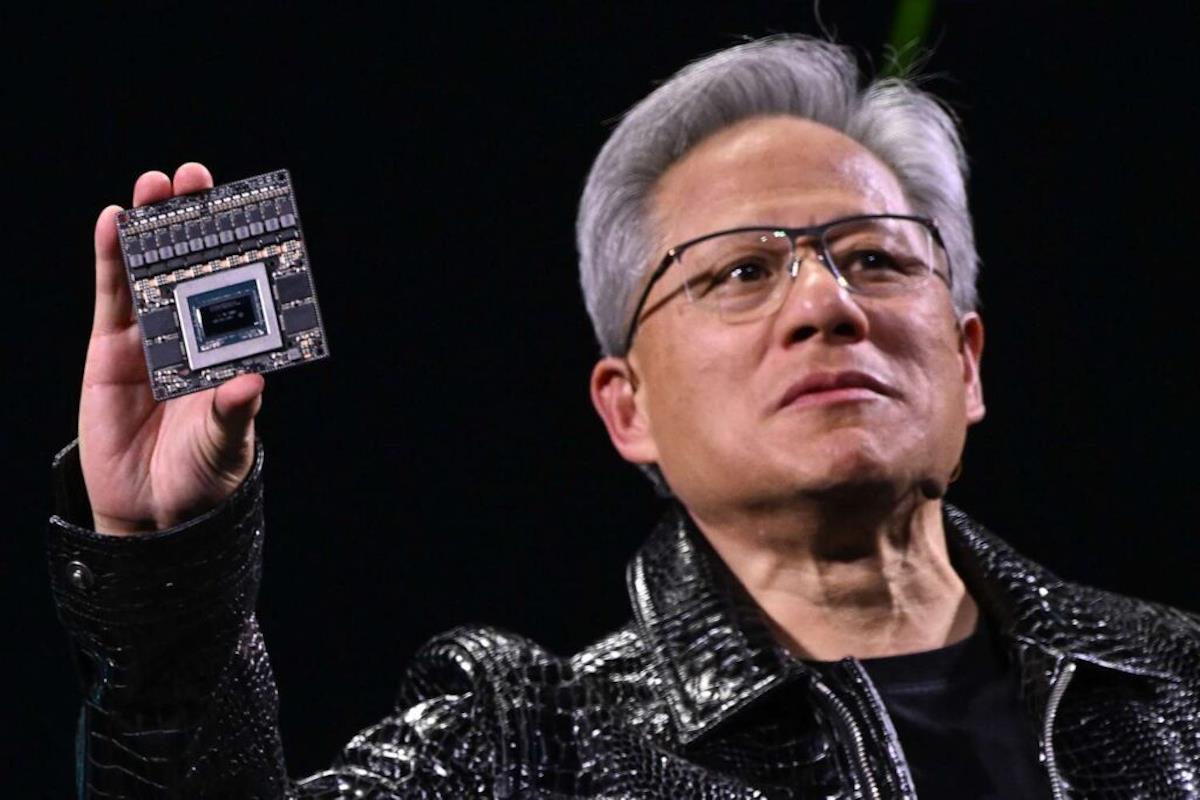

Nvidia Grasping To Hold Onto China's AI Chip Market

Huang, whose visit merited a reception by Chinese Vice Premier He Lifeng at the Great Hall of the People, also met with Ren Hongbin, chairman of the China Council for the Promotion of International Trade (CCPIT), and Liang Wenfeng, founder and CEO of DeepSeek.

He, who is also a member of the Politburo, said,“We welcome more US firms, including Nvidia, to deepen their presence in the Chinese market and leverage their strengths here to gain an edge in global competition.” In reply, Huang said,“We look forward to deepening our presence in China and supporting the advancement of the local tech ecosystem.”

In a separate meeting arranged by CCPIT, Huang told Ren ,“We hope to continue to cooperate with China.” Chinese media also quoted him as saying that“Nvidia will continue to make every effort to optimize its product lineup in compliance with regulatory requirements and will steadfastly serve the Chinese market.”

In a meeting with Liang, Huang reportedly talked about how Nvidia might provide DeepSeek with AI processors that meet both the company's needs and regulatory requirements.

Nvidia issued a statement saying,“We regularly meet with government leaders to discuss our company's products and technology,” but these were not ordinary meetings. The company is now at the center of the increasingly acrimonious US-China trade and tech disputes.

It was an eventful week for Nvidia. In the evening of April 15, Nvidia revealed that exports of its H20 AI processors and similar devices to China and other countries of concern now require a license from the US government, an order that“addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China.”

In after-hours trading, Nvidia's share price dropped 6.3% to US$105.10. By Thursday's close (Friday was a holiday), it was down to $101.42, bringing its year-to-date decline to 26.7%.

With no license likely to be granted, Nvidia stated that its results for the current fiscal quarter ending on April 27“are expected to include up to approximately $5.5 billion of charges associated with H20 products for inventory, purchase commitments, and related reserves.”

AMD, whose MI308 AI accelerators are subject to the same new restriction, dropped 7.1% in after-hours trading on Tuesday and finished the week down 27.5% since the beginning of the year. AMD expects to post special charges approaching $800 million.

Intel's Gaudi 3 processor is also affected. For this and other reasons, Intel's share price was down 27% in the month to Thursday.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment