New Tax Facilities Set Stage For Rapid Growth Of Micro, Small Enterprises: ETA Chief

“We continue to engage directly with the business community to encourage companies to register under the new system ahead of the legal deadlines and to incentivise informal businesses to enter the formal economy,” said Abdel Aal.

She emphasised that the newly introduced tax facilities offer micro and small enterprises a significant opportunity to expand their operations and achieve accelerated growth. The simplified tax system, enacted under Law No. 6 of 2025, is available to all self-employed individuals and freelancers whose annual turnover is below EGP 20 million. Eligible categories include doctors, engineers, artists, media professionals, accountants, lawyers, craftsmen, and other independent professionals.

According to Abdel Aal, the new regime applies a proportional tax rate based on declared turnover, starting at 0.4% for turnover under EGP 500,000 and up to 1.5% for turnover below EGP 20m. Tax obligations begin the day after registration, and registrants benefit from full waivers on tax dues and penalties for prior periods-an approach described as“forgiveness for past periods.”

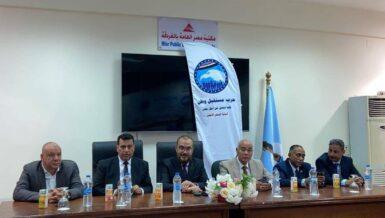

Ragab Mahrous, Advisor to the ETA Chair, highlighted during a recent awareness campaign at the Red Sea Tax Directorate-organised in cooperation with the Future of the Nation Party-that registrants under this simplified integrated system are exempt from tax inspection for five years following enrolment.

Mohsen El-Gayar, General Manager of Customer Service for the Canal Cities region, outlined the Tax Authority's broader transformation since 2018, including the launch of key digital systems. These include e-filing, the new core tax management system (SAB), e-invoicing, the e-receipt platform, unified payroll tax calculation standards, and upgraded infrastructure. He noted that these initiatives have enabled real-time support and effective problem resolution for taxpayers.

El-Gayar also pointed to Law No. 5 of 2025, effective until 12 August, which allows taxpayers to resolve ongoing disputes by filing or amending tax returns for the years 2020 to 2024 without incurring financial penalties. He described the law as a turning point in strengthening the government's partnership with taxpayers and encouraging voluntary compliance.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Most popular stories

Market Research

- Moonbirds And Azuki IP Coming To Verse8 As AI-Native Game Platform Integrates With Story

- B2BROKER Taps Finery Markets To Power Institutional Crypto OTC On B2TRADER

- Forex Expo Dubai 2025 Returns October 67 With Exclusive Prize Draw Including Jetour X70 FL

- “Farewell To Westphalia” Explores Blockchain As A Model For Post-Nation-State Governance

- Schoenherr Opens London Liaison Office As Gateway To Central Eastern Europe

- Falcon Finance Sets Community Sale Record On Buidlpad With $113M $FF Token Commitment

Comments

No comment