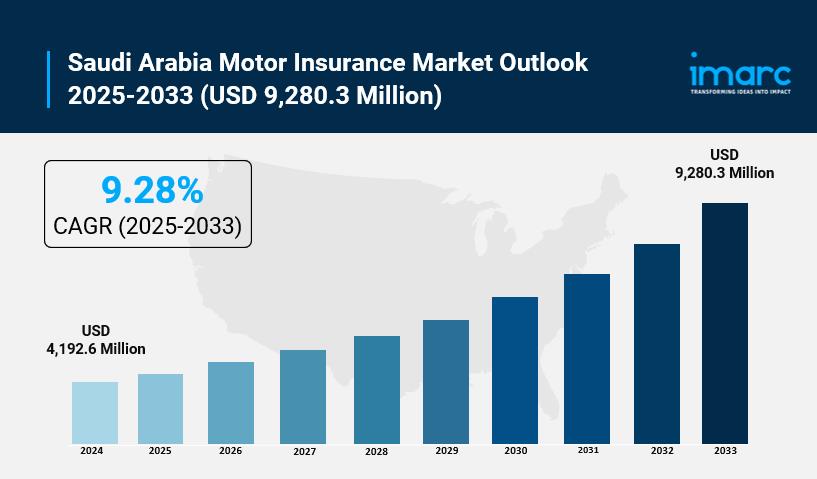

Saudi Arabia Motor Insurance Market Size To Reach USD 9,280.3 Million By 2033: Trends & Outlook

Key Highlights

-

Market size (2024): USD 4,192.6 Million

Forecast (2033): USD 9,280.3 Million

CAGR (2025–2033): 9.28%

Growing demand for comprehensive coverage, telematics-based policies, and digital insurance platforms

Vision 2030 economic diversification and infrastructure development driving vehicle ownership and insurance demand

Key companies operating in the Saudi Arabia motor insurance market include Tawuniya, Bupa Arabia, Allianz Saudi Fransi, Rasan Information Technology Co. (Tameeni), SABB Takaful, Walaa Insurance, ACE Arabia, and other local and international insurance providers

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-motor-insurance-market/requestsample

How Is AI Transforming the Motor Insurance Market in Saudi Arabia?

-

AI-powered telematics and IoT devices now monitor driving behavior in real-time, enabling personalized premium pricing based on individual risk profiles and reducing traditional insurance costs by up to 40%

Smart claims processing systems use AI algorithms to automate damage assessment and fraud detection, reducing claim settlement time by over 60% and minimizing human error in risk evaluation

Automated digital platforms like Tameeni and BCare leverage AI for instant policy comparison and purchase, streamlining the customer acquisition process and improving accessibility across all regions

AI-driven risk assessment models analyze vast amounts of driving data, traffic patterns, and accident statistics to provide more accurate pricing and coverage recommendations for Saudi drivers

Leading insurers are implementing AI-based customer service chatbots and virtual assistants in Arabic and English, providing 24/7 support and improving customer experience across digital channels

Usage-based insurance (UBI) powered by AI and telematics is gaining significant traction, allowing drivers to pay premiums based on their actual driving patterns rather than demographic factors

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-motor-insurance-market/requestsample

Saudi Arabia Motor Insurance Market Trends and Drivers

-

Mandatory insurance enforcement by the Saudi General Traffic Department, with electronic monitoring systems checking vehicle insurance validity every 15 days across all regions

Rapid urbanization in major cities like Riyadh, Jeddah, and Dammam leading to increased traffic congestion, higher accident risks, and greater demand for comprehensive coverage

Vision 2030 economic diversification initiatives attracting expatriates, boosting domestic tourism, and increasing infrastructure investments, resulting in higher vehicle ownership rates

Rising disposable incomes and growing middle class driving demand for comprehensive motor insurance policies beyond basic third-party liability coverage

Government emphasis on road safety improvements and accident cost reduction leading to stricter compliance requirements and enhanced consumer protection regulations

Digital transformation initiatives enabling online policy purchases, mobile claims reporting, and telematics-based personalized insurance products

Strategic geographic position and economic growth attracting international businesses and expatriate workers, increasing commercial vehicle insurance demand

Ask analyst for customized report: https://www.imarcgroup.com/request?type=report&id=13988&flag=E

Saudi Arabia Motor Insurance Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Insurance Type:

-

Third Party Liability

Comprehensive

Analysis by Distribution Channel:

-

Agents

Brokers

Banks

Online

Others

Regional Analysis:

-

Northern and Central Region

Western Region

Eastern Region

Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Motor Insurance Market

-

August 2025: Najm for Insurance Services Company announced an expanded partnership with Cambridge Mobile Telematics (CMT) and AiGeNiX to launch advanced AI-driven telematics solutions across all major Saudi cities. The new DriveWell Fusion® platform integration will provide real-time driving behavior analysis and personalized safety coaching, targeting the Kingdom's Vision 2030 road safety objectives with projected 30% reduction in accident rates.

July 2025: Saudi Arabian Monetary Authority (SAMA) introduced new regulatory frameworks for insurtech companies, enabling faster licensing procedures for AI-powered insurance platforms. The reforms are designed to accelerate digital transformation in the motor insurance sector, with new regulations specifically supporting telematics-based pricing models and usage-based insurance products for the growing Saudi market.

June 2025: Tawuniya, the Kingdom's leading insurance provider, launched its comprehensive AI-powered motor insurance platform featuring instant policy issuance, automated claims processing, and real-time risk assessment capabilities. The platform integrates with government traffic databases and provides seamless digital experience for Saudi drivers, supporting both Arabic and English languages while ensuring compliance with local regulations and Islamic principles.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Motif AI Enters Phase Two Of Its Growth Cycle

- Chaingpt Pad Unveils Buzz System: Turning Social Hype Into Token Allocation

- NOVA Collective Invest Showcases Intelligent Trading System7.0 Iterations Led By Brady Rodriguez

- With Seal, Walrus Becomes The First Decentralized Data Platform With Access Controls

- B2PRIME Secures DFSA Licence To Operate From The DIFC, Setting A New Institutional Benchmark For MENA & Gulf Region

- Bitmex Launches Alpha Showdown Trading Competition Featuring 3 BTC Prize Pool And Additional Rewards

Comments

No comment