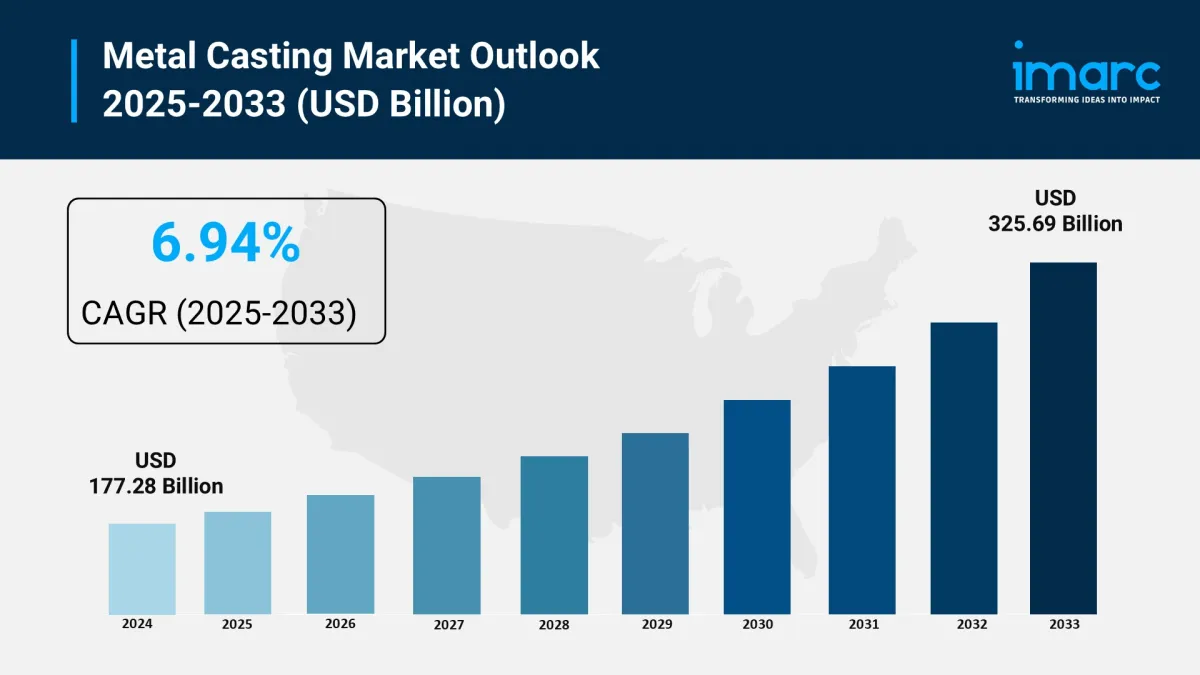

Global Metal Casting Market Size Projected To Reach USD 325.69 Billion By 2033 CAGR Of 6.94%.

The global metal casting market reached a value of USD 177.3 Billion in 2024 and is projected to attain USD 325.7 Billion by 2033 , expanding at a CAGR of 6.94% during 2025–2033 , according to IMARC Group. This growth is primarily driven by increasing demand from the automotive, industrial machinery, and construction sectors, alongside rapid advancements in casting technologies and sustainability-driven manufacturing processes. The market is undergoing a paradigm shift as manufacturers increasingly adopt energy-efficient and precision-based casting solutions to meet modern engineering requirements and global regulatory standards.

Key Stats

-

Market Value (2024): USD 177.3 Billion

Projected Market Value (2033): USD 325.7 Billion

CAGR (2025–2033): 6.94%

Leading Process Segment (2025): Sand casting

Dominant Material Type: Cast iron

Top End Use Segment: Automotive and transportation

Leading Region (2025): Asia Pacific

Key Companies: BASF SE, Arkema Group, Honeywell International Inc., Tosoh Corporation, Zeochem LLC

Request Free Sample Report: https://www.imarcgroup.com/metal-casting-market/requestsample

Growth Drivers

Several structural and technological trends are fueling the upward trajectory of the metal casting market:

-

Automotive Lightweighting & Electrification: The rising focus on vehicle fuel efficiency and EV performance is increasing the demand for lightweight, durable metal cast components such as engine blocks, battery housings, and structural assemblies.

Industrial Expansion in Emerging Economies: Rapid infrastructure and machinery investments in Asia, Latin America, and Africa are creating new avenues for casting foundries, particularly in sectors like construction and heavy equipment.

Precision Engineering & Customization: Growing preference for precision casting technologies that allow for intricate designs, reduced material waste, and higher strength-to-weight ratios is expanding adoption across end-user industries.

Sustainability Goals: Circular economy practices, such as scrap metal recycling and low-emission furnace operations, are becoming standard in metal casting operations as industries align with ESG initiatives.

AI and Technology Impact

The metal casting industry is embracing advanced technologies that are reshaping operational efficiency and product quality:

-

3D Sand Printing: Additive manufacturing allows for rapid prototyping and complex geometries, reducing tooling costs and development timelines.

IoT & Smart Foundries: Integration of IoT-enabled sensors and remote monitoring is enabling predictive maintenance, real-time temperature control, and defect detection.

AI & Simulation Software: AI-powered modeling tools help simulate mold flow and solidification, resulting in optimized casting processes with reduced rejection rates.

Automation & Robotics: Robotics are increasingly utilized for tasks like mold handling, pouring, and finishing, minimizing labor dependency and improving workplace safety.

Segmental Analysis

By Process

-

Sand Casting (Largest Segment)

Gravity Casting

High-Pressure Die Casting (HPDC)

Low-Pressure Die Casting (LPDC)

Others

Sand casting remains dominant due to its versatility and cost-effectiveness, especially in large-scale component production.

By Material Type

-

Cast Iron (Largest Share)

Aluminum

Steel

Zinc

Magnesium

Others

Cast iron is widely used for its mechanical strength and heat resistance, while aluminum is gaining popularity for lightweight applications.

By End Use

-

Automotive and Transportation (Largest Segment)

Equipment and Machinery

Building and Construction

Aerospace and Military

Others

Automotive casting demand is strong due to the proliferation of electric and hybrid vehicle models requiring specialized components.

By Automotive Components

-

Alloy Wheels (Largest Component Segment)

Cylinder Head

Crank Case

Clutch Casing

Battery Housing

Cross Car Beam

Others

By Vehicle Type

-

Passenger Cars (Leading Segment)

Light Commercial Vehicles

Heavy Commercial Vehicles

By Electric/Hybrid Type

-

Hybrid Electric Vehicles (HEV) – Largest Segment

Battery Electric Vehicles (BEV)

Plug-in Hybrid Electric Vehicles (PHEV)

By Application

-

Body Assemblies (Leading Segment)

Engine Parts

Transmission Parts

Others

Regional Insights

Asia Pacific

Asia Pacific dominates the global metal casting market, driven by robust automotive production in China, India, and Japan, along with significant infrastructure development. The region also leads in the adoption of eco-efficient casting technologies.

North America

The U.S. and Canada remain key contributors due to demand in aerospace, automotive, and military sectors. Regulatory emphasis on clean manufacturing is encouraging investment in smart casting technologies.

Europe

Europe's metal casting market is shaped by stringent environmental norms and innovations in lightweight automotive components. Countries like Germany and Italy are prominent hubs for precision casting.

Latin America

Growth in Brazil and Mexico is supported by expanding automotive assembly lines and investments in machinery for mining and agriculture.

Middle East & Africa

Increasing industrial activity in the UAE, Saudi Arabia, and South Africa is supporting market penetration, particularly in construction and transport infrastructure.

Market Dynamics

Drivers

-

Rising demand for lightweight automotive parts

Expanding EV production and infrastructure

Technological innovation in casting methods

Growing use of recycled materials and eco-friendly processes

Restraints

-

High capital investment in automation and digital tools

Volatility in raw material prices (e.g., aluminum, magnesium)

Key Trends

-

Adoption of green sand molding and bio-based binders

Use of simulation and CAD software for defect-free design

Strategic capacity expansions and foundry modernization

Consolidation through mergers and strategic partnerships

Leading Companies

Below are the top companies shaping the metal casting landscape:

BASF SE – A global leader in advanced chemical binders and green casting solutions. Arkema Group – Offers innovative resins and specialty chemicals for molding and casting. Honeywell International Inc. – Known for its smart foundry integration and automation tools. Tosoh Corporation – Supplies high-performance materials and foundry chemicals. Zeochem LLC – Specializes in molecular sieves and additives for high-precision castings. Endurance Technologies – Major player in aluminum die casting for automotive parts. Ahresty Corporation – Focused on lightweight casting solutions for hybrid and EV vehicles. Dynacast International Inc. – Offers precision casting using zinc, aluminum, and magnesium. Ryobi Limited – Prominent in HPDC solutions for engine and transmission components. Hitachi Metals, Ltd. – Supplies advanced metal materials and castings for industrial use. Gibbs Die Casting Corp. – Known for supplying Tier 1 auto manufacturers with cast parts. Nemak – Specialized in structural and electric vehicle component casting. Rheinmetall Automotive AG – Offers sustainable casting solutions aligned with future mobility. Georg Fischer Ltd. – Renowned for casting systems for industrial and infrastructure applications. ConMet (Commercial Vehicle Group) – Focused on heavy vehicle castings and wheel ends.Recent Developments

-

2024: BASF launched a line of bio-based resins for eco-friendly mold production.

2024: Arkema partnered with 3D sand printing companies to develop faster mold fabrication.

2023: Honeywell introduced AI-powered predictive maintenance for foundry operations.

2023: Endurance Technologies expanded its die-casting capacity in Southeast Asia.

2023: Nemak received recognition for sustainable aluminum casting in electric vehicle platforms.

2023: Dynacast opened a new precision casting facility in Mexico to serve North American OEMs.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment