergo structural changes.

- Toyota (TM) Comcast (CMCSA) Eastman Chemical Company (EMN) APA Corporation (APA) Centene Corporation (CNC) Devon Energy (DVN) Verizon Communications (VZ) Qualcomm (QCOM) Delta Air Lines (DAL) Nexstar Media Group (NXST)

- The CMCSA D1 chart shows price action breaking out above its ascending 61.8% Fibonacci Retracement Fan. It also shows Comcast inside of a bullish price channel. The Bull Bear Power Indicator is bullish with an ascending trendline.

- The EMN D1 chart shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan following a double breakout. It also shows Eastman Chemical Company inside a narrow bullish price channel. The Bull Bear Power Indicator turned bullish and has been improving for over three weeks.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment