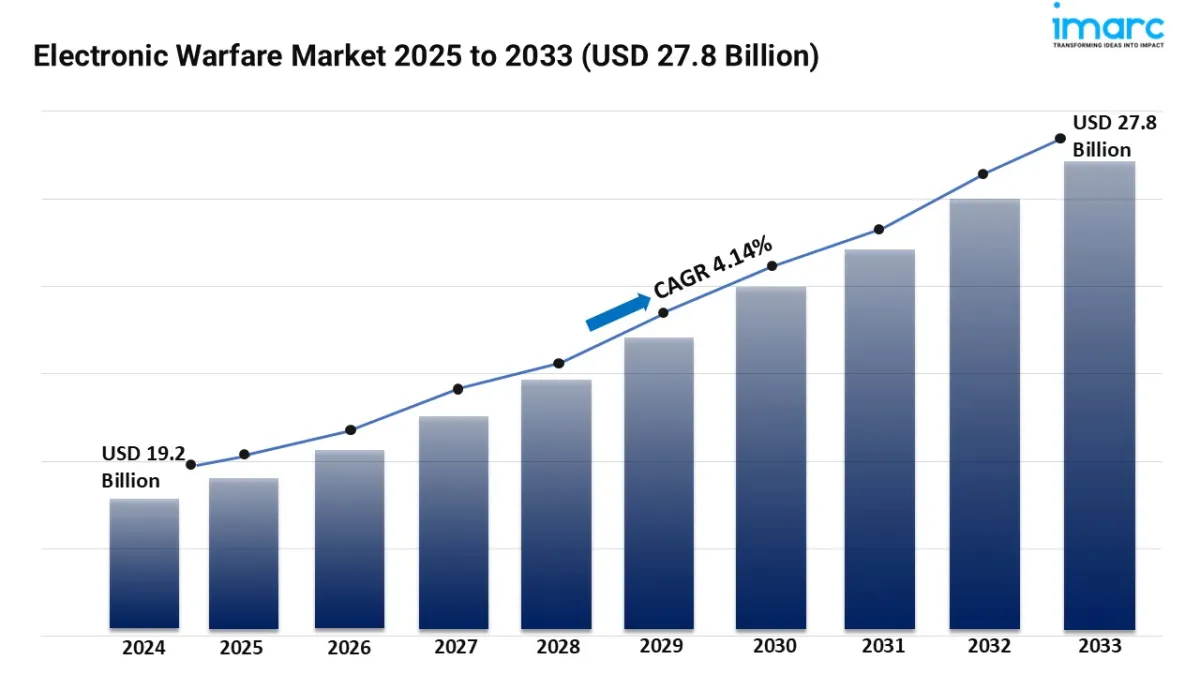

Electronic Warfare Market Size To Hit USD 27.8 Billion By 2033 With A 4.14% CAGR

The Electronic Warfare Market is experiencing rapid growth, driven by Escalating Geopolitical Conflicts, Surge in Military Modernization Programs and Growing Focus on Unmanned and Autonomous Systems. According to IMARC Group's latest research publication, “Electronic Warfare Market Report by Product (EW Equipment, EW Operational Support), Equipment (Jammer, Countermeasure System, Decoy, Directed Energy Weapon, and Others), Capacity (Electronic Protection, Electronic Support, Electronic Attack), Platform (Land, Naval, Airborne, Space), and Region 2025-2033” , The global electronic warfare market size reached USD 19.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.14% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Claim Your Free“Electronic Warfare Market” Insights Sample PDF

Our Report Includes:

-

Market Dynamics

Market Trends and Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

-

Escalating Geopolitical Conflicts

One of the biggest drivers behind the rising demand for electronic warfare systems is the increase in geopolitical tensions across regions like Eastern Europe, the Middle East, and the Asia-Pacific. Governments are prioritizing EW capabilities to safeguard national assets and deter adversarial threats. For instance, the ongoing military buildup in Eastern Europe has prompted NATO countries to fast-track investments in jamming, spoofing, and signal intelligence solutions. The U.S. Department of Defense continues to allocate billions to modernize its EW arsenal under programs like the Electromagnetic Spectrum Superiority Strategy. These shifts are influencing defense contractors like Northrop Grumman, BAE Systems, and Raytheon to ramp up development of next-gen EW platforms.

-

Surge in Military Modernization Programs

As nations invest in updating their military infrastructure, electronic warfare is increasingly viewed as a core capability alongside traditional air, land, and naval assets. Countries such as India, Japan, France, and Saudi Arabia are rolling out multi-billion-dollar defense modernization plans that emphasize electronic countermeasures, radar jamming, and cyber-electronic integration. For example, India's Defence Research and Development Organisation (DRDO) is spearheading several indigenous EW programs such as 'Shakti' for naval platforms. Similarly, Germany recently committed to enhancing its tactical EW aircraft systems as part of NATO interoperability goals. These efforts are not only driving procurement of new EW systems but also upgrades of legacy systems to handle modern threats like drones and hypersonic missiles.

-

Growing Focus on Unmanned and Autonomous Systems

The increasing use of unmanned aerial vehicles (UAVs), drones, and autonomous systems on the battlefield is creating fresh demand for adaptive EW capabilities. These platforms require sophisticated systems for electronic support, attack, and protection to operate safely in contested environments. Military drone fleets are now being equipped with compact EW pods for counter-surveillance, RF jamming, and GPS spoofing. The U.S. Army has also tested autonomous EW-equipped ground vehicles capable of identifying and disabling enemy signals without human intervention. Additionally, countries like Israel and China are deploying drones with built-in EW functions to conduct silent, deep penetration missions.

Key Trends in the Electronic Warfare Market:-

Shift Toward AI-Powered Electronic Warfare

Artificial Intelligence is becoming central to the evolution of electronic warfare systems. Modern EW environments are data-intensive and time-sensitive, making real-time signal analysis and response critical. AI enables systems to autonomously detect, classify, and respond to electromagnetic threats faster than human operators. For example, BAE Systems is working on AI-enabled EW systems for fighter jets that can instantly jam radar or switch frequency bands to avoid detection. These platforms can also learn and adapt from past encounters, improving performance with each mission. AI is being integrated into software-defined radios, cognitive jammers, and autonomous drones to enhance spectrum agility.

-

Miniaturization and Modular EW Systems

There's a growing trend toward developing compact and modular electronic warfare systems that can be easily integrated across platforms-airborne, naval, ground, or space-based. Instead of relying solely on large, fixed installations, militaries now demand plug-and-play EW modules that can be deployed on small drones, armored vehicles, or even satellites. Lockheed Martin, for instance, has unveiled miniaturized EW pods for unmanned aircraft that offer full-spectrum jamming in compact formats. This modularity also improves scalability and reduces system downtime, allowing forces to swap or upgrade components in the field.

-

Integration of Cyber and Electronic Warfare

The lines between electronic warfare and cyber operations are increasingly blurring, leading to a new hybrid warfare domain known as cyber-electromagnetic activities (CEMA). Military planners are now combining electronic attacks with cyber intrusions to achieve multidimensional dominance. For instance, an EW system may jam enemy communications while simultaneously injecting malware into their networks. Countries like the U.S. and Russia are developing capabilities to disrupt both physical and digital infrastructure using a single platform. In the commercial defense space, Raytheon is already integrating EW tools with offensive cyber capabilities for multi-domain operations. This convergence is driving demand for more advanced software-centric EW systems capable of cross-domain targeting.

Leading Companies Operating in the Global Electronic Warfare Industry:

-

BAE Systems

Elbit Systems Ltd

General Dynamics Mission Systems, Inc.

Hensoldt AG

Israel Aerospace Industries

L3Harris Technologies Inc.

Leonardo S.p.A.

Lockheed Martin Corporation

Northrop Grumman Corporation

RTX Corporation

Saab AB

Thales Group

Electronic Warfare Market Report Segmentation:

Breakup by Product:

-

EW Equipment

EW Operational Support

Electronic warfare (EW) equipment was the primary focus.

Breakup by Equipment:

-

Jammer

Countermeasure System

Decoy

Directed Energy Weapon

Others

Jammers were the most commonly used EW equipment.

Breakup by Capability:

-

Electronic Protection

Electronic Support

Electronic Attack

Electronic protection was the primary EW capacity.

Breakup by Platform:

-

Land

Naval

Airborne

Space

Land-based platforms were the major platform for EW systems.

Breakup by Region:

-

North America (United States, Canada)

Europe (Germany, France, United Kingdom, Italy, Spain, Others)

Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

North America was the leading region for EW technology adoption.

Research Methodology:

The report employs a comprehensive research methodology , combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability .

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment