403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

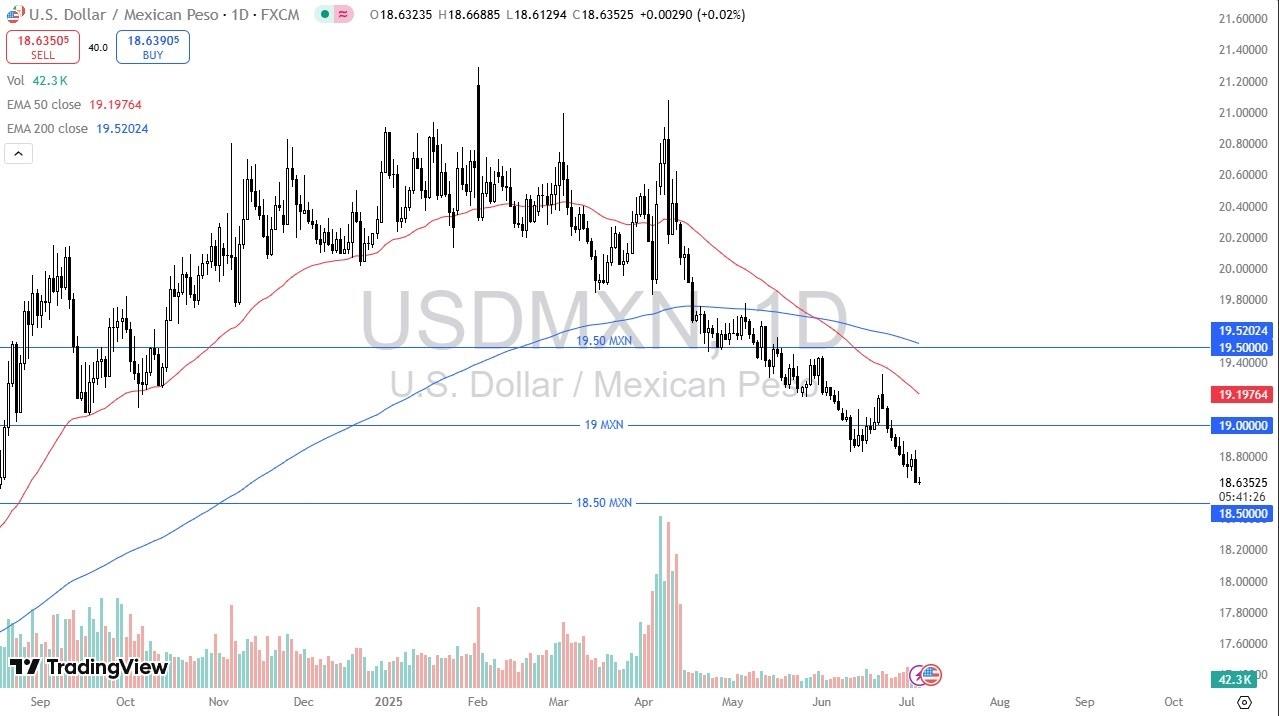

USD/MXN Forecast 07/07: Interest Rate Gap Widens (Chart)

(MENAFN- Daily Forex) The US dollar has been very quiet during the trading session on Friday, as the market continues to look like it is going to favor the Mexican peso over the US dollar makes a certain amount of sense considering that there is so much in the way of interest rate differential that traders can take advantage of by owning the Mexican peso, you should keep in mind that the US economy has a major influence on what happens with the Mexican peso itself all, Mexico sends over 85% of its exports into the United States as it is the world\u0026rsquo;s largest exporter of goods and services to the US. In other words, if the US economy is doing fairly well, it generally benefits the Mexican peso as there will be more demand for goods and services coming out of that country. Top Forex Brokers 1 Get Started 74% of retail CFD accounts lose money Read Review BrokerGeoLists({ type: \u0027MobileTopBrokers\u0027, id: \u0027mobile-top-5\u0027, size: SidebarBrokerListAmount, getStartedText: \u0060Get Started\u0060, readReviewText: \u0060Read Review\u0060, Logo: \u0027broker_carrousel_i\u0027, Button: \u0027broker_carrousel_n\u0027, });Furthermore, you also have to keep in mind that there is a bit of question when it comes to the remittances coming out of the US for Mexican immigrants sending money back home. There has been a bit of a dent put into that as of late, but over the longer term, the larger economy situation is much more favorable for growth, meaning that Mexico should do fairly well. EURUSD Chart by TradingView Technical AnalysisThe technical analysis for this pair is rather negative and has been done for some time. It\u0026rsquo;s worth noting that the last time that we reached the 50 Day EMA, the market ended up selling off quite drastically, showing signs of further selling pressure. The interest rate differential favors the Mexican peso which of course is something that a lot of people will be paying attention to. Ultimately, I believe this is a market that will fall enough to test the 18.50 MXN level, but I also believe that we could very well break down there based on the fact that the momentum has been so strong. Beyond that, you also have to keep in mind that a lot of traders anticipate that the Federal Reserve will in fact cut rates in September, only whitening interest rate differential.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment