Ethereum Stabilizes As Open Interest Signals Possible Breakout

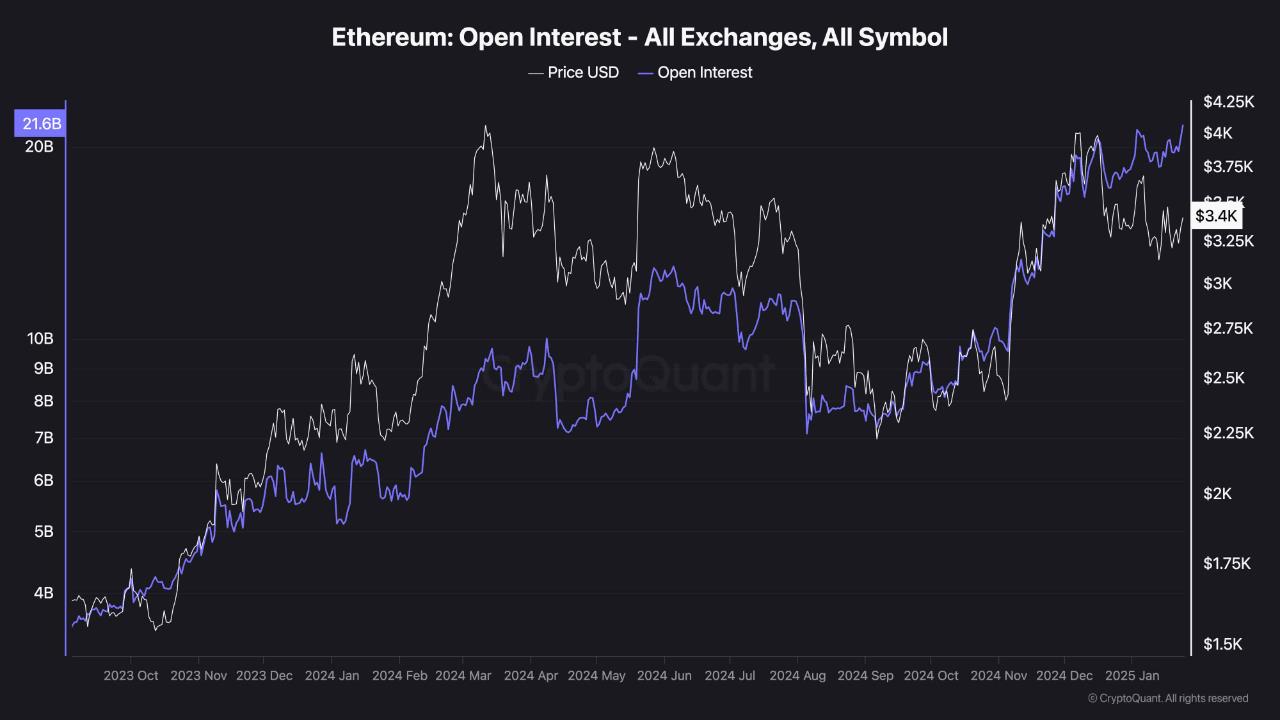

In light of these developments, CryptoQuant analyst ShayanBTC has shared a new insight into Ethereum 's trajectory. He points out an intriguing contrast between the rising open interest in Ethereum futures and the asset's price, which has not yet reached its prior peaks.

Rising Futures Market and Diverging Price TrendsShayan recently noted on CryptoQuant's QuickTake platform that Ethereum 's open interest-an important gauge of active futures contracts-has climbed to its highest levels in recent weeks, indicating increased market engagement and heightened interest among traders.

The analyst observes that while Ethereum 's open interest is rising, its price performance has been lackluster, suggesting a misalignment between market sentiment and price action. Although futures traders display optimism, this sentiment has not yet resulted in Ethereum surpassing significant resistance levels . He stated:

Shayan also points out that heightened open interest could lead to increased volatility. Historical trends show that major buildups in open interest are often followed by significant price fluctuations as positions get liquidated.

While the future direction remains uncertain, current activity and sentiment indicate a potential bullish breakout. Shayan suggested that if Ethereum can break through crucial resistance, it could trigger a more sustained upward trend.

Market Worries and Bearish SignsConversely, CryptoQuant analyst Darkfost shares a more cautious viewpoint . Darkfost highlights various bearish signals, such as rising Ethereum inflows and increased reserves on Binance .

According to Darkfost's data, since September 2024, Ethereum inflows have consistently exceeded outflows, resulting in higher exchange reserves. This pattern indicates a growing selling pressure , as a larger volume of Ethereum is transferred to exchanges, possibly signaling an intent to sell rather than hold.

Additionally, Binance 's taker buy-sell ratio has maintained a bearish trend for months, revealing a dominance of sell orders. Darkfost explains that these shifts in metrics suggest some investors may be cashing in their profits or reallocating their investments, contributing to a more cautious market sentiment .

Featured image created with DALL-E, Chart from TradingView

Crypto Investing Risk WarningCrypto assets are highly volatile. Your capital is at risk.

Don't invest unless you're prepared to lose all the money you invest.

This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment