Brazil Specialty Fertilizers Market Outlook: Size, Share & Forecast 20252033

Key Highlights:

-

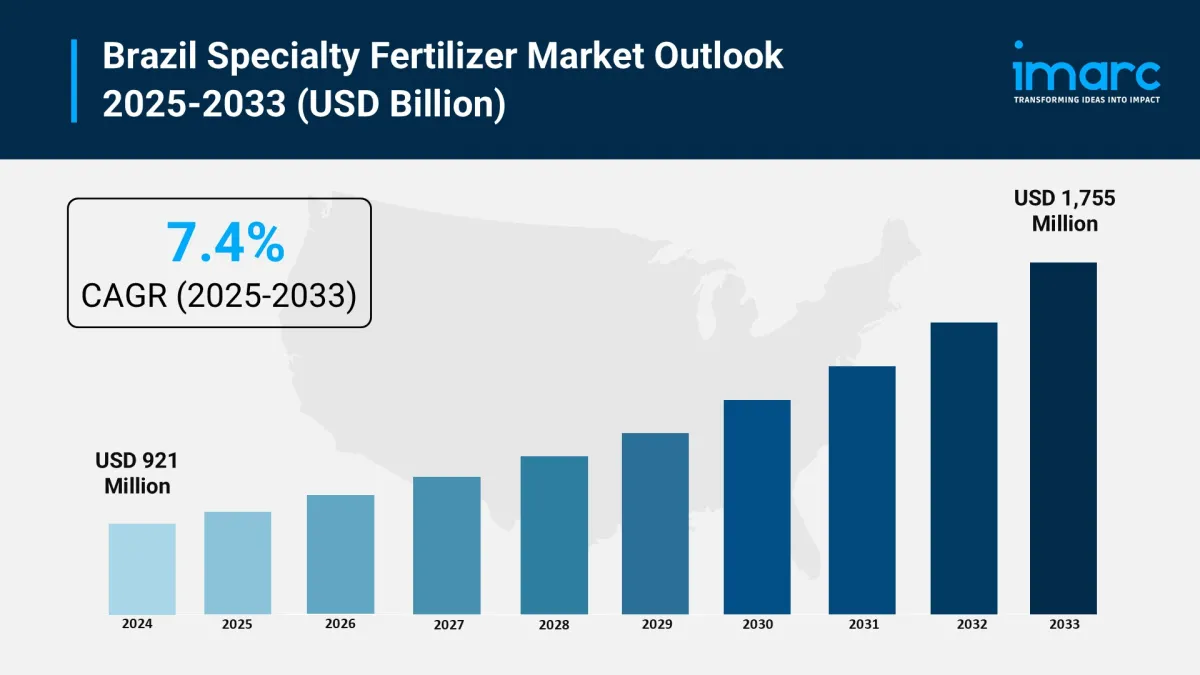

Market Size in 2024: USD 921 Million

Market Forecast in 2033: USD 1,755 Million

Market Growth Rate 2025-2033: 7.4%

Segment Variations & Application Trends:

Liquid fertilizers made up about 53.8% of the market in 2022, valued at around USD 945 million. They are popular for their quick uptake and ease of use. Controlled-release fertilizers (CRFs) are the fastest-growing specialty type due to their efficient nutrient delivery.

Geographic Dominance:

Brazil holds about 60% of the South American specialty fertilizer market share, showcasing its leadership in the region's farming landscape.

Drivers of Sector Expansion:

Precision agriculture-such as GPS-enabled application and sensor-based nutrient management-is improving fertilizer use and increasing the demand for specialty products.

Smart Farming Solutions: AI Driving Growth in Brazil's Specialty Fertilizer MarketArtificial intelligence (AI) is transforming Brazil's specialty fertilizer sector. It enables precise application, optimizes resource use, and boosts productivity. Farmers are increasingly using AI tools to analyze soil conditions, monitor crop health, and predict nutrient needs. This data-driven approach reduces fertilizer waste, cuts costs, and enhances sustainability. AI platforms also help manufacturers improve formulations and streamline supply chains. As Brazil modernizes agriculture, AI enhances efficiency and drives innovation in specialty fertilizer production and distribution.

-

AI enables real-time soil nutrient analysis for customized fertilizer application.

Smart farming platforms improve crop yield predictions and nutrient planning.

AI reduces overuse of specialty fertilizers , lowering environmental impact.

Manufacturers use AI to develop advanced formulations for regional crops.

Predictive analytics enhances logistics and distribution efficiency in fertilizer delivery.

Adoption of AI aligns with Brazil's goal for sustainable agricultural growth .

Download a sample copy of the Report: https://www.imarcgroup.com/brazil-specialty-fertilizer-market/requestsample

Brazil Specialty Fertilizer Market Key Trends and DriversThe Brazil specialty fertilizer market is growing as farmers adopt advanced practices for better productivity and sustainability. Rising demand for high-value crops, government support for precision farming, and a shift to eco-friendly fertilizers are key drivers. Innovations in slow-release and water-soluble fertilizers meet the need for efficient nutrient management. Increased use of digital tools, including AI, helps farmers optimize fertilizer application and reduce costs while ensuring higher yields. This shift aligns Brazil's agriculture with global trends toward smart and sustainable farming.

Key Trends and Drivers:

-

Growing demand for precision agriculture to enhance nutrient efficiency.

Rising adoption of water-soluble and slow-release fertilizers for sustainable farming.

Government initiatives promoting advanced fertilizer use and eco-friendly products.

Increased investment in R&D for innovative fertilizer formulations.

Integration of digital farming solutions and AI tools for optimized application.

Shift toward high-value crops driving specialized nutrient needs.

Specialty Type Insights:

-

CRF

-

Polymer Coated

Polymer-Sulfur Coated

Others

The report includes a detailed analysis of the market based on specialty types, including CRF (polymer coated, polymer-sulfur coated, and others), liquid fertilizers, SRF, and water-soluble options.

Application Mode Insights:

-

Fertigation

Foliar

Soil

The report also breaks down the market based on application modes: fertigation, foliar, and soil.

Crop Type Insights:

-

Field Crops

Horticultural Crops

Turf and Ornamental

The report offers detailed insights based on crop types, including field crops, horticultural crops, and turf and ornamental.

Regional Insights:

-

Southeast

South

Northeast

North

Central-West

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=15796&flag=C

Latest Developments in the Industry:-

In April 2025 , Brazilian fertilizer producer Rifertil filed for bankruptcy protection, citing R647.9 million ($112.7 million) in debt. Pressures included falling fertilizer prices, droughts in Goiás, customer defaults, and exchange rate losses from a stronger US dollar.

In February 2025 , Haifa Group launched a blending facility in Uberlândia, Minas Gerais, to produce its Multicote controlled-release fertilizer. The plant aims for 5,000–7,000 tonnes per year, focusing on custom formulations for specific crop and soil needs. This strengthens Haifa's role in Brazil as a precision nutrition provider.

In February 2024 , ICL acquired the Brazilian biologicals firm Nitro 1000 for $30 million to enhance its specialty plant nutrition portfolio. This acquisition supports ICL's expansion strategy in Brazil's agri-input market, targeting crops like soybeans, corn, and sugarcane with sustainable alternatives. Nitro 1000's expertise will boost ICL's R&D and market share in Brazil's growing biologicals segment.

About Us:

IMARC Group is a global management consulting firm. We help ambitious changemakers create lasting impact. Our services include market assessments, feasibility studies, company incorporation support, factory setup assistance, and regulatory navigation. We also offer branding, marketing and sales strategies, competitive analyses, pricing research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment