Pacific Bay Brazil Gold Property Update, Trading Resumption

| Activity | Cost (US$) |

| Drilling | 850,000 |

| Lab assaying | 150,000 |

| Metallurgical tests | 25,000 |

| Resources statement report | 38,000 |

| Vehicles/rent/facilities/IT | 55,000 |

| G&A | 300,000 |

| Continency (10%) | 142,000 |

| Subtotal | $1,560,000 |

To view an enhanced version of this graphic, please visit:

Figure 2 Hills formed by quartzites, facing southeast

To view an enhanced version of this graphic, please visit:

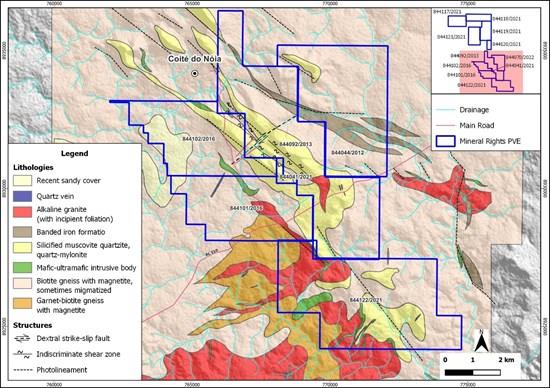

Figure 3 Geological map with the main lithologies and structural features within the Pereira Velho Project area.

To view an enhanced version of this graphic, please visit:

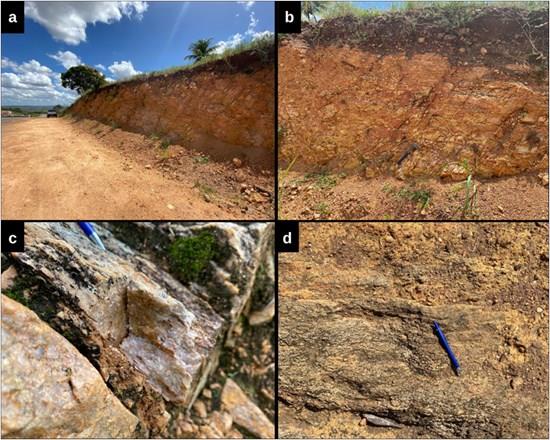

Figure 4 (a) Outcrop of fractured quartzite with the presence of (b) folded structure (flexural?); (c) quartzite with foliation trending to the NE and with boxwork and (d) outcrop of the quartzite with foliation trending to the SW

To view an enhanced version of this graphic, please visit:

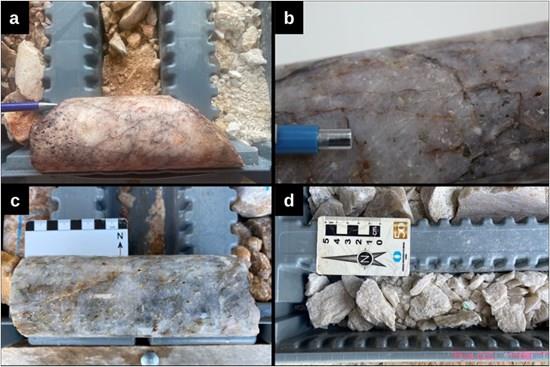

Figure 5 (a, b) Drill core composed of biotite gneiss with propylitic alteration; (c) quartzo-feldspathic gneiss with argillic alteration.

To view an enhanced version of this graphic, please visit:

Figure 6 (a) Free gold (VG-visible gold) identified in hole PVDH-045, at a depth of 49.50 meters; (b) Free gold (VG-visible gold) in hole PVDH-015, at a depth of 95.65 m

To view an enhanced version of this graphic, please visit:

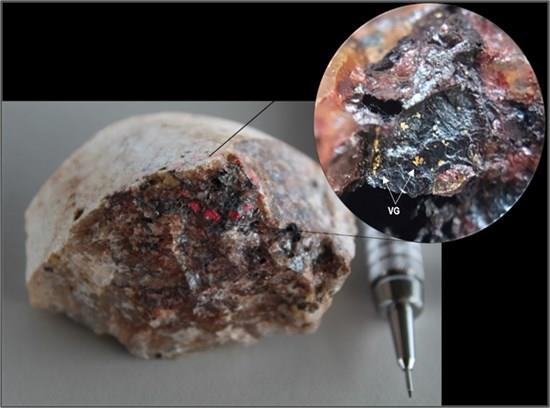

Figure 7 Visible gold (VG) in drill core sample, PVDH-007

To view an enhanced version of this graphic, please visit:

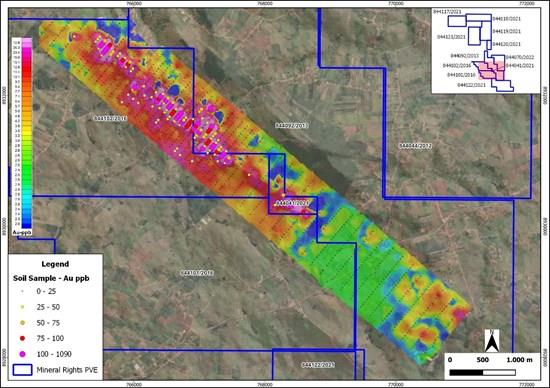

Figure 8 Map with the compilation of soil geochemistry campaigns carried out by MVV and PVE. First-order anomalies for gold marked in magenta with values between 100 and 1090 ppb.

To view an enhanced version of this graphic, please visit:

The Agreement

As previously announced, key terms of the Agreement are:

Payment to Appian of CND$710,000 in cash and CDN$700,000 in either common shares or cash, at the company's discretion. These payments are structured in two tranches:

- Upon signing the definitive agreement and obtaining necessary approvals:

- CDN $280,000 in cash. CDN $250,000 in cash or common shares.

- CDN $430,000 in cash. CDN $450,000 in cash or common shares.

Appian is to retain a 1.5% NSR on production from the project. Pacific Bay has the option to buy back this royalty at any time for a total of USD $3.5 million.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Mr. David Bridge, P.Geo., a consultant of the Company, who is a "Qualified Person" as defined in NI 43-101

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment