Vietnam Textile Recycling Market Size, Share, Demand And Forecast 2025-2033

Key Highlights

-

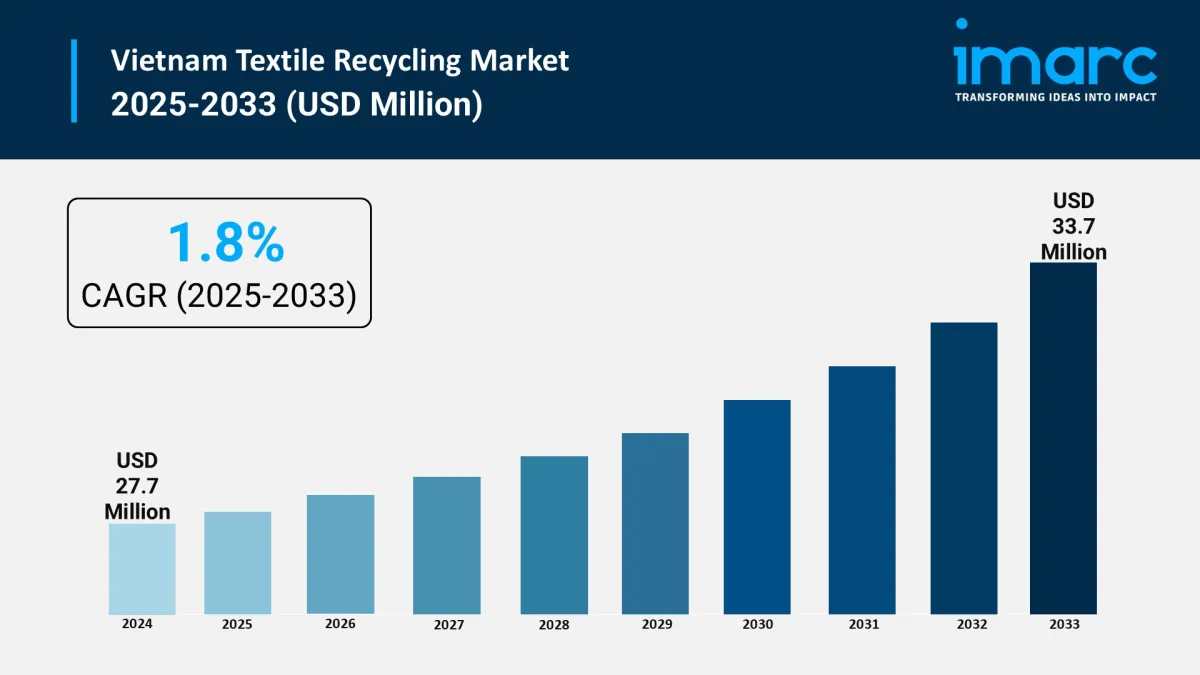

Market size (2024): USD 27.7 million .

Forecast (2033): USD 33.7 million .

CAGR (2025–2033): 1.8% .

Policy tailwinds: Vietnam's EPR framework is progressing, pushing producers/importers toward recycling obligations or contributions to the VEP Fund.

Waste stream reality: Pre-consumer textile waste is sizeable (~ 276,000 tonnes est.), with 60% currently recycled and the balance routed to co-processing/WtE-highlighting headroom for true textile-to-textile loops.

Request Sample For PDF Report: https://www.imarcgroup.com/vietnam-textile-recycling-market/requestsample

Market Trends

-

Brands sourcing from Vietnam are raising recycled-content targets, improving traceability, and piloting take-back schemes. This cascades pressure-and opportunity-through local supply chains.

The evolving Extended Producer Responsibility regime is steering producers toward measurable recycling outcomes or compliance fees-gradually improving feedstock availability and formalizing collection/sorting.

Vietnam's deep apparel/textile base and maturing tech landscape make it attractive for advanced recyclers; GIZ notes the country's fit for scaling both mechanical and chemical recycling (polyester and blends).

EU moves on circular textiles and harmonized EPR frameworks raise the bar for exporters-favoring mills that can validate recycled inputs and circular processes.

Facilities like SAITEX are setting benchmarks (water recycling, on-site circularity, bluesign® partnerships), nudging peers and buyers toward higher standards.

Market Segmentation

Product Type Insights:

-

Cotton Recycling

Wool Recycling

Polyester and Polyester Fiber Recycling

Nylon and Nylon Fiber Recycling

Others

Textile Waste Insights:

-

Pre-consumer Textile

Post-consumer Textile

Distribution Channel Insights:

-

Online Channel

Retail and Departmental Store

End User Insights:

-

Apparel

Industrial

Home Furnishings

Non-woven

Others

Regional Insights:

-

Northern Vietnam

Central Vietnam

Southern Vietnam

Latest News & Developments

-

Policy & ecosystem building (2024–2025): GIZ's ecosystem mapping highlights Vietnam's sizable pre-consumer waste pool, growing recycler base, and initiatives (“Waste No More,”“To the Finish Line”) engaging 900+ manufacturers in 2024 to accelerate waste tracking, segregation, and textile-to-textile pilots.

Advanced recycler interest: RecoverTM planned a Vietnam production hub (feedstock: pre- and post-consumer cotton/polycotton), signaling confidence in local supply and infrastructure.

Industry leadership: SAITEX continues to expand its sustainability leadership-recycling up to 98% of water, scaling renewable energy usage, and deepening standards alignment.

National narrative: Vietnam's industry press underscores circular economy as a strategic lever to move up the value chain (2025 coverage), with targets to boost tech intensity and reduce low-skill dependence.

Ask Analyst Report: https://www.imarcgroup.com/request?type=report&id=16930&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment