Vingroup's Debt-Driven Empire On Shaky Global Ground

The company, owned by Vietnam's wealthiest man, Pham Nhat Vuong, is burdened with liabilities totaling US$31 billion. This figure requires $3.2 million in daily interest payments on its international credit loans.

This financial strain suggests that the glittering image polished by domestic media may be concealing a bleak and uncertain future, as Vingroup's own Q2/2025 financial report and business results sketch a portrait of a high-profile conglomerate whose foundation appears to be riddled with risk.

Heavy debt loadVingroup's debt surged by approximately $4.7 billion in the first six months of the year, bringing its total liabilities to a staggering $31 billion by the end of Q2/2025. This figure represents 86% of the company's total assets.

The immediate pressure comes from short-term liabilities, which comprise over $19.5 billion (63%) of the total debt and are approaching maturity. The cost of servicing this debt is substantial, with interest payments exceeding $295 million in the second quarter alone-equivalent to $3.2 million per day across Vingroup's ecosystem.

The company faces significant deadlines next year, including $860 million in credit loans and $1.14 billion in bond interest coming due.

To manage these obligations with just over $3 billion in cash on hand, Vingroup has been actively raising capital. The company recently generated $1.6 billion by selling 41.5% of its shares in Vincom Retail.

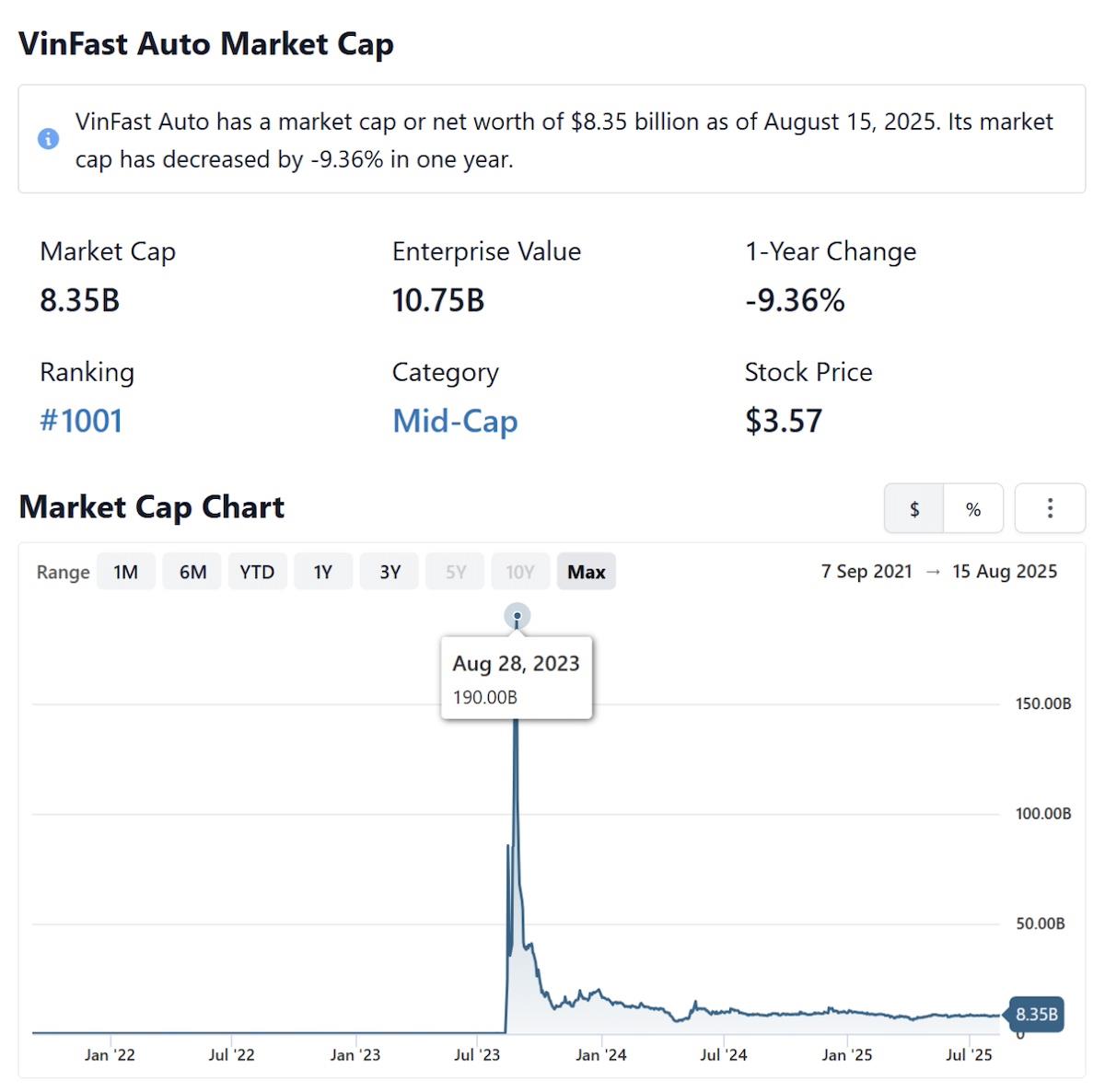

Vingroup chairman Vuong also secured over $1 billion in new credit from international lenders like Deutsche Bank AG and the Asian Development Bank, with $510 million of that amount designated for the subsidiary VinFast.

VinGroup chairman Pham Nhat Vuong. Photo: VIC Irregular figures

Despite immense daily interest payments, Vingroup's recent business reports project an image of resilience, enabling the conglomerate to secure new loans for ambitious projects. The foundation for this confidence, however, appears to be highly irregular figures in its financial statements.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Mutuum Finance (MUTM) New Crypto Coin Eyes Next Price Increase As Phase 6 Reaches 50% Sold

- Bydfi Highlights 'BUIDL' Ethos During Newcastle United Match Against Arsenal

- Flexm Recognized As“Highly Commended” In The Regtech Category At The Asia Fintech Awards Singapore 2025

- Solotto Launches As Solana's First-Ever Community-Powered On-Chain Lottery

- Moonx: The Leading Crypto Trading Platform With X1000 Leverage And Unlimited Meme Coin Access

- Stonehaven Circle Marks 13Th Anniversary With Hadrian Colwyn Leading Calvio Ailegacyx Innovation

Comments

No comment