Trade Finance Market 2025 Edition: Industry Size, Share, Growth And Competitor Analysis

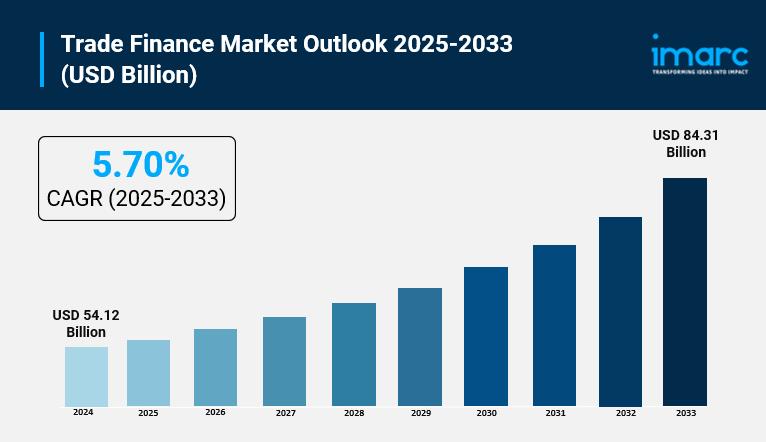

The global trade finance market size was valued at USD 54.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 84.31 Billion by 2033, exhibiting a CAGR of 5.70% during 2025-2033. North America currently dominates the market. The market is undergoing steady growth due to the growing volume of international trade, integration of artificial intelligence (AI) and data analytics to enhance risk assessment and increasing complexity in the supply chain.

Key Stats for the Global Trade Finance Market:-

Market Size (2024): USD 54.12 Billion

Market Forecast (2033): USD 84.31 Billion

CAGR (2025–2033): 5.70%

Dominant Region: North America

High-Growth Regions: Europe, Asia-Pacific, Latin America, Middle East & Africa

Key Players: HSBC Holdings plc, JPMorgan Chase & Co., Standard Chartered PLC, Citigroup Inc., BNP Paribas, Deutsche Bank AG, Bank of America Corporation, Wells Fargo & Company, ING Groep N.V., and Barclays PLC.

Request to Get the Sample Report: https://www.imarcgroup.com/trade-finance-market/requestsample

Why Is the Global Trade Finance Market Growing?-

Surge in Global Trade & E-Commerce

The rapid expansion of international trade and e-commerce is a primary catalyst for the growth of the trade finance market. As businesses increasingly engage in cross-border transactions, the demand for secure and efficient financial instruments to facilitate these deals has escalated. Trade finance solutions like letters of credit, trade credit insurance, and export factoring play a crucial role in mitigating risks and ensuring smooth transactions.

-

Digital Transformation in Trade Finance

The integration of advanced technologies such as blockchain, artificial intelligence (AI), and machine learning is revolutionizing the trade finance sector. These innovations enhance the efficiency, transparency, and security of trade transactions. For instance, blockchain facilitates real-time tracking of goods and automated contract execution, while AI and machine learning improve risk assessment and fraud detection.

-

Support for Small and Medium-Sized Enterprises (SMEs)

SMEs are increasingly participating in global trade, driving the demand for accessible and affordable trade finance solutions. Financial institutions are developing tailored products to meet the unique needs of these businesses, such as supply chain financing and invoice factoring, thereby fostering their growth in international markets.

-

Risk Mitigation in Uncertain Times

In the face of geopolitical tensions, economic uncertainties, and supply chain disruptions, businesses are seeking reliable mechanisms to protect against risks associated with international trade. Trade finance instruments offer assurances and guarantees that help companies navigate these challenges, ensuring the continuity of their global operations.

-

Strategic Initiatives by Financial Institutions

Major financial institutions are launching programs to bridge the trade finance gap, particularly in emerging markets. For example, HSBC and the World Bank's International Finance Corporation (IFC) have initiated a $1 billion trade finance program aimed at supporting trade transactions in 20 countries across Africa, Asia, Latin America, and the Middle East. Such initiatives are instrumental in enhancing liquidity and fostering economic growth in these regions.

AI Impact on the Trade Finance MarketArtificial intelligence (AI) is transforming the trade finance sector by enhancing efficiency, reducing risk, and improving decision-making across global transactions. Traditional trade finance processes often involve manual document verification, complex compliance checks, and time-consuming risk assessments, which can delay transactions and increase operational costs. AI-driven solutions are streamlining these operations by automating workflows, analyzing large volumes of data, and detecting anomalies in real time.

AI-powered tools enable financial institutions to perform faster and more accurate credit risk assessments for importers, exporters, and supply chain participants. Machine learning algorithms analyze historical transaction data, market trends, and counterparty behavior to predict potential defaults or fraudulent activities. This not only improves security but also reduces the time and resources required for due diligence.

In addition, AI enhances document processing in trade finance. Natural language processing (NLP) and optical character recognition (OCR) technologies allow automated extraction, validation, and classification of invoices, letters of credit, bills of lading, and other trade documents. This reduces human errors, accelerates transaction settlements, and enables paperless operations.

Trade Finance Market Segmental Analysis:The trade finance market is segmented based on on finance type, offering, service provider, and end-user. Each segment plays a vital role in shaping the market's growth dynamics.

Breakup by Finance Type:

-

Structured Trade Finance

Supply Chain Finance

Traditional Trade Finance

The report provides a comprehensive segmentation and analysis of the market based on finance type, which includes structured trade finance, supply chain finance, and traditional trade finance.

Breakup by Offering:

-

Letters of Credit

Bill of Lading

Export Factoring

Insurance

Others

The report further offers a comprehensive segmentation and analysis of the market based on offering, covering letters of credit, bill of lading, export factoring, insurance, and others.

Breakup by Service Provider:

-

Banks

Trade Finance Houses

The report provides an in-depth segmentation and analysis of the market based on service providers, which include banks and trade finance houses. As per the report, banks accounted for the largest share of the market.

Breakup by End-User:

-

Small and Medium Sized Enterprises (SMEs)

Large Enterprises

The report provides an in-depth segmentation and analysis of the market based on end users, classifying them into small and medium-sized enterprises (SMEs) and large enterprises.

Analysis of Trade Finance Market by Regions

-

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

In 2024, North America held the largest share of the trade finance market. The region's strong economy, high volume of international trade, and well-developed financial infrastructure, supported by established banking institutions, position it as a key hub for trade finance activities.

Drivers, Restraints, and Key Trends of the Trade Finance Market

Market Drivers:

The trade finance market is being driven by the expanding volume of international trade and globalization of supply chains. Businesses increasingly require secure, efficient, and cost-effective solutions to manage cross-border transactions, mitigate payment risks, and ensure liquidity. In 2025, digitalization and technological advancements-such as blockchain, AI-powered risk assessment, and automated documentation-are expected to further propel market growth by streamlining processes, reducing transaction times, and enhancing transparency. Growing demand from emerging markets, increasing exports and imports, and supportive government trade policies are also encouraging adoption of trade finance solutions across industries such as manufacturing, agriculture, and retail.

Market Restraints:

Despite strong growth, the trade finance market faces certain challenges. Complex regulatory frameworks, varying compliance requirements across countries, and high operational costs can restrict market penetration, especially for small and medium-sized enterprises (SMEs). Risk of fraud, credit defaults, and geopolitical uncertainties can further deter adoption. Additionally, limited awareness of advanced digital trade finance solutions in emerging economies and reliance on traditional paper-based processes can slow overall growth. Currency fluctuations and interest rate volatility also pose challenges for financial institutions offering trade finance services.

Key Market Trends:

The trade finance industry is witnessing rapid technological innovation and process modernization. In 2025, there is a growing focus on digital trade finance platforms, blockchain-based solutions, and AI-driven risk assessment tools to enhance transaction security, reduce fraud, and accelerate payment processing. Banks and financial institutions are increasingly offering integrated trade finance services that combine letters of credit, supply chain financing, and export-import solutions for seamless customer experiences. Sustainable trade finance is also emerging, with increased emphasis on supporting environmentally responsible and socially compliant trade practices. Strategic collaborations between banks, fintech firms, and global trade organizations are shaping the future landscape, promoting efficiency, transparency, and wider accessibility in the market.

Leading Players of Trade Finance Market:

The competitive landscape of the trade finance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

-

Asian Development Bank

Banco Santander SA

Bank of America Corp.

BNP Paribas SA

Citigroup Inc.

Crédit Agricole Group

Euler Hermes

Goldman Sachs Group Inc.

HSBC Holdings Plc

JPMorgan Chase & Co.

Mitsubishi Ufj Financial Group Inc.

Morgan Stanley

Royal Bank of Scotland

Standard Chartered Bank

Wells Fargo & Co.

Key Developments in the Trade Finance Market:

-

December 2024: Modifi announced plans to dedicate a substantial portion of its recently raised USD 15 million Series C funding to expand its trade finance operations. The investment will focus on bolstering local markets and accelerating growth, with the goal of improving access to cross-border financing for SMEs. This strategic initiative highlights Modifi's commitment to simplifying global trade and supporting small and medium enterprises in international transactions.

December 2024: HSBC, in collaboration with the World Bank's International Finance Corporation (IFC), launched a USD 1 billion trade finance program aimed at supporting emerging markets. The initiative is designed to strengthen cross-border trade, enhance exports across key sectors, and address global supply chain challenges. By improving access to trade finance solutions, this partnership seeks to foster economic growth and enable businesses in critical industries to expand their international operations.

November 2024 : The African Development Bank has approved a USD4 Million trade finance guarantee for Access Bank Sierra Leone Limited (ABSL). This initiative aims to enhance access to financing for small and medium-sized enterprises (SMEs) and local businesses. The guarantee will facilitate trade, bolster economic growth, and strengthen Sierra Leone's private sector. This marks a significant step in empowering the country's entrepreneurial landscape.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment